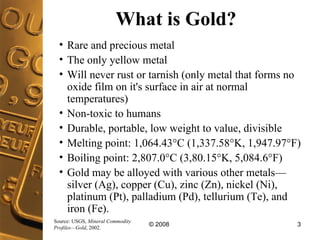

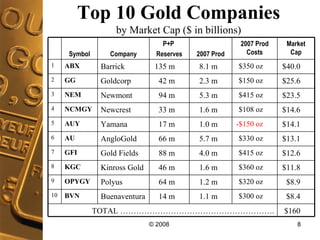

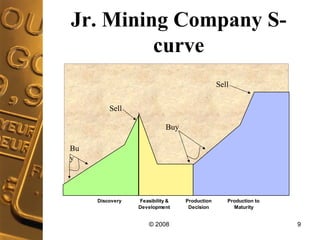

The document presents an overview of investing in gold, covering its properties, various investment avenues such as physical gold, ETFs, and mining stocks, as well as the different stages of gold mining companies. It discusses factors influencing gold prices, including economic indicators and global liquidity conditions. Additionally, it emphasizes investment strategies for junior miners and the importance of due diligence in selecting gold mining stocks.