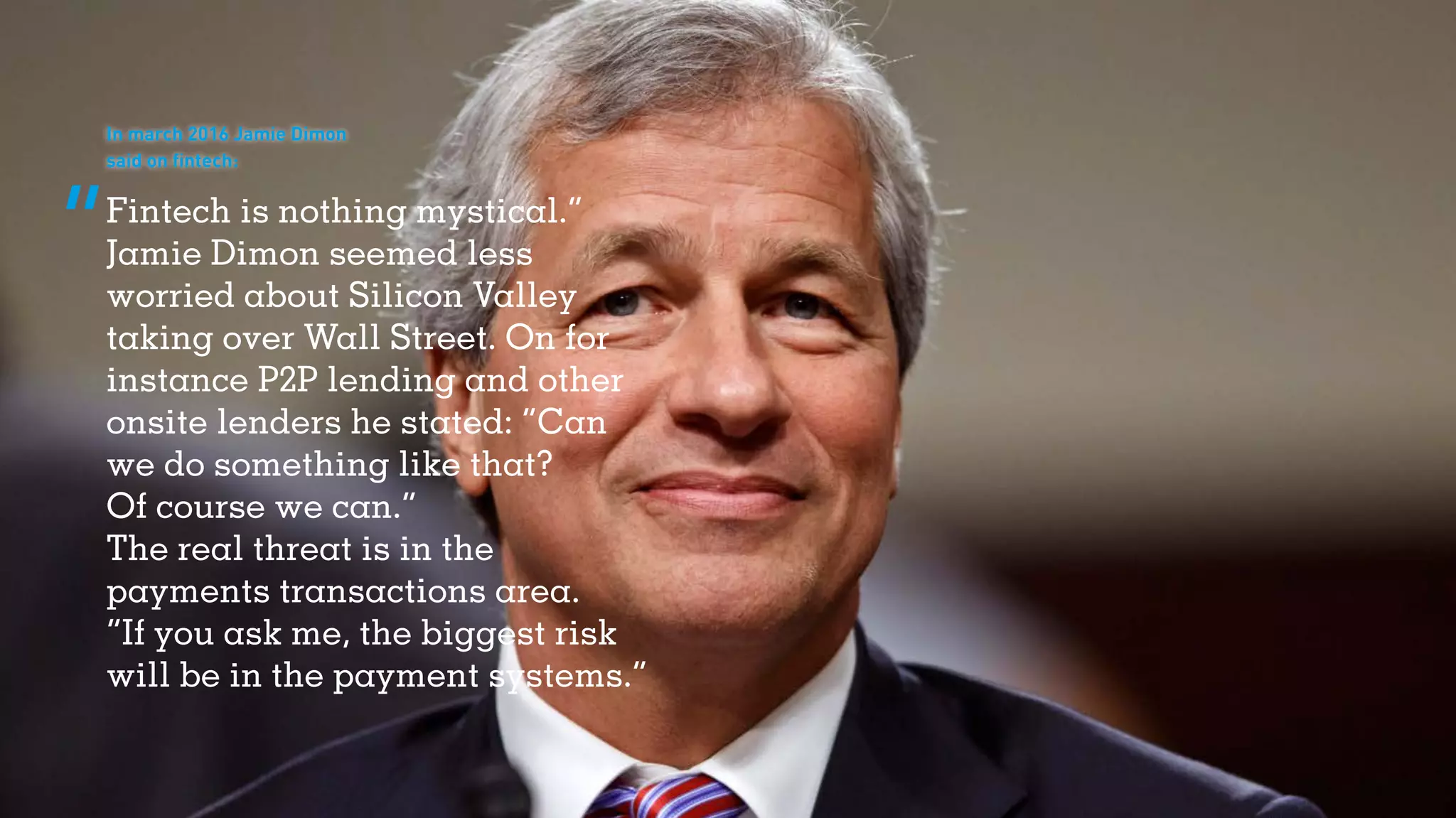

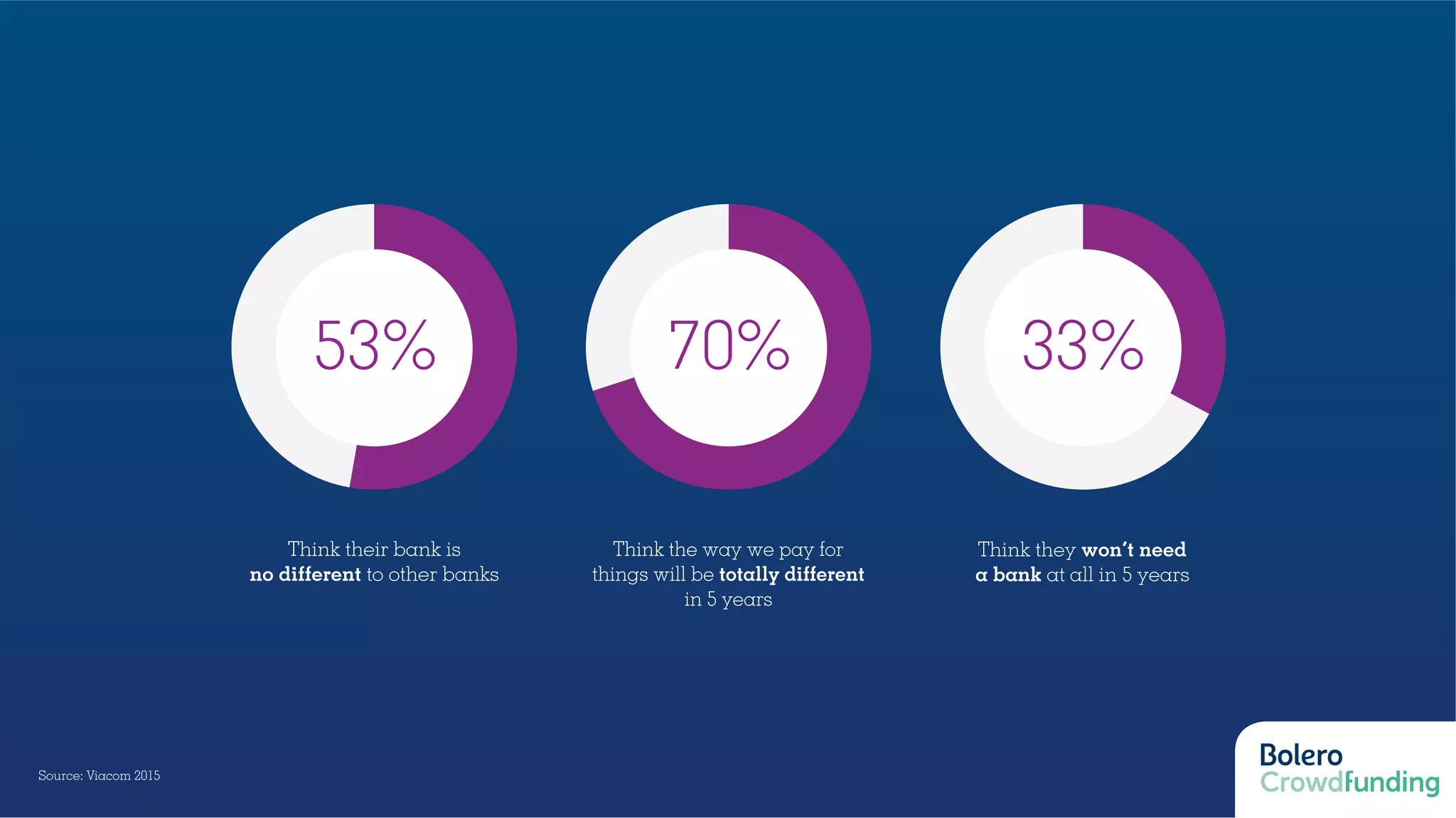

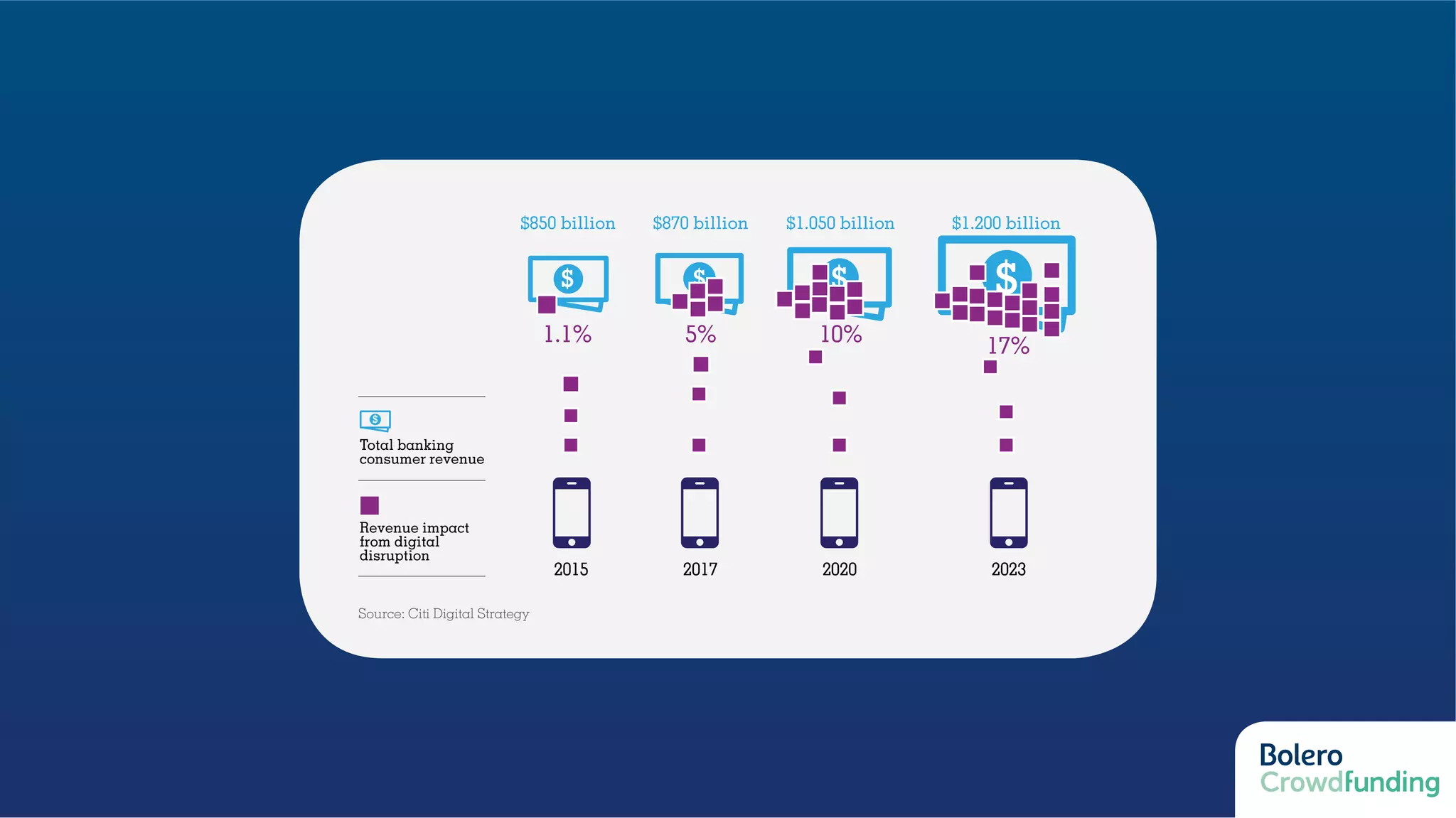

