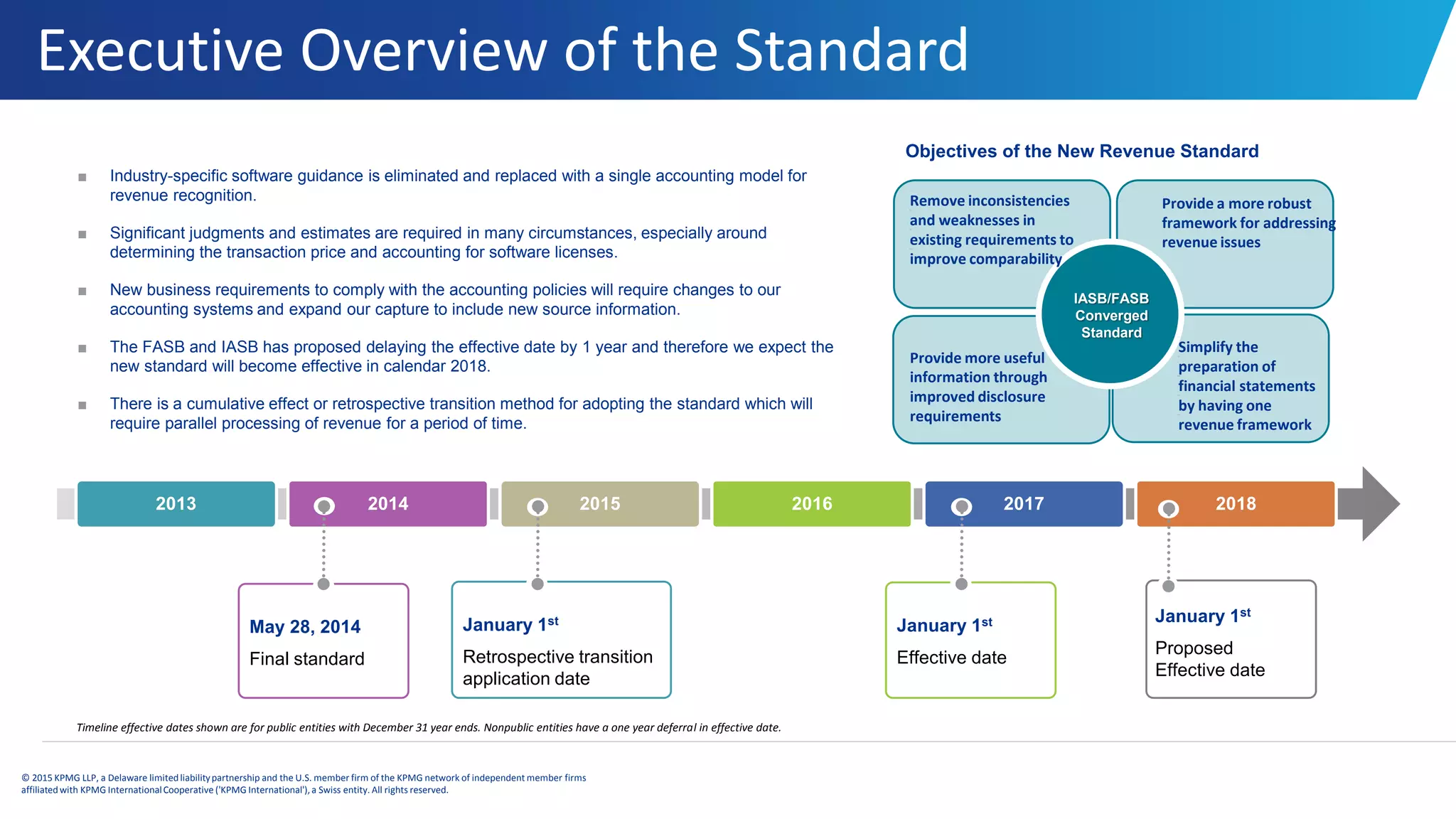

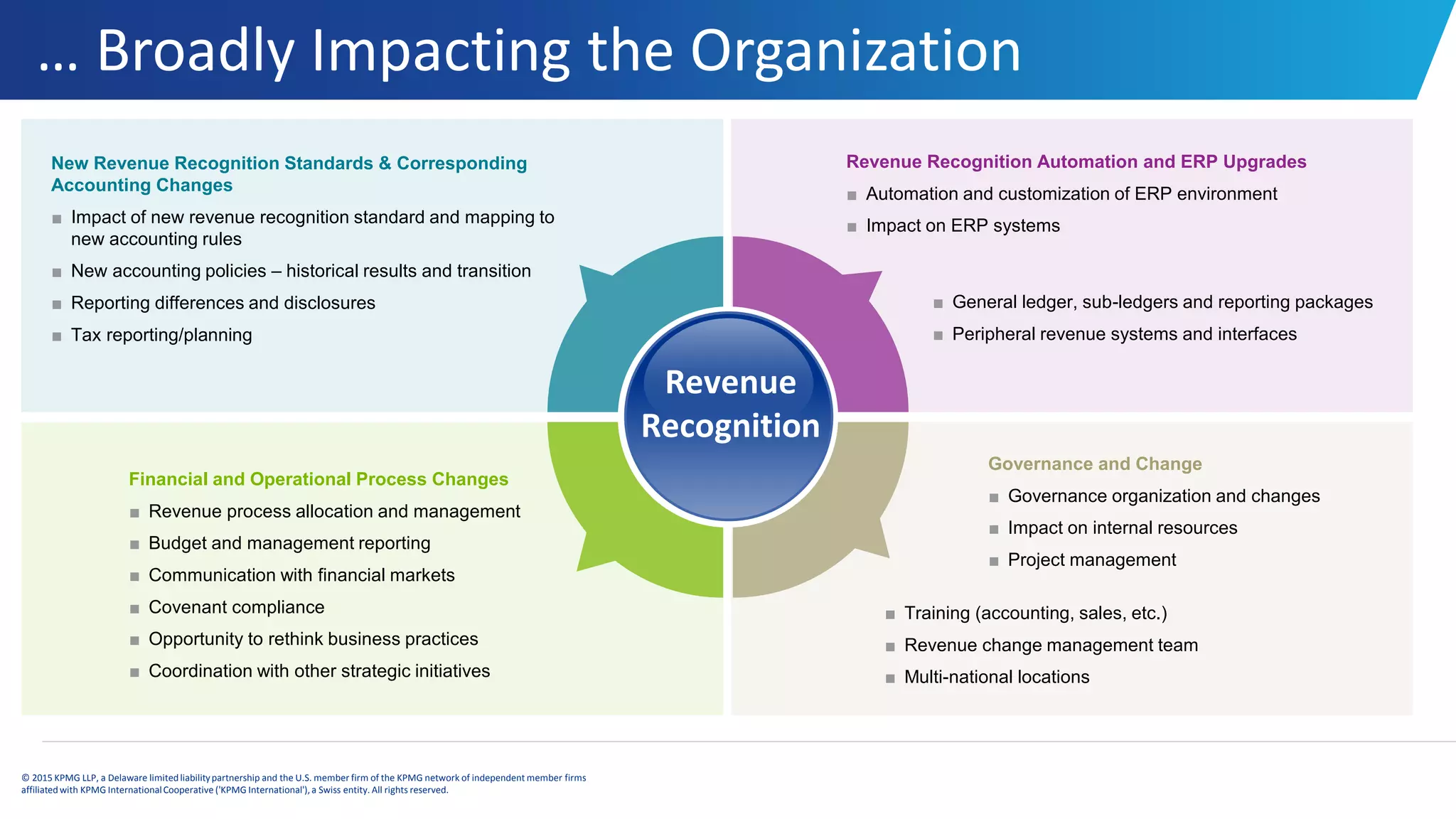

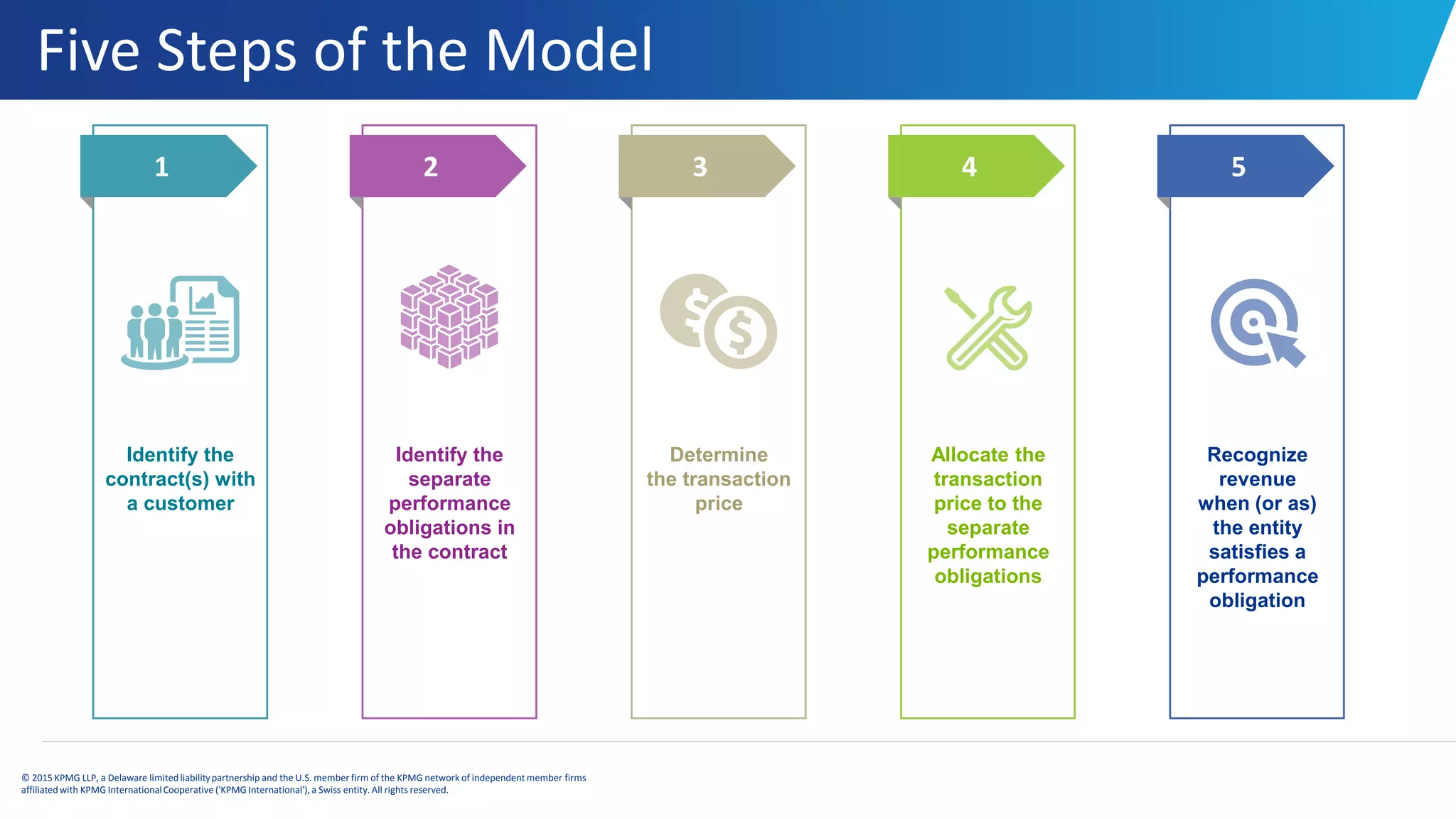

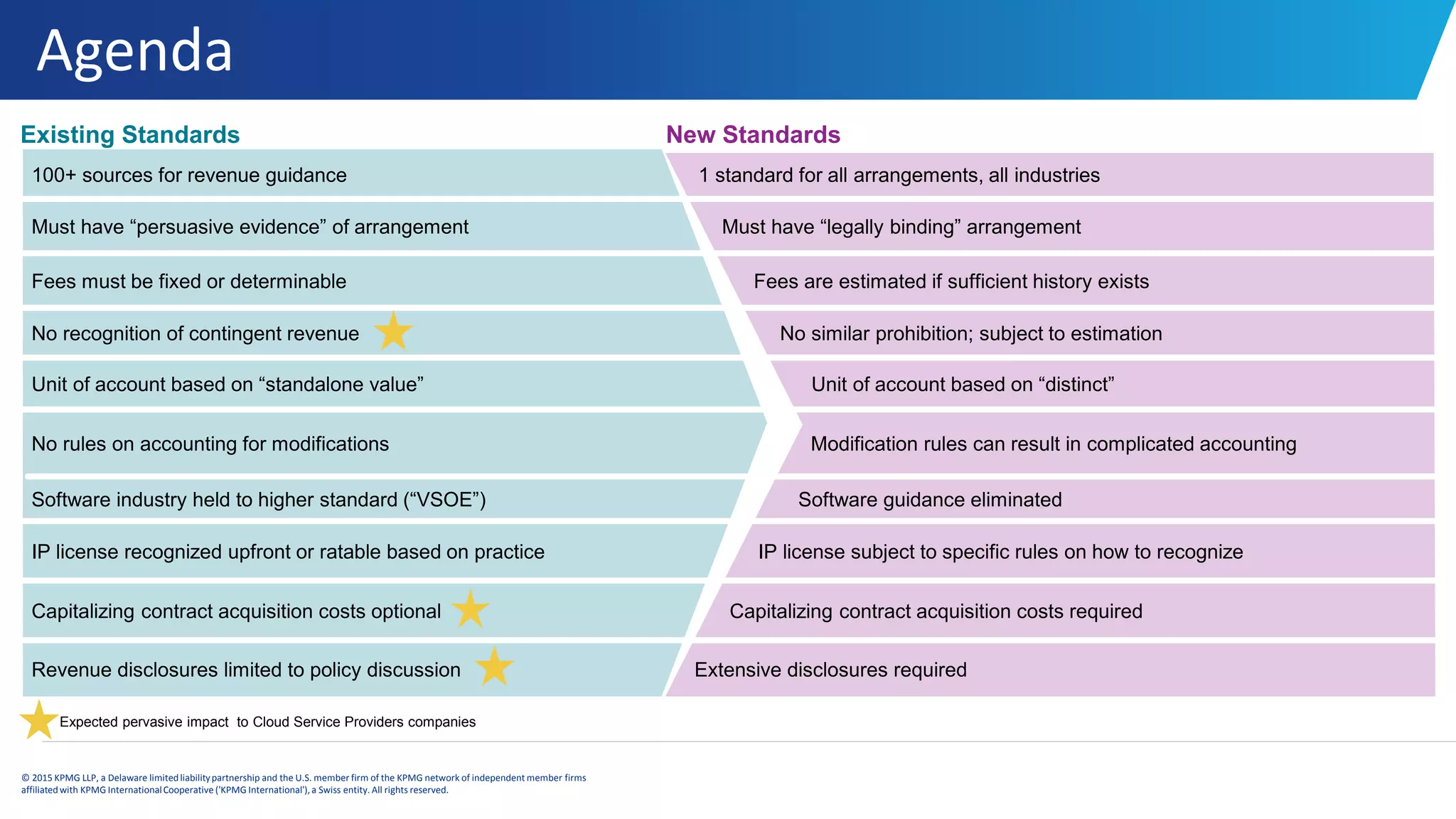

