Oz Metals 20150503

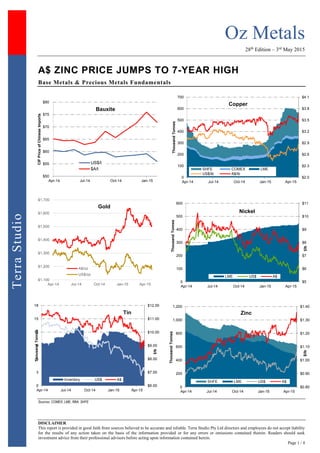

- 1. Oz Metals 28th Edition – 3rd May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 4 TerraStudio A$ ZINC PRICE JUMPS TO 7-YEAR HIGH Base Metals & Precious Metals Fundamentals Sources: COMEX, LME, RBA, SHFE $50 $55 $60 $65 $70 $75 $80 Apr-14 Jul-14 Oct-14 Jan-15 CIFPriceofChineseImports Bauxite US$/t $A/t $2.0 $2.3 $2.6 $2.9 $3.2 $3.5 $3.8 $4.1 0 100 200 300 400 500 600 700 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 ThousandTonnes Copper SHFE COMEX LME US$/lb A$/lb $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Gold A$/oz US$/oz $5 $6 $7 $8 $9 $10 $11 0 100 200 300 400 500 600 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Nickel LME US$ A$ $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 0 3 6 9 12 15 18 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Tin Inventory US$ A$ $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 0 200 400 600 800 1,000 1,200 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Zinc SHFE LME US$ A$

- 2. Oz Metals 28th Edition – 3rd May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 4 TerraStudio Markets & Majors The global refined copper market is expected to see a surplus of 365,000 tonnes this year, down from a 595,000 t surplus estimated in April 2014, according to the International Copper Study Group (ICSG). Last October, the ICSG revised down the surplus for this year to 390,000 tonnes. The copper market could show a second consecutive surplus in 2016, but this is expected to be lower at 230,000 tonnes as demand growth outpaces production growth. Terra Studio’s review indicates that higher surpluses forecasted by the ICSG at the same period in 2013 and 2014 for the corresponding year turned into actual deficits. Thomson Reuters - Pure-play silver miners, a niche investment market popular with retail investors, are moving up the endangered list. Buffeted by a 68% plunge in the price of silver since 2011, miners who traditionally made most of their money from silver are increasingly diversifying into gold, buying mines that have been put up for sale and looking to acquire more. Thomson Reuters - The Philippines' mining industry regulator said on Monday two new nickel mines would help boost production of the country's top metal export this year, but prices may remain weak amid tepid demand from top consumer China. The Southeast Asian country was last year's biggest nickel ore supplier to China's producers of nickel pig iron, used in stainless steel production, after previous top supplier Indonesia banned exports of unprocessed metallic minerals. Funding, Mergers & Acquisitions mining.com - Rio Tinto, the world’s second largest mining company, is ready to restart looking for deals, but only if it can secure the right asset at the correct valuation and win investor support, analysts and banking