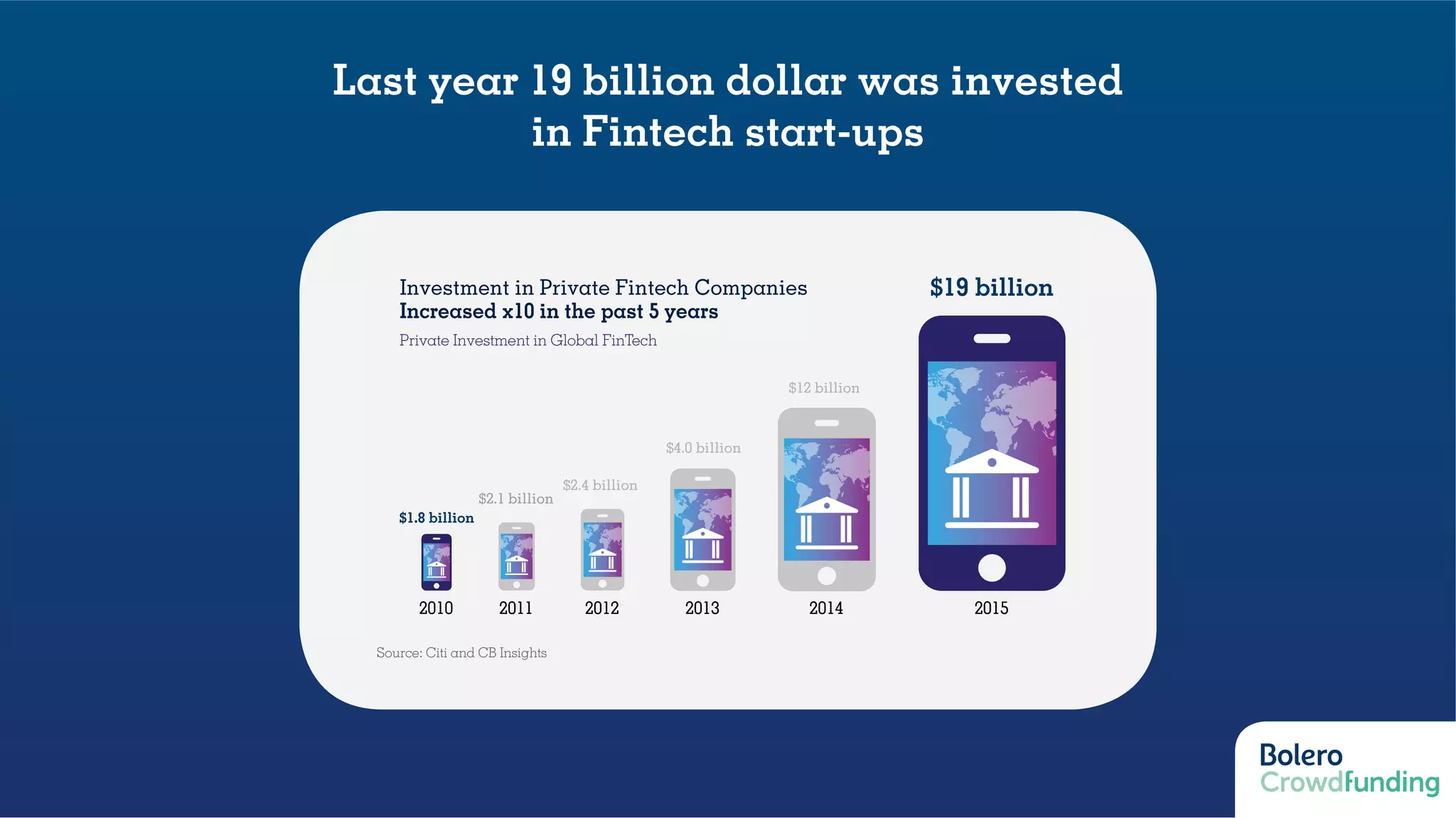

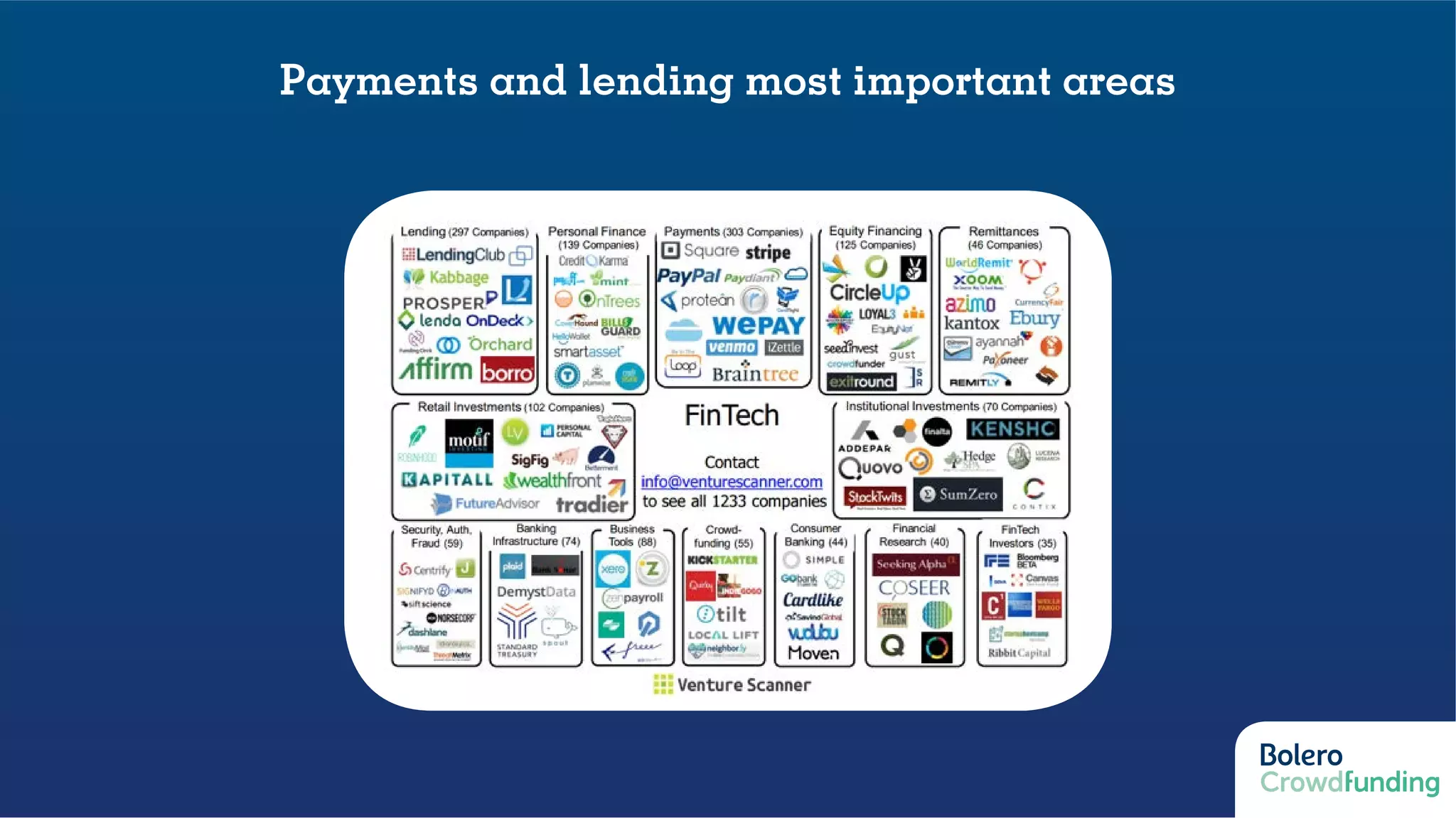

