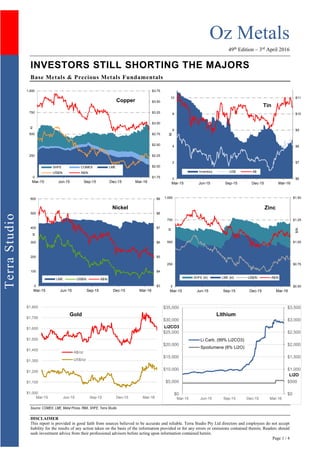

Several investors are betting that mining stock prices will decrease by shorting major companies like Rio Tinto and BHP Billiton. Global mining firms like Glencore and Anglo American have bought back billions in debt to ease investor concerns over leverage. Codelco, Chile's state-owned copper miner, may open parts of the company to the stock exchange to fund international expansion. Analysts are uncertain how changes in unreported Chinese copper stocks will impact global supply and demand balances.