sources say. Newmont Mining has inked a nonbinding letter of intent to sell its Newmont Waihi Gold unit to Oceana Gold for cash proceeds of US$101 million and a US$5 million contingent payment. In addition, Newmont will retain a 1% net smelter royalty on a recent discovery north of Waihi's current operations at its namesake Waihi gold mine in New Zealand. Following the execution of a definitive acquisition agreement, fulfillment of all conditions precedent and receipt of necessary board and regulatory approvals, Oceana Gold will acquire all of Waihi's open pit and underground mining assets and liabilities, including all social, environmental and employee obligations. Both parties have agreed to complete due diligence and target execution of a definitive acquisition agreement in mid-May. According to a report by The Australian Financial Review, the Cowal gold mine would fit OZ Minerals' new criteria of seeking acquisitions outside its primary commodity, copper. Kidman Resources has agreed to acquire the Burbanks gold mine located near Coolgardie in Western Australia in a move, which will see it generating production and cashflow within the September quarter. Under the agreement, Kidman will pay private company Blue Tiger Mines Pty Ltd $3 million for an 80% stake in the Burbanks mine and the nearby Coolgardie North gold project, which includes the Gunga open pit mine. Kidman will also inject $2.4 million to a total working capital pool of $3 million to help fund resource definition drilling and the stage one mining plan at Burbanks. Mungana Goldmines has received an off-market takeover offer from Auctus Chillagoe Pty Ltd, to acquire all of the ordinary shares of Mungana Goldmines for 13.5 Australian cents per share in cash. The offer represents a 29% premium to the April 28 closing price of Mungana shares on the ASX. St Barbara has signed a deed of sale for the Gold Ridge project and a number of associated subsidiaries to a Solomon Islands company associated with local landowners for a nominal purchase price and on confidential terms. Thor Mining is moving to full ownership of the Spring Hill gold property in the Northern Territory. The company has agreed on terms to acquire the 49% interest in Spring Hill that it does not already own from Western Desert Resources subsidiary WDR Gold Pty Ltd, which is currently in receivership. Consideration has been agreed at A$210,000 plus A$100,000 worth of Thor Mining CHESS depository interests. Bauxite Sector Source: Bloomberg, SNL Metals & Mining, Terra Studio Zinc & Poly-metallic Sector Source: SNL Metals & Mining Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABX Australian Bauxite 0.32 ▼ (9%) 3% 40 4 36 BAU Bauxite Resources 0.082 ▲ 2% (16%) 19 24 (5) CAY Canyon Resources 0.040 — 0% (20%) 5 1 4 MLM Metallica Minerals 0.066 ▲ 16% 20% 11 2 9 MMI Metro Mining 0.086 ▲ 8% 219% 25 5 20 