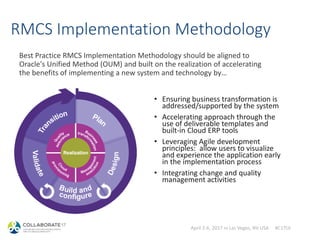

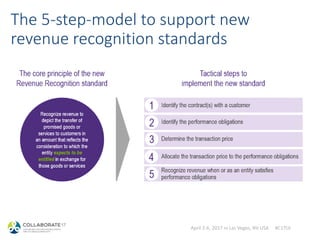

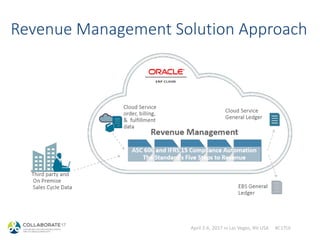

The document provides information about a presentation on Oracle's Revenue Management Cloud Service (RMCS) and the new revenue recognition standards. It introduces the two presenters, Chris Stephenson and Brad Kwiatek, and their backgrounds. It then provides an agenda for the presentation which includes discussing the new revenue recognition standards, the 5-step model to support the standards, transition and implementation considerations, managing revenue with RMCS, and a Q&A session. It also includes appendices on the 5-step model and its challenges.

![April 2-6, 2017 in Las Vegas, NV USA #C17LV

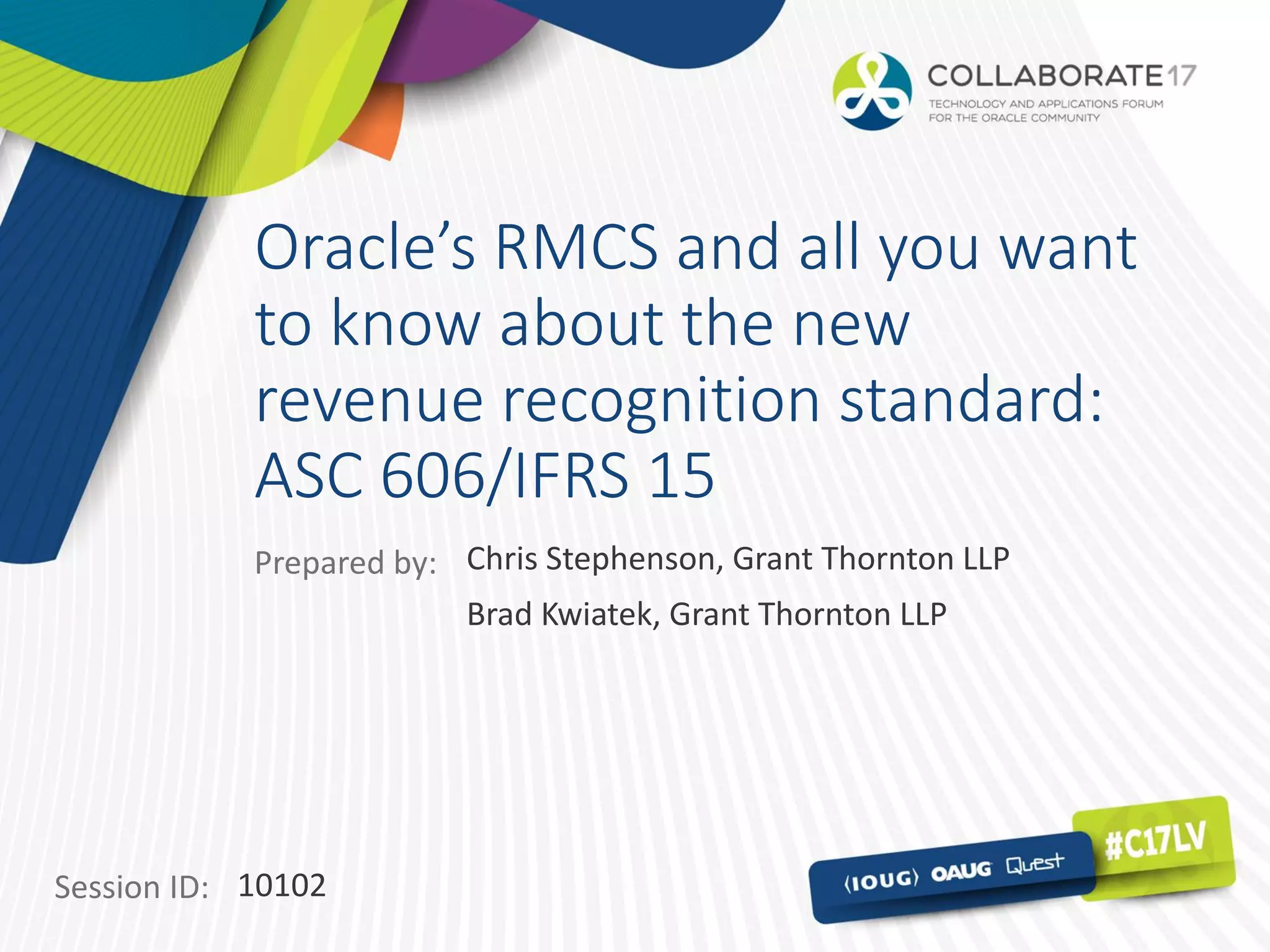

Revenue Management Process

Standard 5 Steps

Pricing bands, Pricing

Dimensions (Stratifications)

Stand Alone Selling Price

Profiles

Establish SSP

Upload ESP using ADFdi

Contract & Performance

Obligation Identification

Rules

Satisfaction Rules

Review/Exempt/Approve

Contract/PO, Discard Contract,

Update Pricing Dimensions,

Review/Add Satisfaction Events

SLA Account/Journal Line

Rules

JERS / Accounting Method

Standalone Selling

Prices

Contracts,

Obligations, and

Satisfaction Events

Contract

Accounting Entries

Manage Stand

Alone Selling

Prices

Accounting

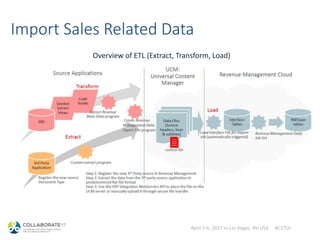

Register data sources

Review and fix data

import errors using ADFDi

Validated Source

Documents

Extract,

Transform &

Load

Calculate

Stand Alone Selling Price

(Basis for Revenue Allocation)

Identify Customer Contracts &

PO

Value Contracts

Value POs (Revenue Allocation)

Determine Liabilities & Assets

Recognize Revenue

Create Accounting

Data extract program

File upload to UCM

Process Revenue Basis

Lines

BIP/OTBI Reporting [OTBI in subsequent releases]

Configurations

Automated

Processes

Actions

Data

Outputs

InputsOutputs](https://image.slidesharecdn.com/oracles-rmcs-180524210845/85/Oracle-Revenue-Management-Cloud-Service-15-320.jpg)