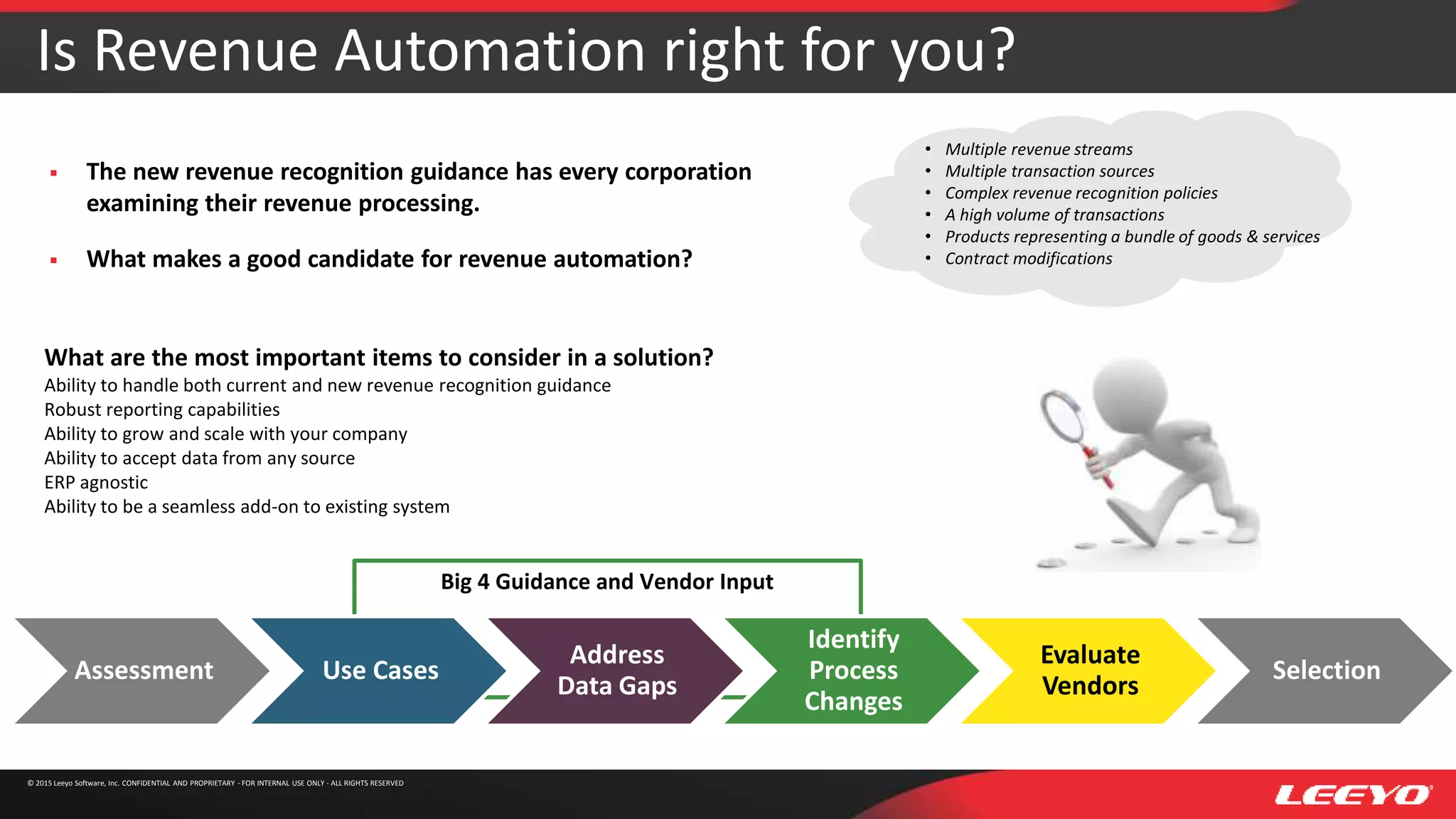

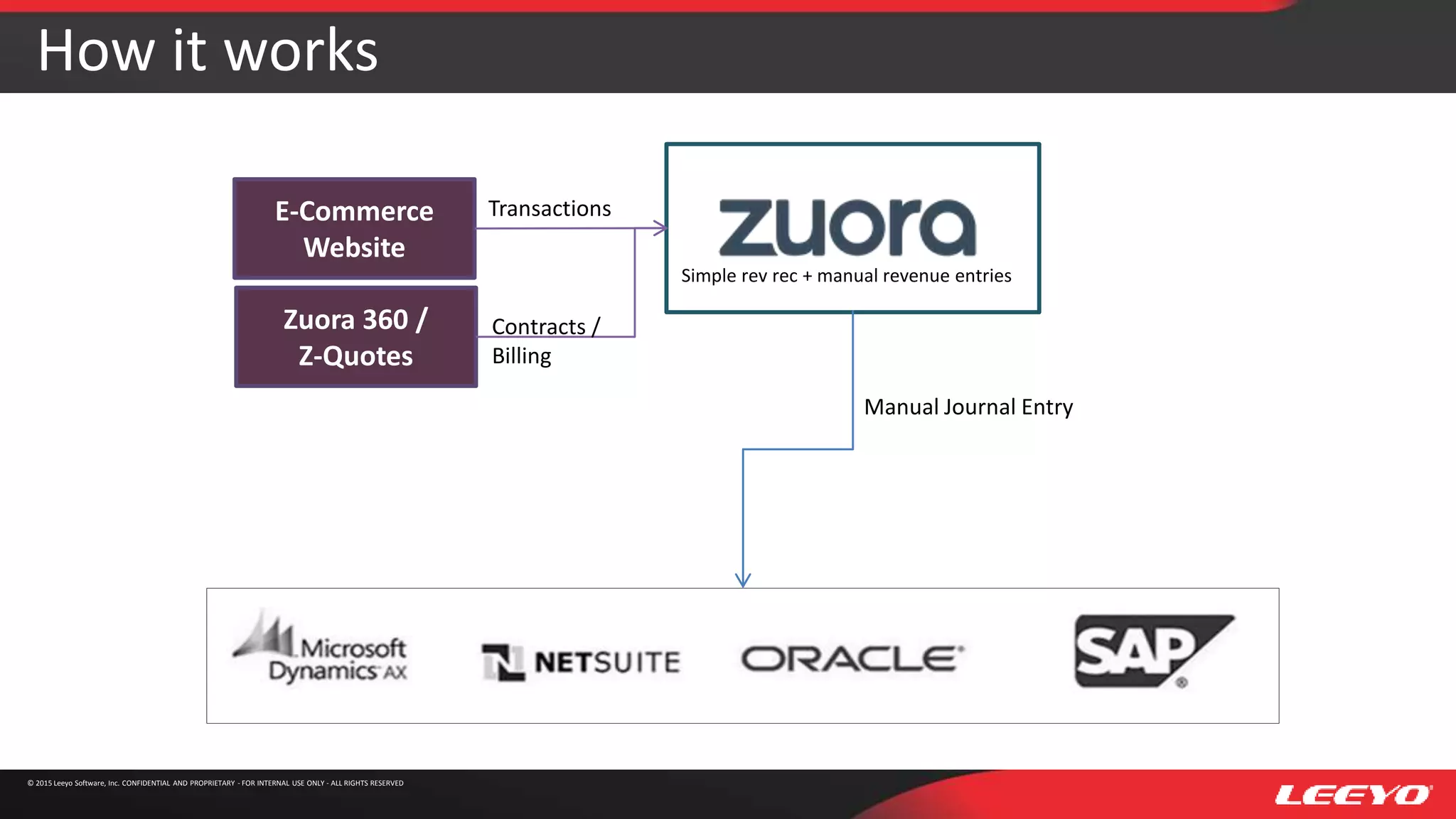

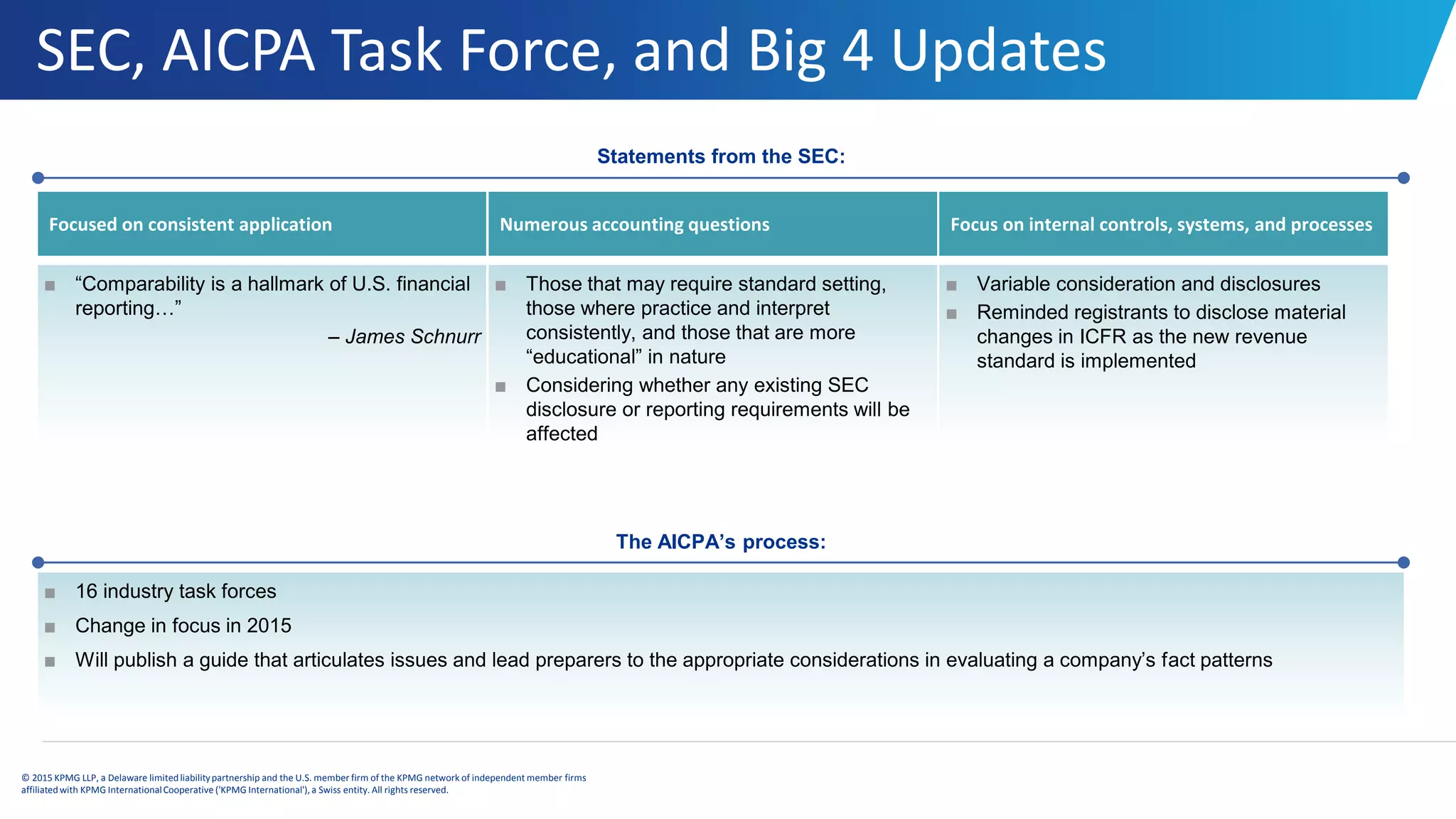