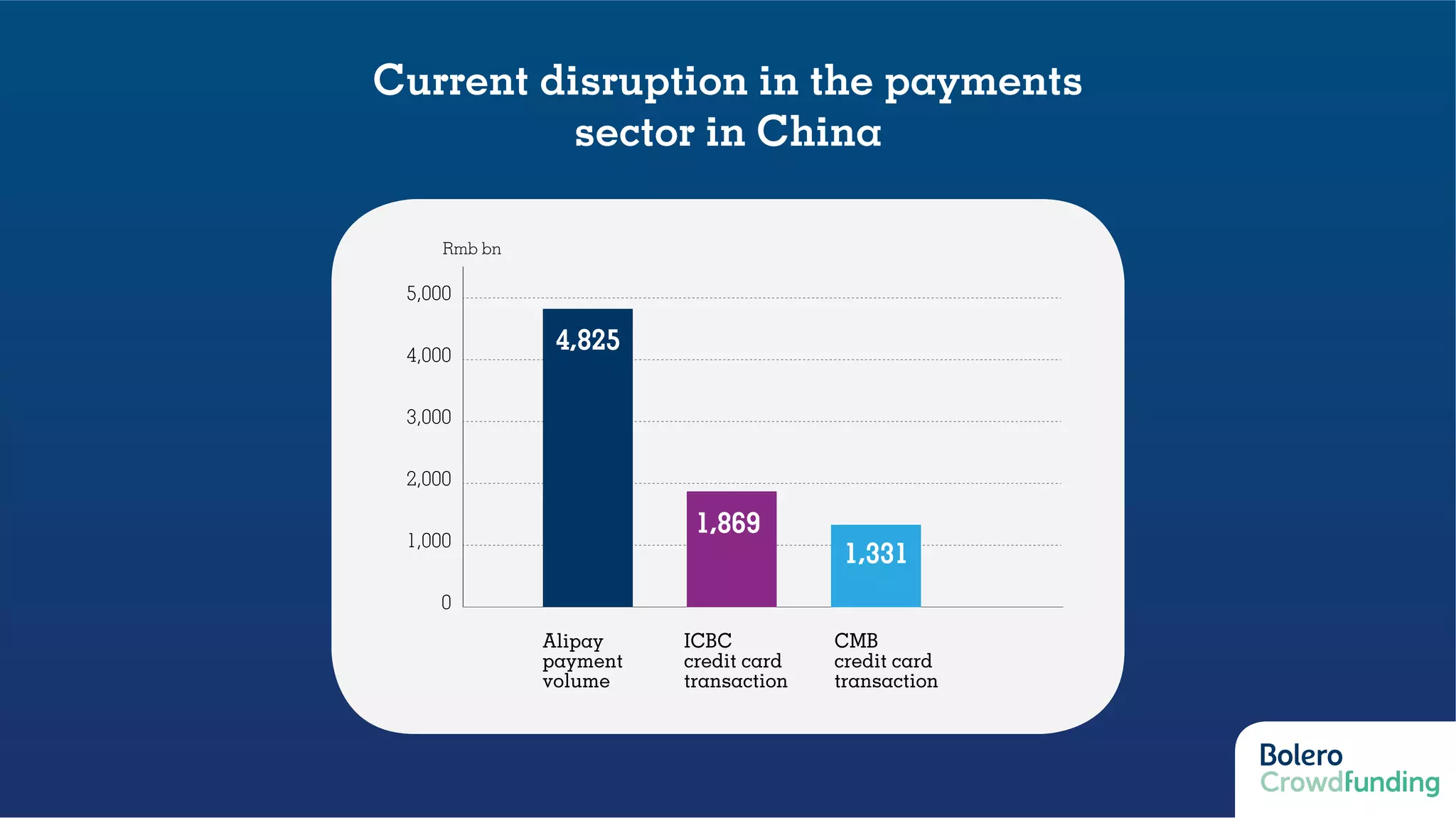

1) Fintech is disrupting the traditional banking model through faster innovation and customer experience from startups. Payments and lending are seen as the most vulnerable areas for incumbent banks.