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AQR Aeon Metals 0.085 ▲ 6% (15%) 26 3 38 DGR DGR Global 0.033 — 0% 3% 14 23 15 HRR Heron Resources 0.13 ▲ 4% 4% 47 26 21 IBG Ironbark Zinc 0.120 ▲ 4% 50% 53 3 50 IPT Impact Minerals 0.017 ▼ (15%) (29%) 10 1 7 IVR Investigator Resources 0.012 — 0% (25%) 6 5 1 MRP MacPhersons Resources 0.096 ▼ (13%) (23%) 30 5 25 PNX Phoenix Copper 0.017 — 0% (43%) 6 2 5 RDM Red Metal 0.040 — 0% (51%) 7 4 3 RVR Red River Resources 0.17 ▲ 18% 50% 29 4 25 RXL Rox Resources 0.028 ▼ (3%) 0% 24 3 21 TZN Terramin Australia 0.110 ▲ 22% 0% 167 1 212 VAR Variscan Mines 0.012 ▲ 9% (51%) 4 1 4 VXR Venturex Resources 0.005 ▲ 25% 0% 8 1 6

- 3. Oz Metals 28th Edition – 3rd May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 4 TerraStudio Tin Sector Source: SNL Metals & Mining Nickel Sector Source: SNL Metals & Mining Copper Producers Source: SNL Metals & Mining Copper Developers & Explorers Source: SNL Metals & Mining Gold Producers Source: SNL Metals & Mining Gold Developers & Explorers Source: SNL Metals & Mining Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) CSD Consolidated Tin Mines 0.054 ▲ 4% 32% 15 3 15 ELT Elementos 0.007 ▼ (13%) (13%) 5 1 4 KAS Kasbah Resources 0.034 ▲ 10% (37%) 15 3 9 MLX Metals X 1.50 ▲ 11% 91% 624 57 517 MOO Monto Minerals 0.004 — 0% 100% 5 1 5 SRZ Stellar Resources 0.032 ▼ (3%) 10% 10 3 7 VMS Venture Minerals 0.020 — 0% (35%) 6 4 2 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) IGO Independence Group 5.90 ▲ 4% 33% 1,382 57 1,291 MBN Mirabella Nickel 0.140 ▲ 8% 383% 130 21 232 MCR Mincor Resources 0.60 ▲ 3% 3% 113 26 95 PAN Panoramic Resources 0.55 ▲ 14% 30% 175 64 116 WSA Western Areas 3.77 ▲ 8% 1% 877 231 826 AVQ Axiom Mining 0.275 ▲ 15% 22% 66 1 65 CZI Cassini Resources 0.07 ▲ 3% (38%) 8 3 6 DKM Duketon Mining 0.18 ▲ 9% (31%) 14 7 7 LEG Legend Mining 0.007 ▼ (7%) 0% 14 7 7 MAT Matsa Resources 0.180 ▲ 9% 6% 26 0 26 MLM Metallica Minerals 0.066 ▲ 16% 20% 11 2 8 PIO Pioneer Resources 0.018 ▲ 6% 38% 12 2 10 POS Poseidon Nickel 0.14 ▲ 8% 13% 92 8 109 SEG Segue Resources 0.005 — 0% 0% 10 1 10 SGQ St George Mining 0.065 ▼ (16%) 3% 7 1 6 SIR Sirius Resources 2.90 ▲ 10% 13% 991 210 745 TLM Talisman Mining 0.16 — 0% 0% 20 15 6 WIN Winward Resources 0.16 ▲ 7% 0% 17 4 14 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA ABY Aditya Birla Minerals 0.20 ▲ 5% 0% 61 137 (43) NA HGO Hillgrove Resources 0.34 — 0% (24%) 50 9 60 1.3x KBL KBL Mining 0.022 ▼ (12%) (27%) 11 7 34 NA MWE Mawson West 0.047 ▼ (18%) (10%) 19 26 71 NM OZL OZ Minerals 4.73 ▲ 8% 36% 1,435 219 1,217 3.5x PNA PanAust 1.76 ▲ 1% 24% 1,137 90 1,357 NM SFR Sandfire Resources 5.02 ▲ 5% 10% 785 58 870 NA SRQ Straits Resources 0.008 ▲ 100% 60% 10 13 166 NA TGS Tiger Resources 0.063 ▲ 24% (52%) 72 80 279 6.1x 985 CST Mining 0.016 ▼ (5%) 125% 439 146 260 3.7x 1208 MMG 0.54 ▲ 4% 39% 2,881 307 14,603 15.4x 3993 China