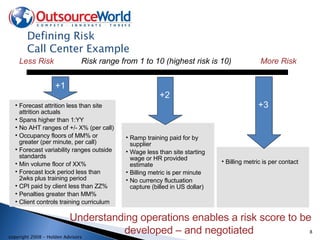

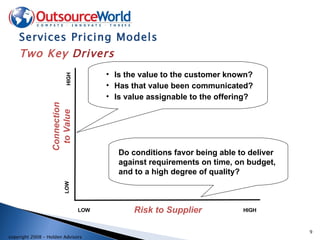

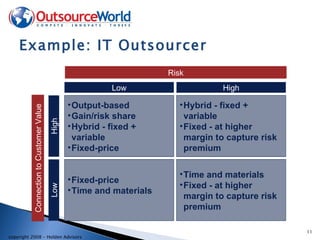

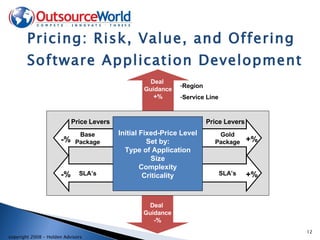

The document discusses different approaches to pricing outsourcing deals. It argues that pricing is often disconnected from risk and value, leading to suboptimal solutions and performance. The document recommends defining risk through service level agreements and using a pricing model that balances value and risk, such as gain/risk sharing or fixed pricing plus variables. This approach provides clearer communication, better solutions, and greater profits for both clients and service providers.

![Thank You! Mark Burton Holden Advisors 978-405-0020 x1021 [email_address] www.holdenadvisors.com www.pricingwithconfidencebook.com](https://image.slidesharecdn.com/oswpricingforsuccessmarkburton-12422417001-phpapp01/85/Osw-Pricing-For-Success-Mark-Burton-14-320.jpg)