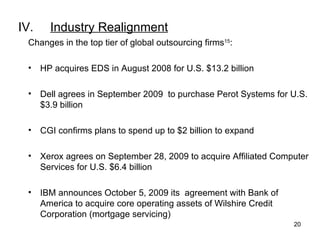

The document discusses the impact of the recession on outsourcing trends in 2009, noting declines in contract activity and a shift towards cost-focused outsourcing strategies, including renegotiations and renewals. It highlights the increasing importance of 'green IT' and cloud computing in outsourcing agreements, influencing service provider selection and cost structures. Additionally, it outlines significant industry realignments, mergers, and the evolving nature of technology services amidst economic pressures.