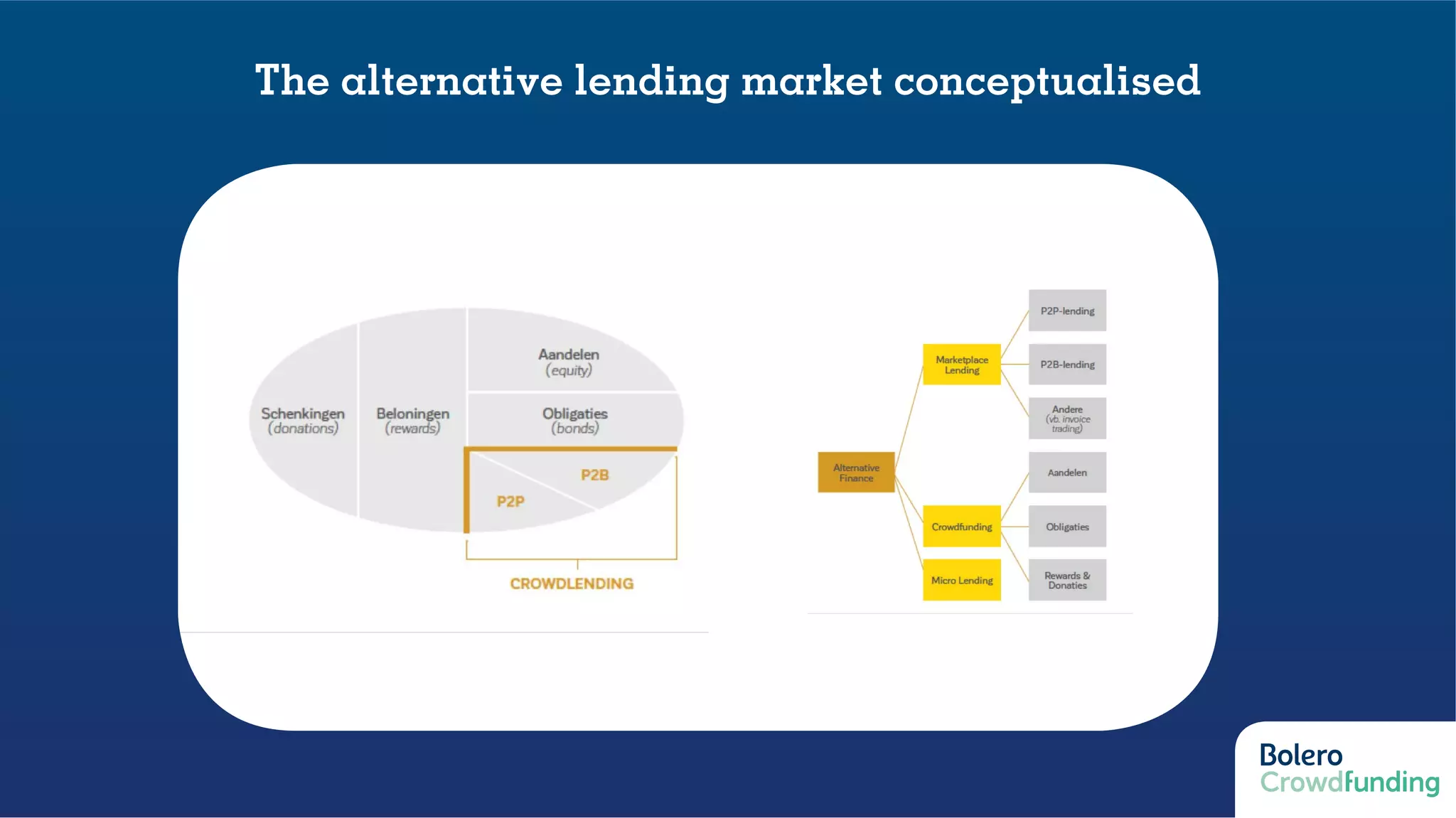

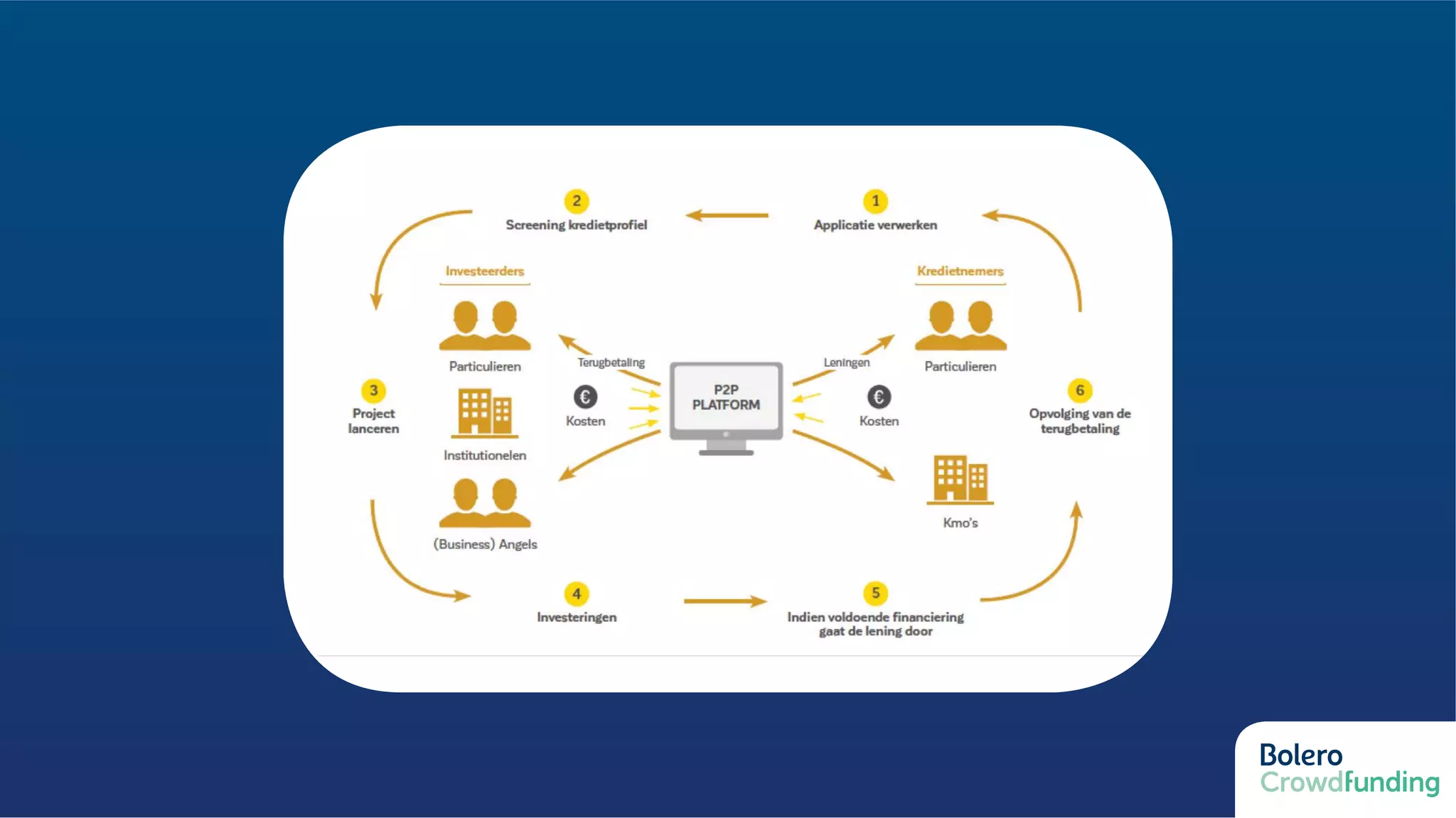

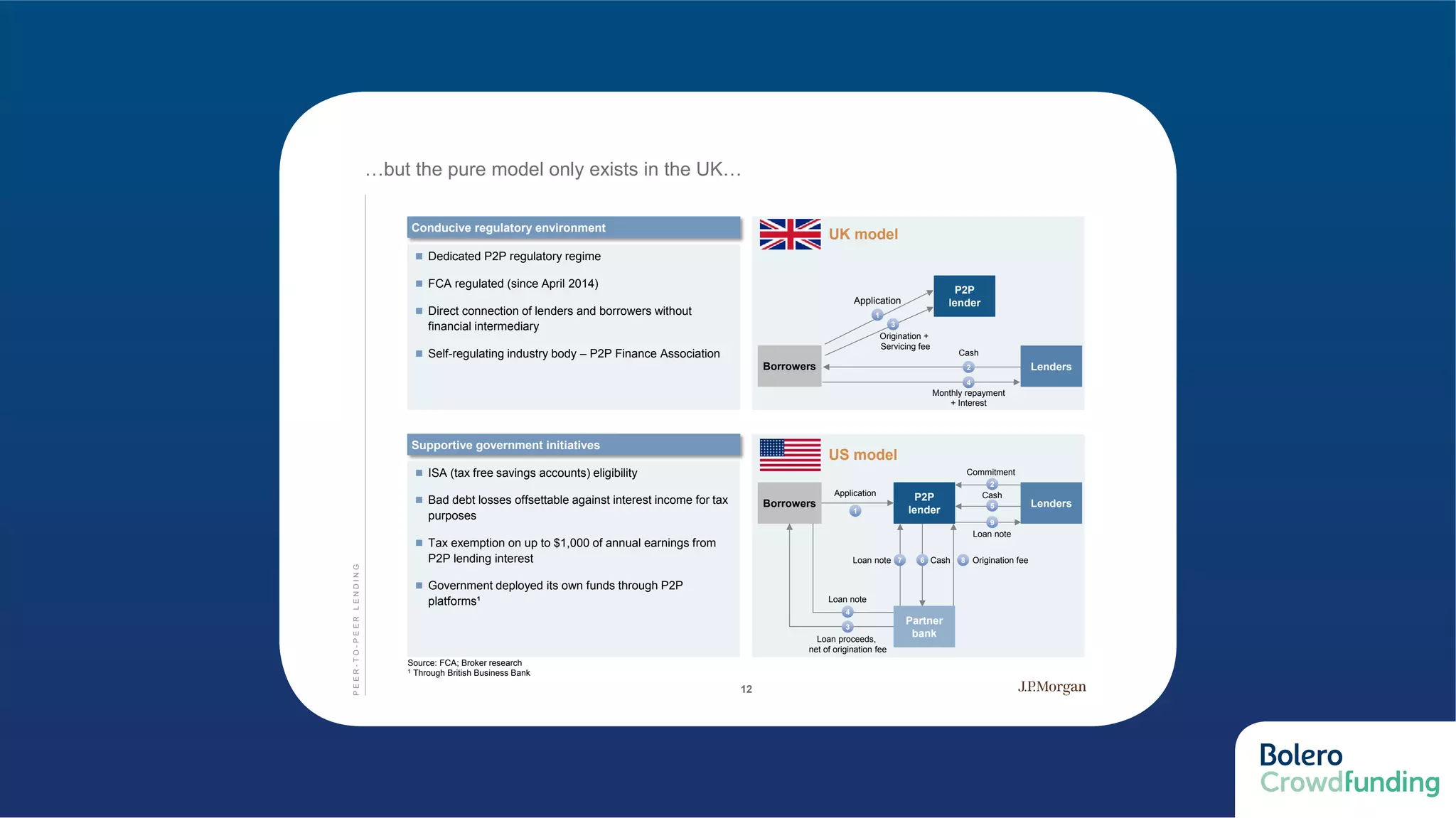

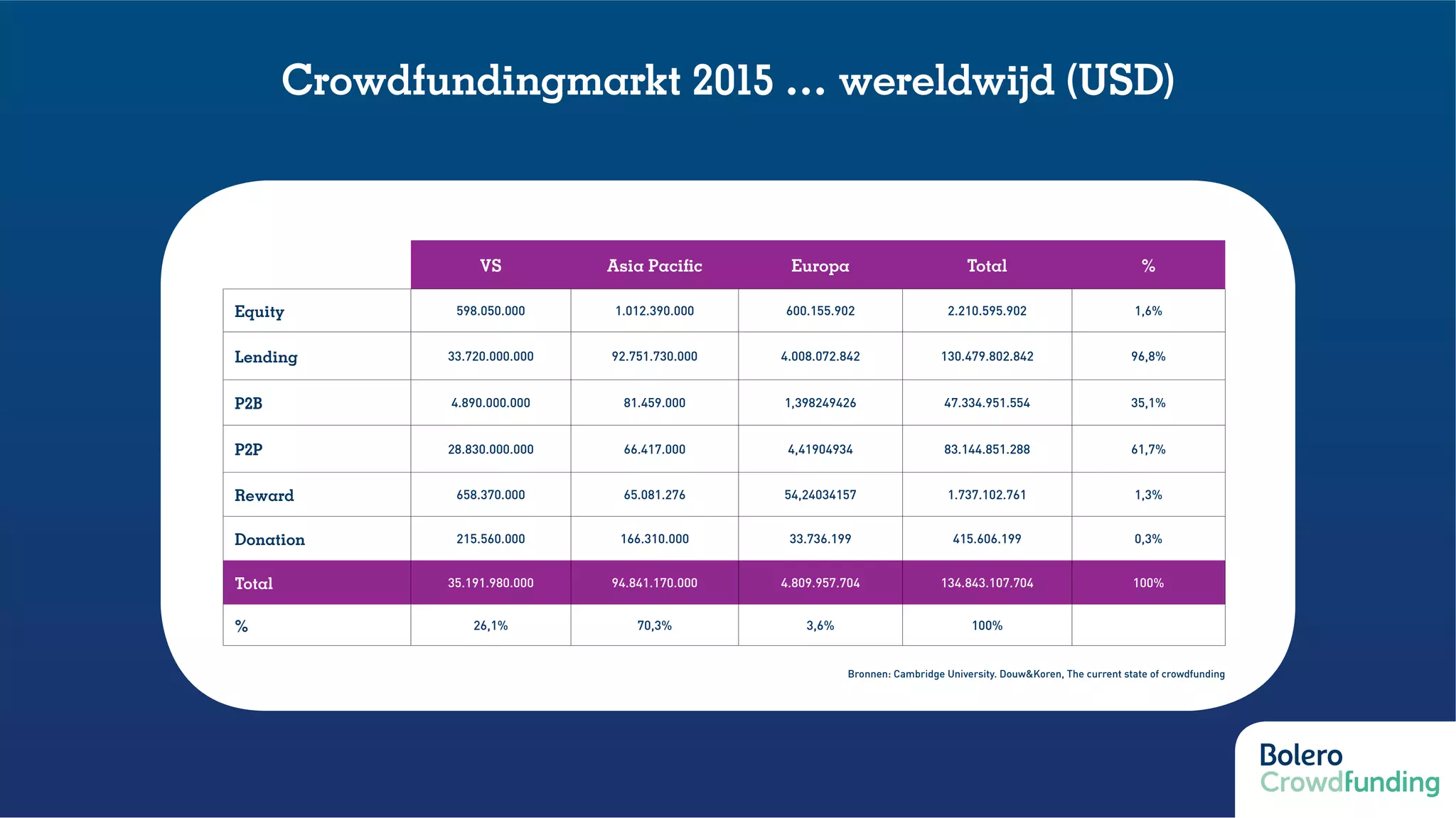