Molybdenum 1.27 ▼ (3%) 73% 14,378 1,834 14,938 NA Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AOH Altona Mining 0.105 — 0% (56%) 56 48 9 ARE Argonaut Resources 0.007 — 0% (56%) 3 1 2 AVB Avanco Resources 0.079 — 0% 4% 131 16 111 AVI Avalon Minerals 0.031 ▲ 11% 55% 6 3 4 AZS Azure Minerals 0.014 — 0% (42%) 14 1 13 CDU CuDeco (suspended) 1.41 S (28%) 384 16 450 CVV Caravel Minerals 0.011 ▲ 38% 38% 8 1 8 ENR Encounter Resources 0.14 ▲ 13% 4% 18 2 16 ERM Emmerson Resources 0.034 ▲ 13% 10% 13 3 10 FND Finders Resources 0.16 ▲ 3% 3% 102 28 103 GCR Golden Cross Resources 0.060 ▲ 2% (14%) 6 1 5 GPR Geopacific Resources 0.038 — 0% (27%) 15 4 11 HAV Havilah Resources 0.26 ▼ (7%) 86% 41 3 39 HCH Hot Chili 0.12 ▲ 15% (28%) 40 5 46 HMX Hammer Metals 0.075 ▼ (11%) (9%) 8 1 7 IAU Intrepid Mines 0.13 ▲ 13% (4%) 48 71 23 KDR Kidman Resources 0.069 ▲ 30% 3% 8 1 7 KGL KGL Resources 0.15 ▲ 3% (33%) 21 8 12 MEP Minotaur Exploration 0.08 ▼ (7%) (45%) 14 4 8 MNC Metminco 0.005 ▼ (10%) (44%) 9 1 8 MTH Mithril Resources 0.006 ▲ 20% (14%) 3 1 1 PEX Peel Mining 0.084 — 0% 22% 11 2 9 RDM Red Metal 0.040 — 0% (51%) 7 4 3 RER Regal Resources 0.040 ▼ (11%) (13%) 9 2 6 RTG RTG Mining 0.609 ▼ (6%) 0% 82 11 79 RXM Rex Minerals 0.110 ▲ 28% 0% 24 13 17 SMD Syndicated Metals 0.023 ▼ (21%) (28%) 6 1 5 SRI Sipa Resources 0.083 ▼ (2%) 124% 52 1 51 SUH Southern Hemisphere 0.011 ▲ 10% (74%) 3 1 2 THX Thundelarra Resources 0.095 — 0% (14%) 30 6 23 XAM Xanadu Mines 0.105 ▲ 17% 5% 39 6 39 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AGD Austral Gold 0.16 ▲ 7% 23% 77 5 68 ALK Alkane Resources 0.27 ▼ (16%) 20% 110 16 91 AMI Aurelia Metals 0.26 — 0% 6% 99 22 200 BDR Beadell Resources 0.22 ▼ (4%) (4%) 172 13 277 BOK Black Oak Minerals 0.38 ▲ 7% 39% 17 3 29 DRM Doray Minerals 0.47 ▲ 4% (3%) 111 16 110 EVN Evolution Mining 0.99 ▼ (2%) 53% 706 32 815 IGO Independence Group 5.90 ▲ 4% 33% 1,382 57 1,291 KCN Kingsgate Consolidated 0.73 ▲ 3% 10% 162 54 245 KRM Kingsrose Mining 0.31 ▲ 22% 20% 109 7 120 LSA Lachlan Star 0.024 — 0% 20% 4 2 22 MIZ Minera Gold 0.002 — 0% (33%) 6 0 11 MLX Metals X 1.50 ▲ 11% 91% 624 57 517 MML Medusa Mining 0.91 ▲ 2% 39% 188 14 181 MOY Millennium Minerals 0.030 ▲ 11% (19%) 7 2 42 NCM Newcrest Mining 14.46 ▲ 2% 33% 11,084 141 15,501 NGF Norton Gold Fields 0.23 ▲ 18% 84% 214 19 342 NST Northern Star Resources 2.15 ▼ (4%) 44% 1,274 82 1,246 OGC OceanaGold Corp. 2.51 ▲ 5% 18% 761 63 819 PGI PanTerra Gold 0.185 ▲ 9% 3% 16 3 77 PRU Perseus Mining 0.37 ▼ (4%) 40% 192 37 158 RMS Ramelius Resources 0.135 ▼ (4%) 165% 63 12 46 RRL Regis Resources 1.25 ▼ (0%) (35%) 625 7 634 RSG Resolute Mining 0.33 ▲ 8% 23% 208 19 239 SAR Saracen Mineral Holdings 0.45 ▲ 2% 76% 357 36 337 SBM St Barbara 0.47 ▲ 22% 343% 230 79 553 SLR Silver Lake Resources 0.18 ▼ (3%) (10%) 88 24 95 TBR Tribune Resources 3.45 ▼ (2%) 30% 173 11 187 TRY Troy Resources 0.41 ▼ (12%) (12%) 79 43 119 