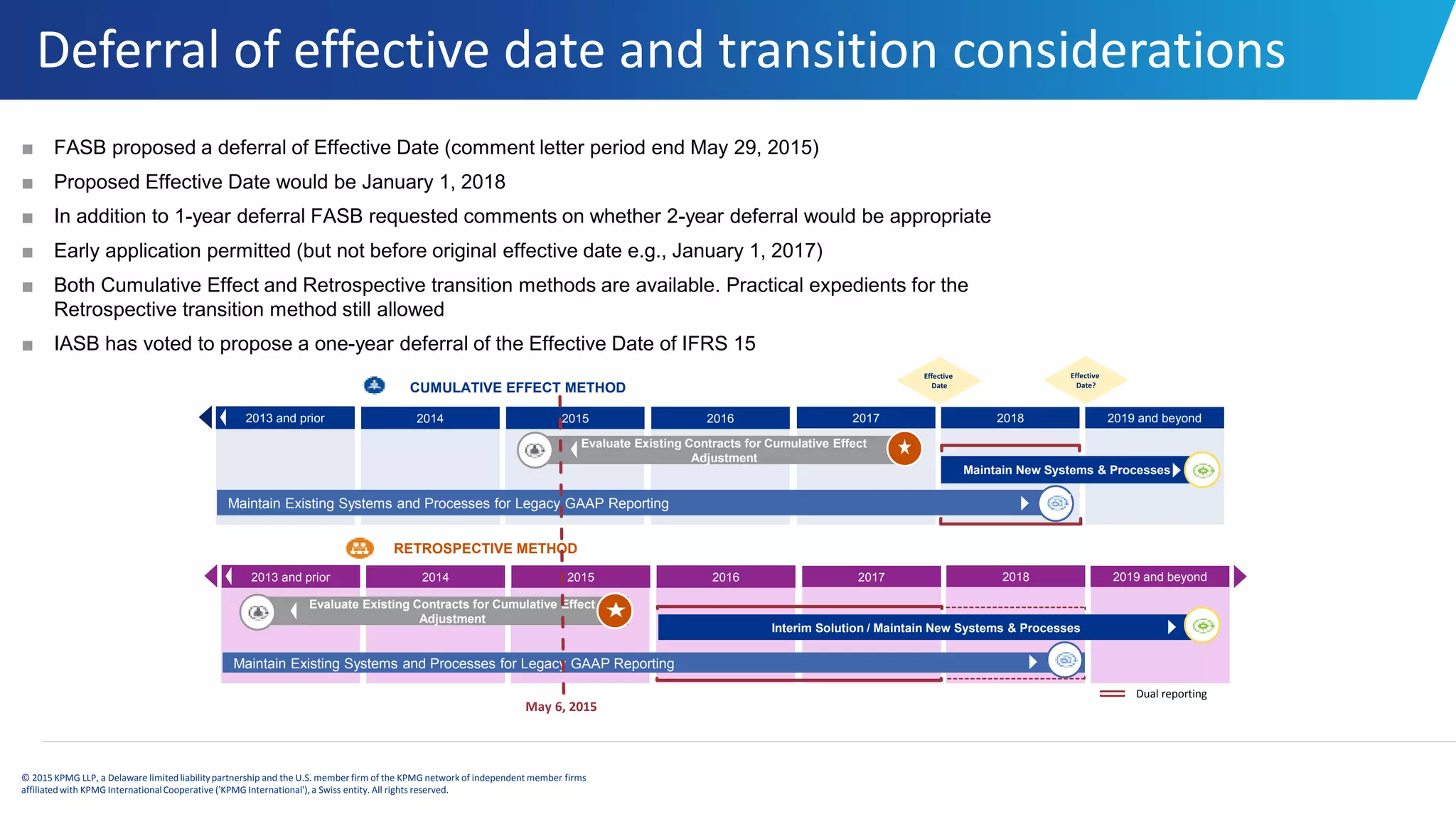

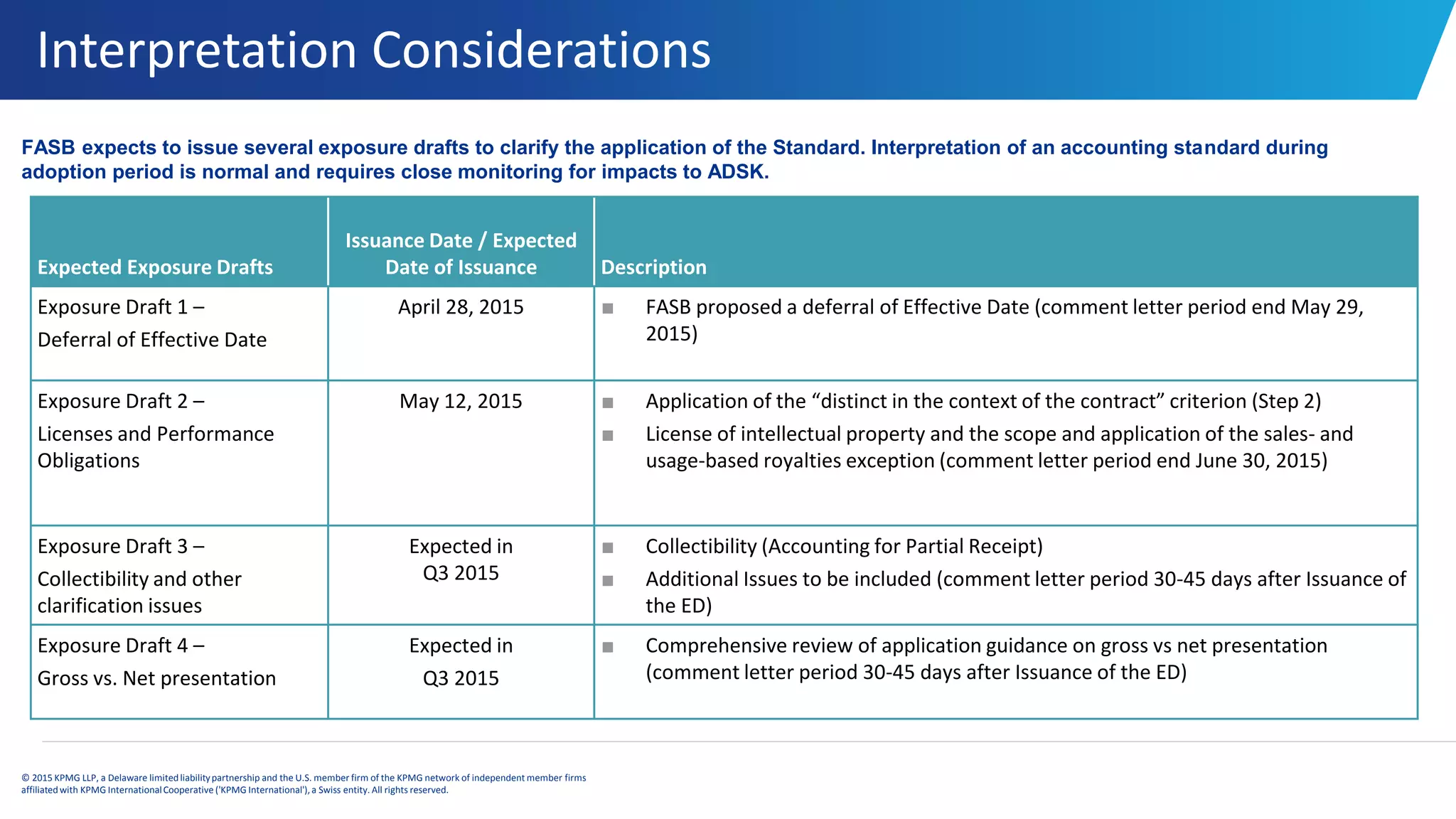

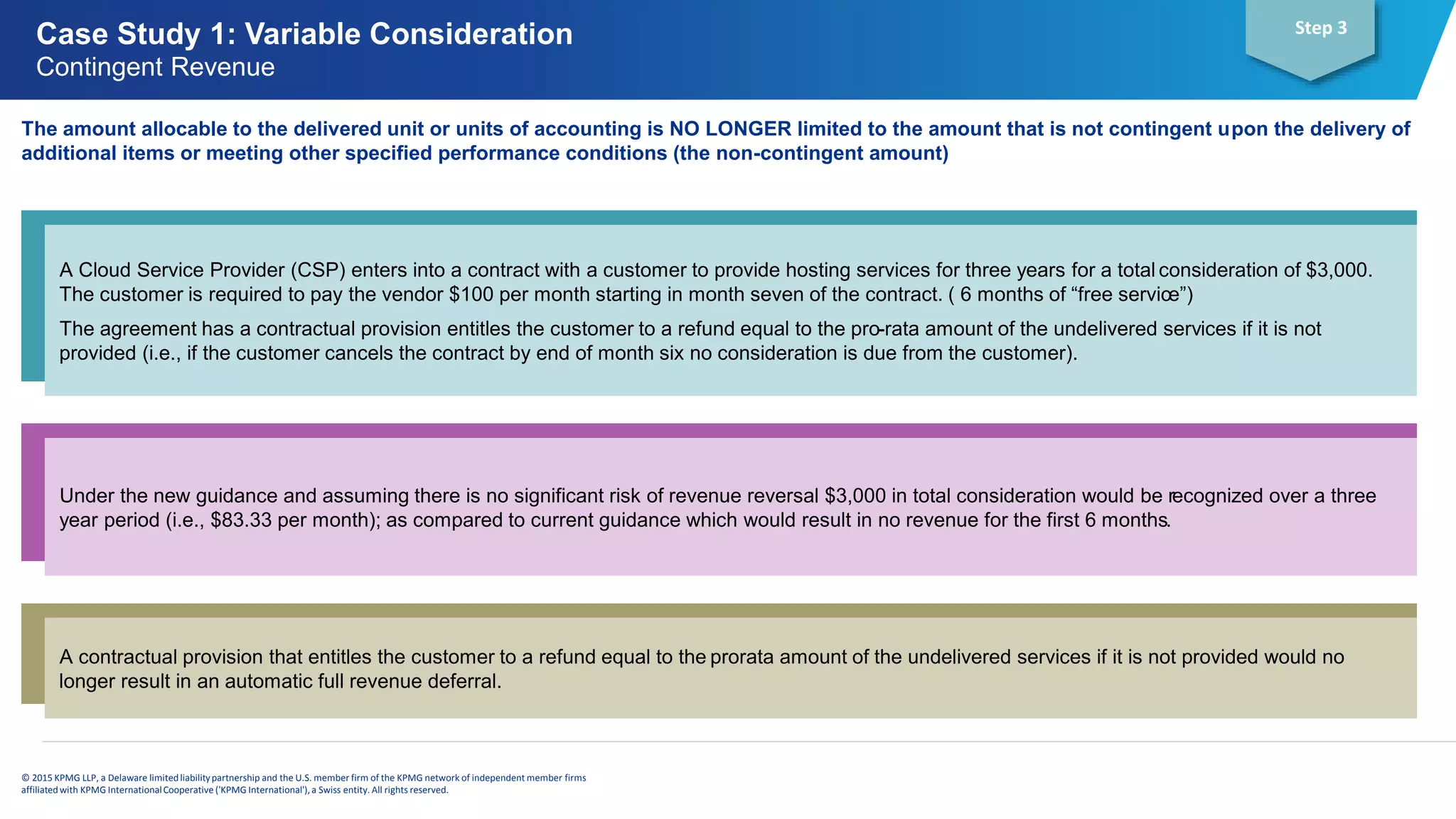

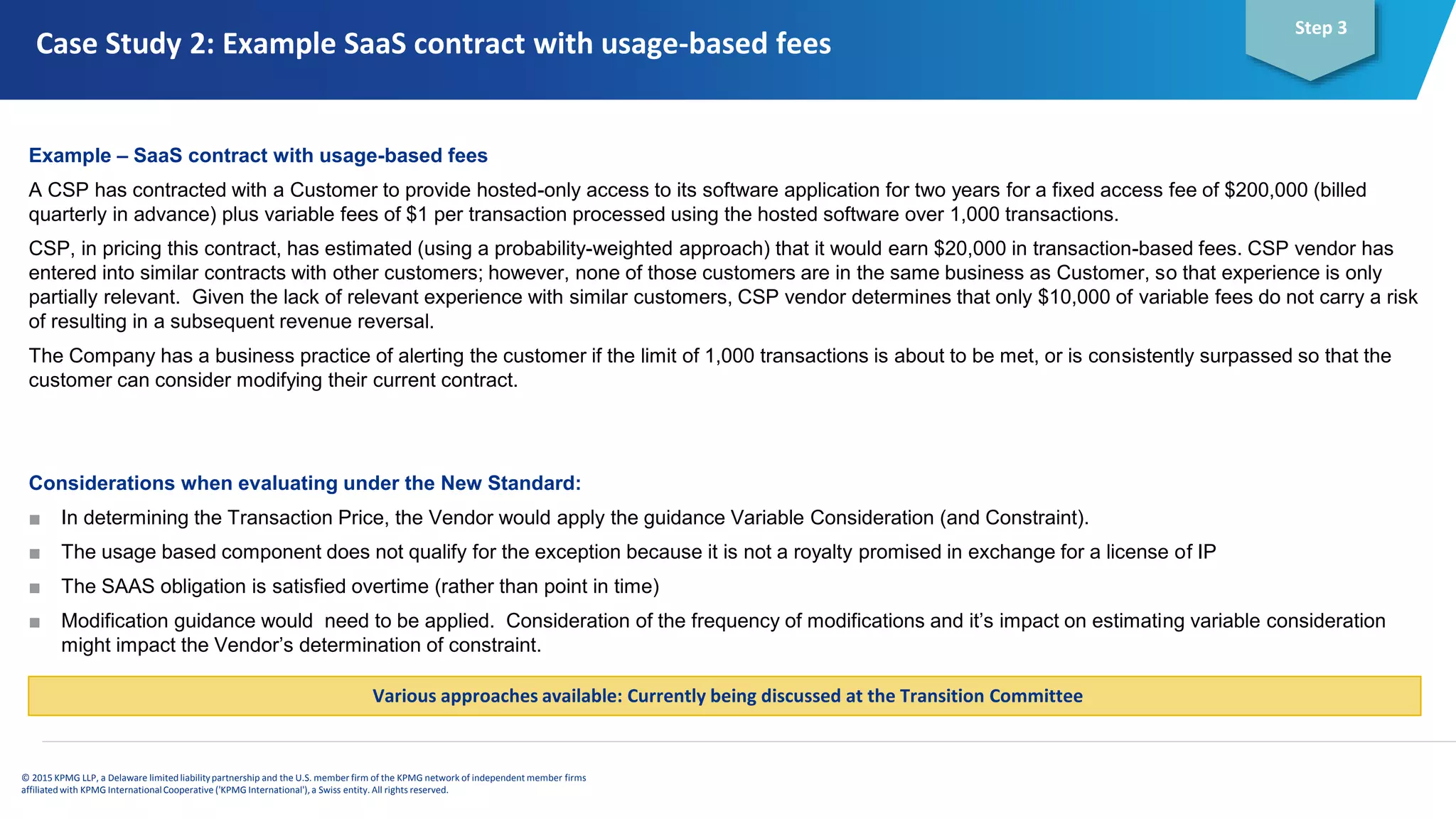