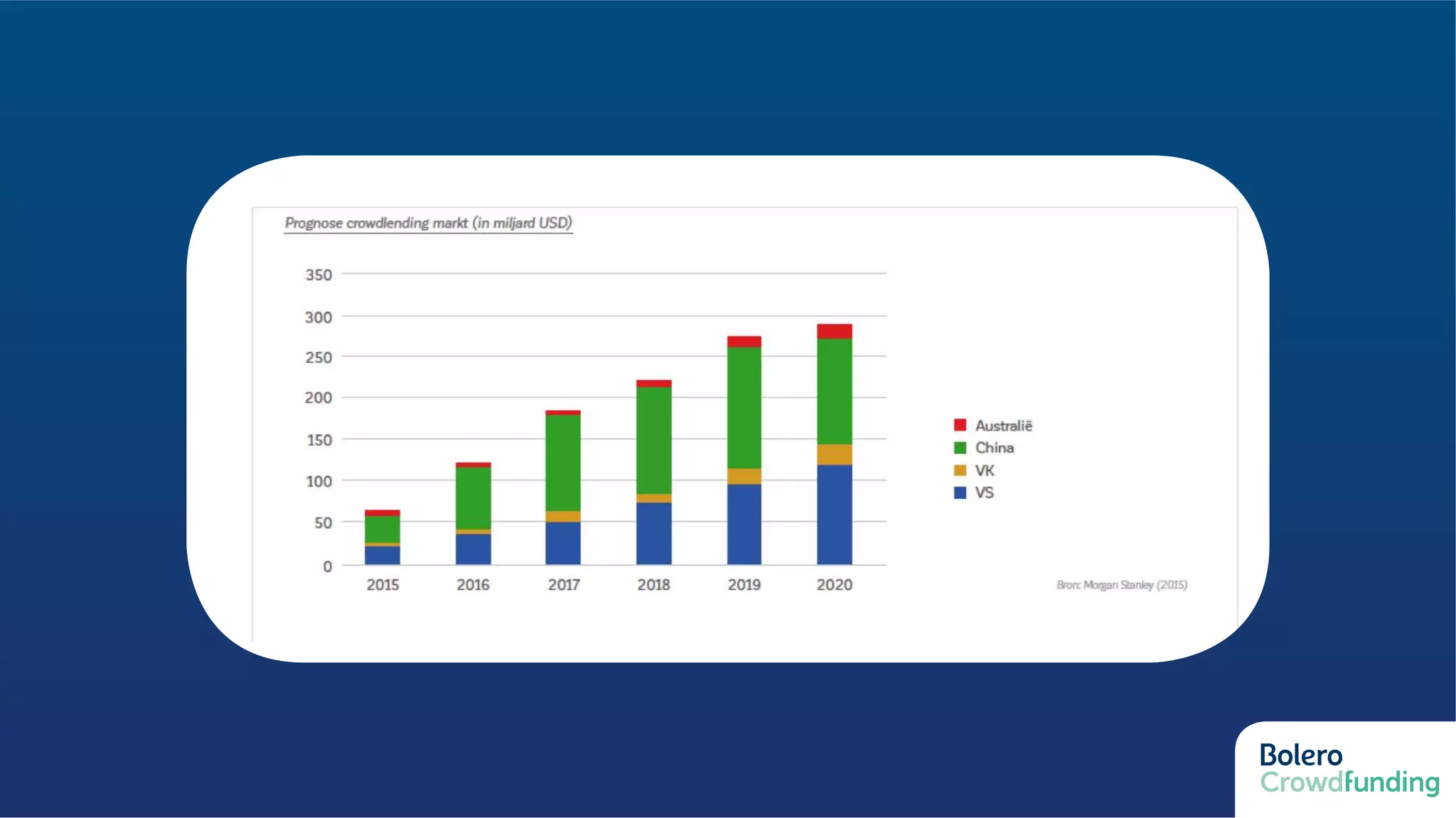

2) Peer-to-peer lending is growing exponentially due to lower costs and better rates for borrowers and lenders