UML Unity Mining 0.012 ▲ 9% 71% 14 7 2 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AYC A1 Consolidated 0.028 ▼ (18%) (30%) 8 0 7 ABU ABM Resources 0.26 ▲ 6% (10%) 89 23 78 AWV Anova Metals 0.043 ▼ (14%) 59% 13 1 11 AZM Azumah Resources 0.024 — 0% 20% 9 3 8 BLK Blackham Resources 0.14 ▲ 4% 175% 25 0 25 BSR Bassari Resources 0.012 ▲ 20% 0% 16 (0) 16 CHN Chalice Gold Mines 0.12 — 0% 14% 34 41 (9) CHZ Chesser Resources 0.033 — 0% (8%) 7 8 3 DCN Dacian Gold 0.42 ▼ (3%) 50% 40 7 33 EXG Excelsior Gold 0.090 ▼ (5%) 48% 42 2 41 FML Focus Minerals 0.007 — 0% (7%) 59 80 50 GCY Gascoyne Resources 0.080 ▼ (6%) 13% 14 1 14 GMR Golden Rim Resources 0.008 ▼ (11%) 60% 12 1 11 GOR Gold Road Resources 0.35 — 0% 43% 208 19 187 GRY Gryphon Minerals 0.065 ▲ 12% 2% 26 20 2 KGD Kula Gold 0.040 ▼ (7%) (9%) 10 1 8 MSR Manas Resources 0.014 — 0% 0% 7 0 7 MUX Mungana Goldmines 0.150 ▲ 67% 20% 36 2 41 OGX Orinoco Gold 0.070 ▼ (3%) 20% 11 1 12 PNR Pacific Niugini 0.070 ▼ (7%) 40% 27 11 27 PXG Phoenix Gold 0.088 ▲ 31% (10%) 37 7 32 RED Red 5 0.100 ▼ (9%) 9% 76 13 58 RNI Resource & Investment 0.045 — 0% (40%) 23 0 39 RNS Renaissance Minerals 0.040 ▲ 11% (38%) 16 4 12 SAU Southern Gold 0.013 ▲ 18% 63% 7 1 8 SIH Sihayo Gold 0.014 ▼ (13%) 75% 16 0 11 TAM Tanami Gold 0.032 — 0% 129% 38 1 47 WAF West African Resources 0.070 ▼ (1%) (30%) 19 6 19 WPG WPG Resources 0.034 ▼ (3%) (11%) 9 2 7

- 4. Oz Metals 28th Edition – 3rd May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 4 TerraStudio Specialty Metals Sector Source: SNL Metals & Mining For further information, please contact: J-François Bertincourt +61 406 998 779 jf@terrastudio.biz Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AJM Altura Mining (Li-Ta) 0.011 ▼ (7%) (81%) 5 1 5 ALK Alkane Resources (RE) 0.27 ▼ (16%) 20% 110 16 91 ARU Arafura Resources (RE) 0.056 ▼ (7%) 17% 25 19 6 CNQ Carbine Tungsten (WO3) 0.14 ▲ 12% 8% 43 1 43 GXY Galaxy Resources (Li) 0.033 ▲ 6% 32% 35 3 128 KNL Kibaran Resources (C) 0.19 ▼ (3%) 23% 28 1 26 LMB Lamboo Resources (C) 0.085 ▼ (7%) (51%) 13 0 12 LML Lincoln Minerals (C) 0.045 ▲ 13% (24%) 12 1 10 LYC Lynas Corp. (RE) 0.044 ▼ (6%) (35%) 148 44 585 NMT Neometals (Li) 0.090 ▲ 13% 137% 45 9 43 ORE Orocobre (Li) 2.52 ▲ 18% (9%) 382 66 383 PEK Peak Resources (RE) 0.084 ▼ (8%) 17% 28 5 30 PLS Pilbara Minerals (Li-Ta) 0.051 ▲ 46% 21% 31 1 30 SBU Siburan Resources (WO3) 0.046 — 0% (10%) 11 2 9 SFX Sheffield Resources (MS) 0.74 — 0% (1%) 99 6 94 SHE Stonehenge Metals (WO3) 0.037 ▼ (18%) 825% 31 1 30 SYR Syrah Resources (C) 3.90 ▲ 5% 22% 644 15 628 TLG Talga Resources (C) 0.40 ▲ 7% 67% 55 3 53 TNG TNG (WO3) 0.16 — 0% 94% 97 4 90 TON Triton Minerals (C) 0.38 ▼ (10%) 103% 125 1 123 VML Vital Metals (WO3) 0.040 ▲ 5% 38% 12 1 15 VXL Valence Industries (C) 0.36 ▲ 1% (34%) 55 3 47 WLF Wolf Minerals (WO3) 0.39 ▲ 1% 43% 311 43 308 YRR Yellow Rock Resources (V2O5) 0.011 ▲ 10% 22% 8 4 5