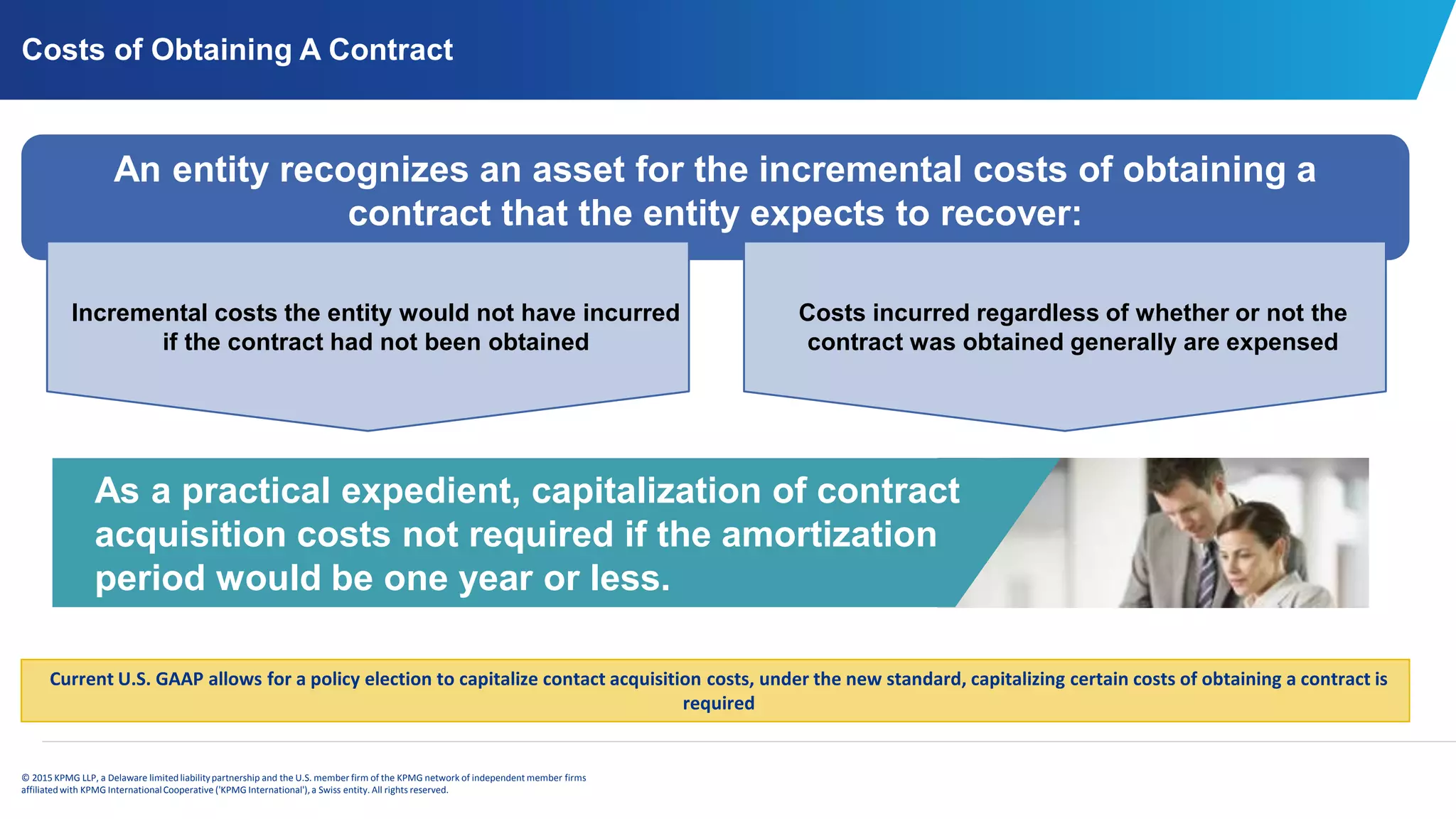

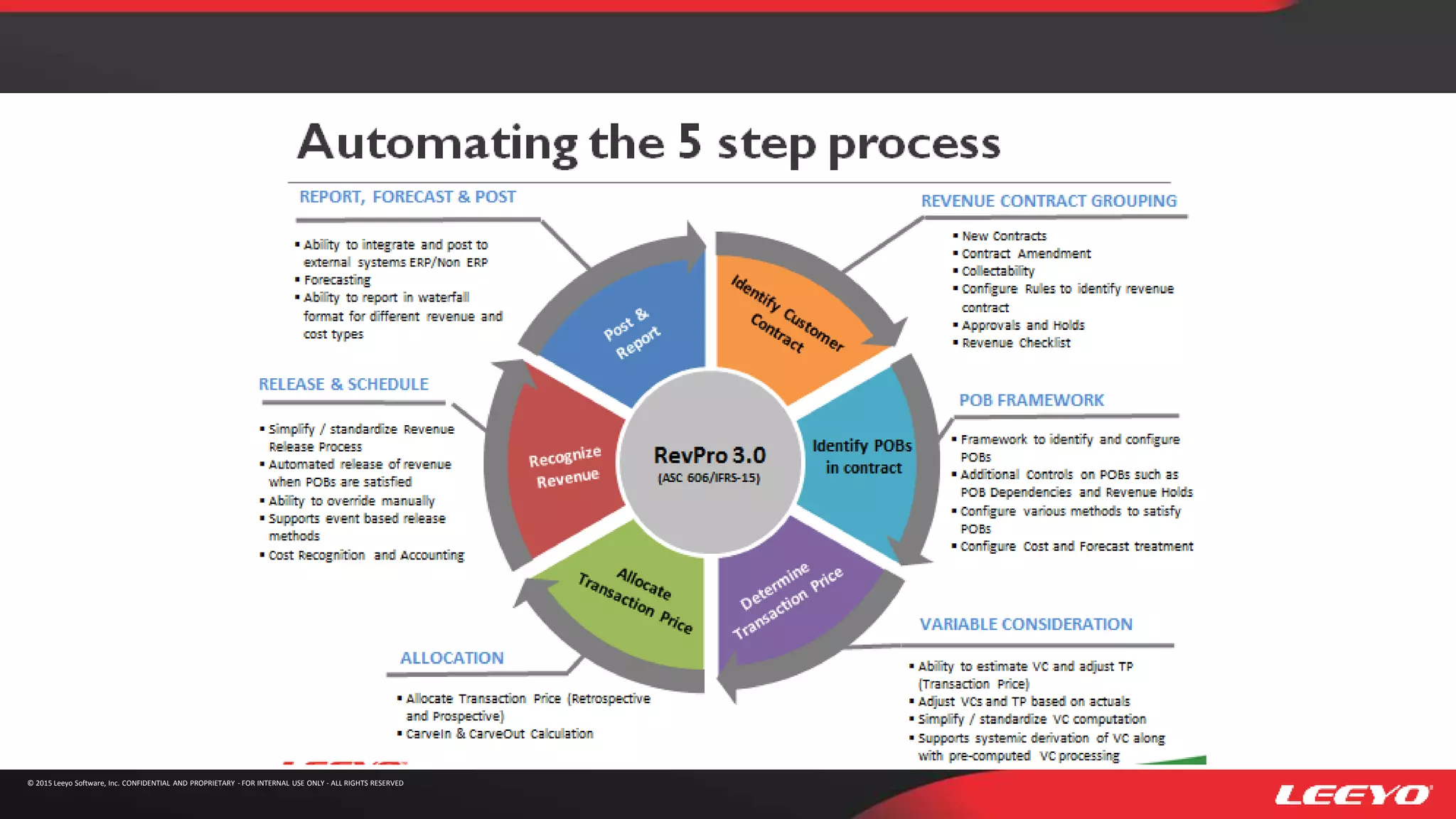

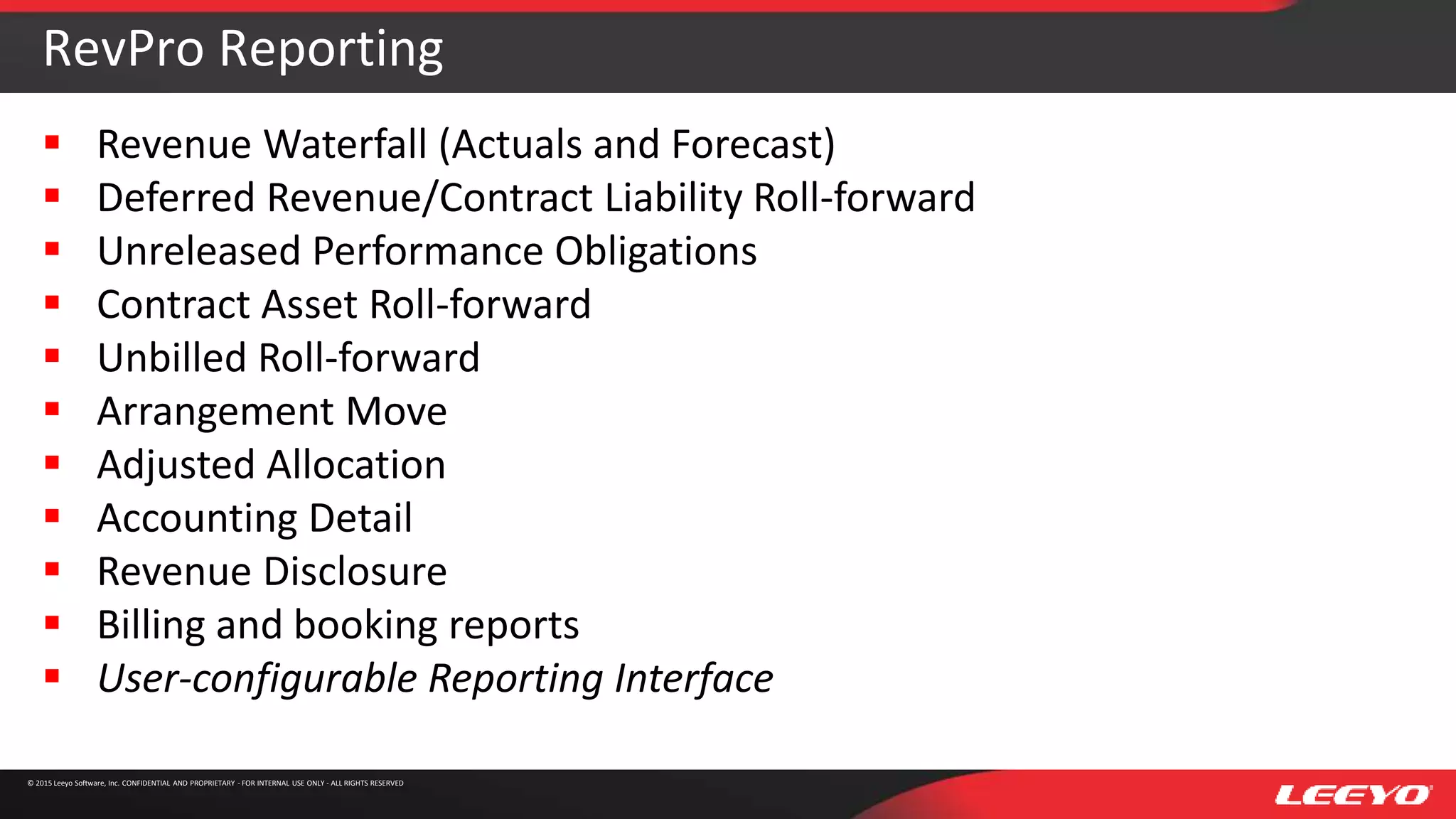

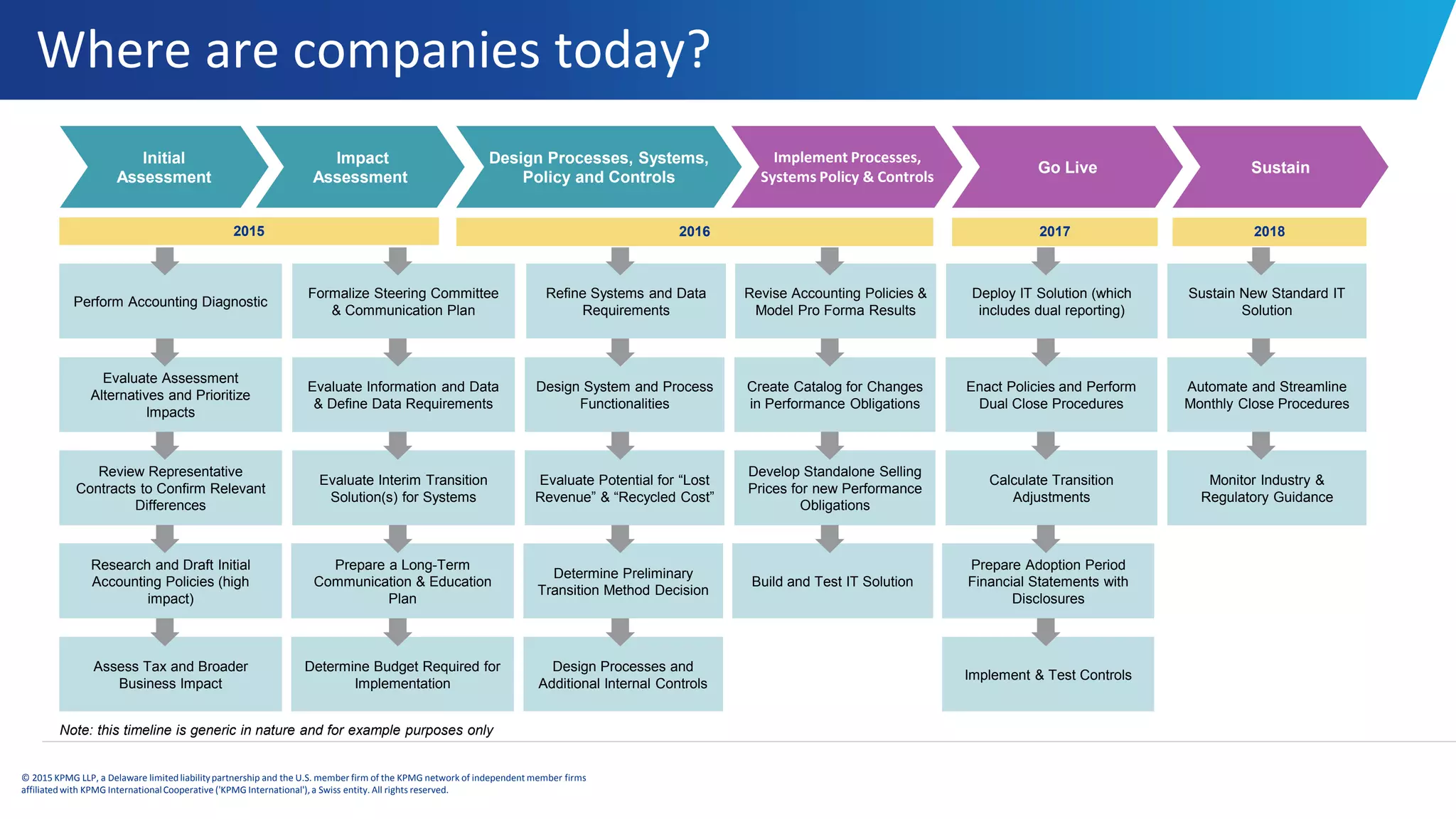