compared to traditional banks. However, regulatory issues in the US pose challenges for the business model.

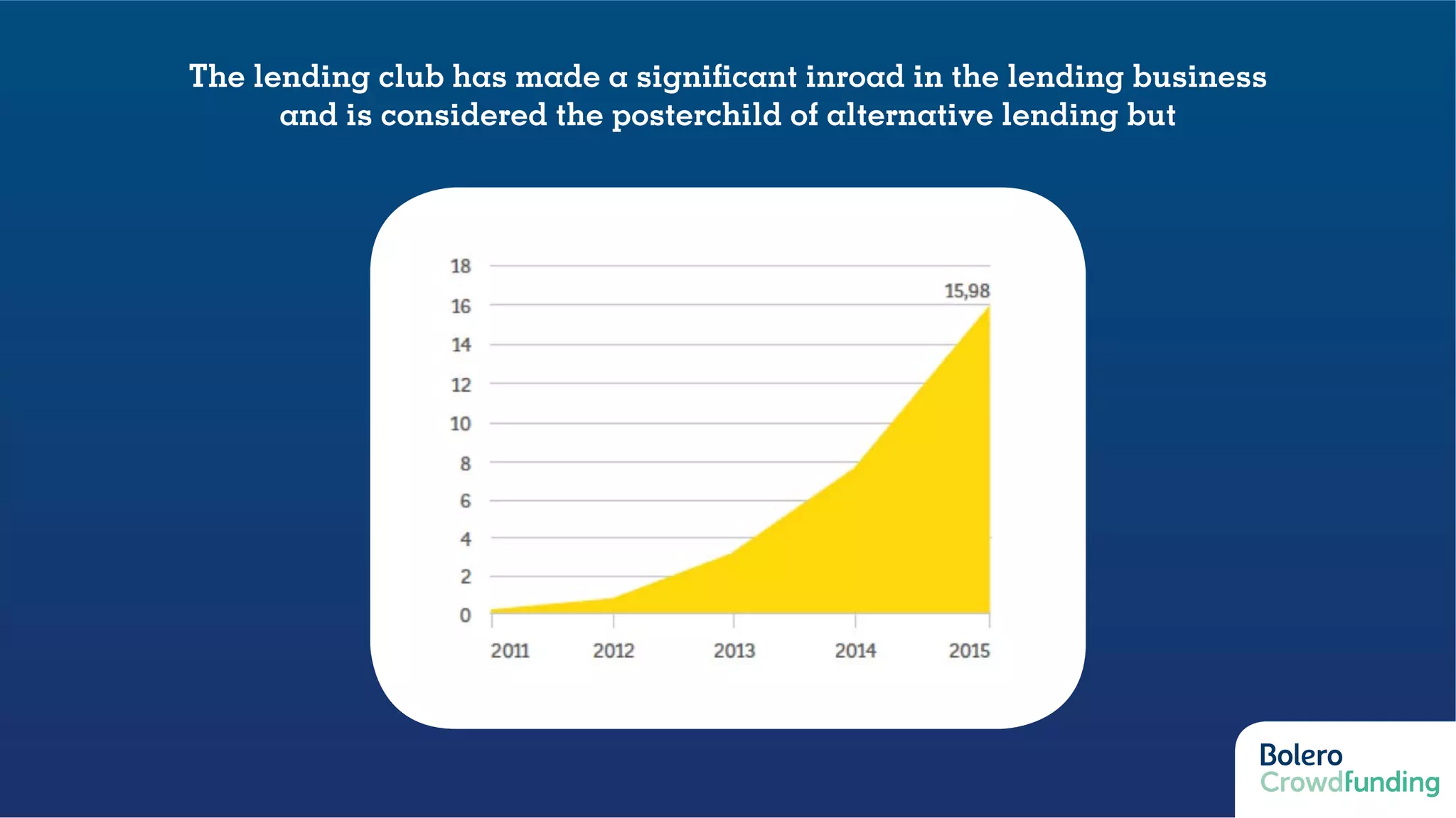

3) The Lending Club IPO and subsequent events highlight growing pains in the US marketplace lending industry as it faces headwinds around regulations and operational issues.