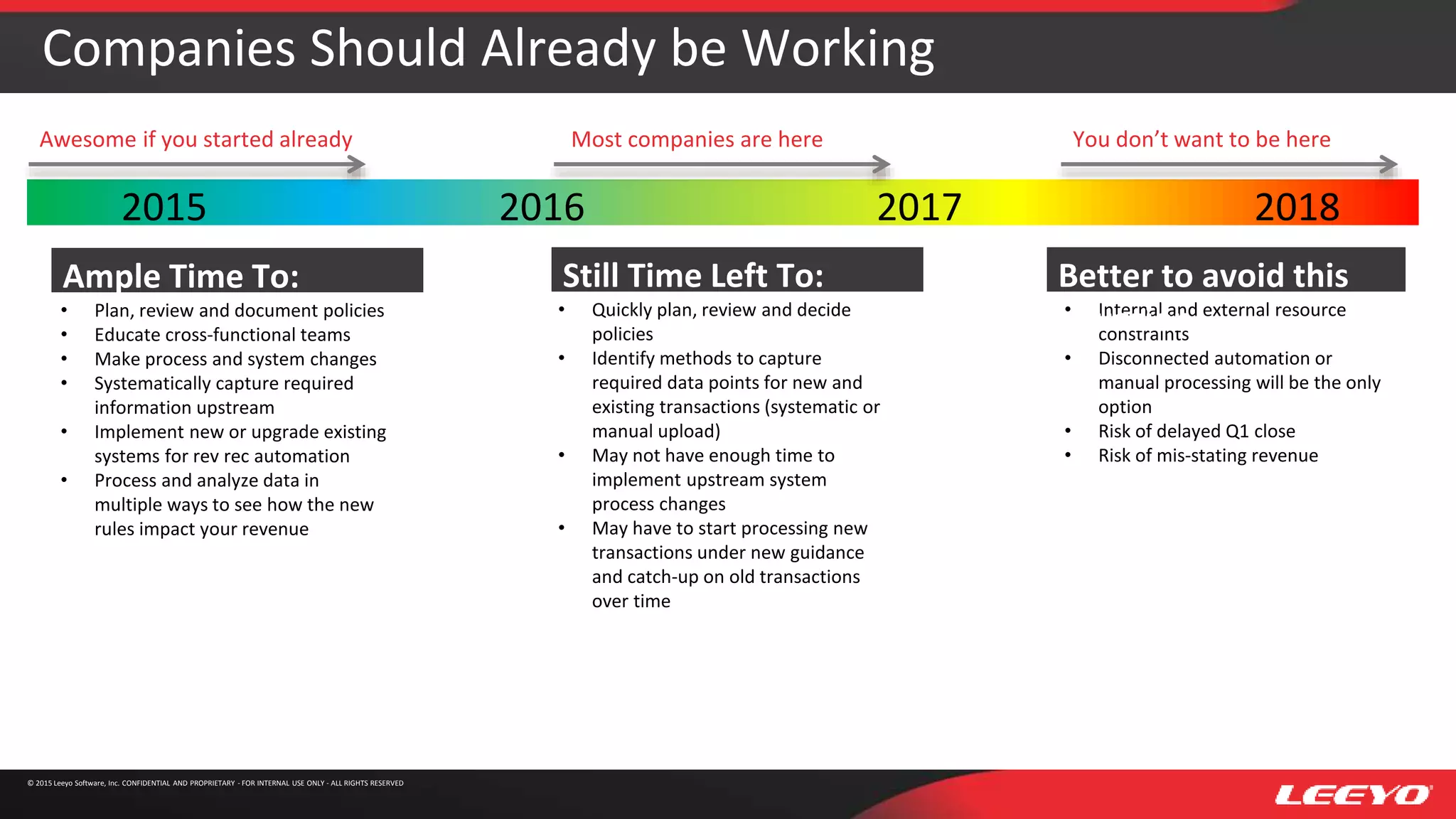

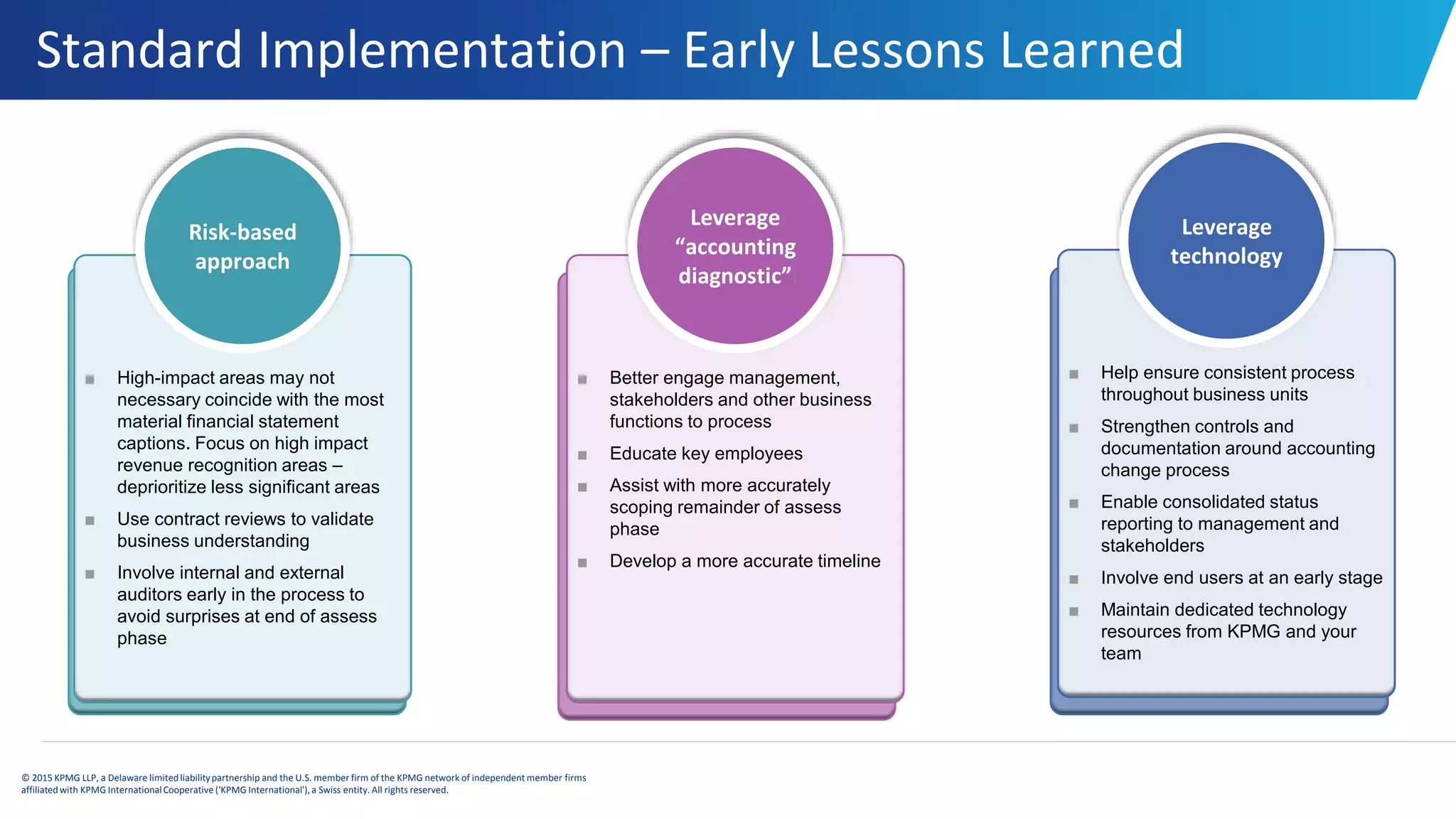

The document outlines the new revenue recognition standard affecting SaaS companies, highlighting the shift to a single accounting model that eliminates industry-specific guidance and requires significant judgments regarding transaction pricing. It details the timeline for adoption, the need for changes to accounting systems, and outlines the five-step model for revenue recognition. Case studies demonstrate the practical implications of the standard on contract management and revenue reporting practices.