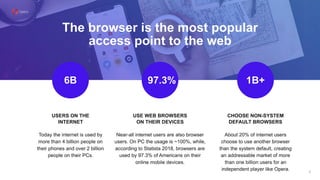

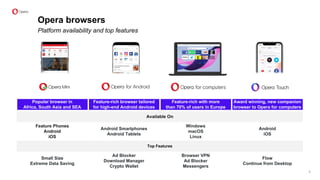

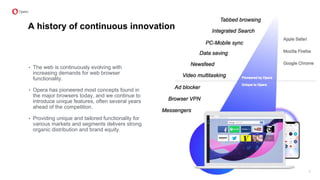

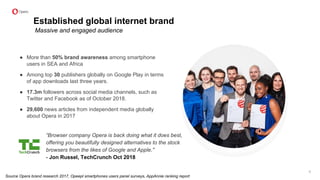

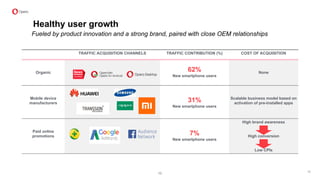

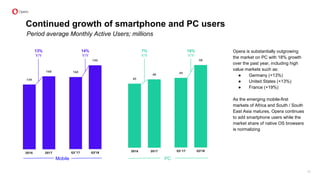

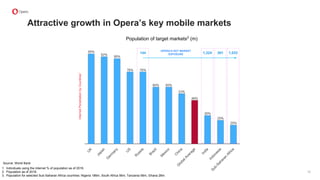

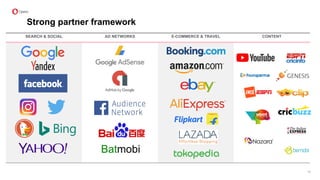

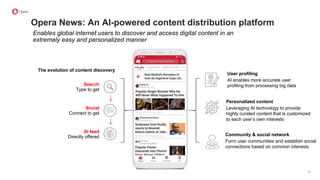

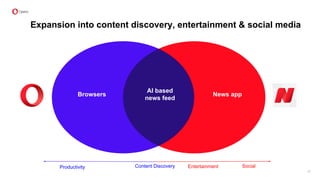

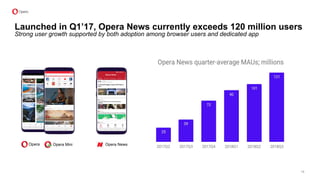

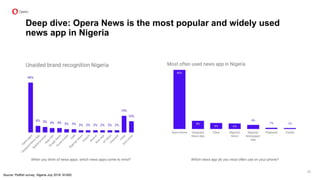

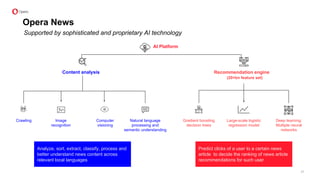

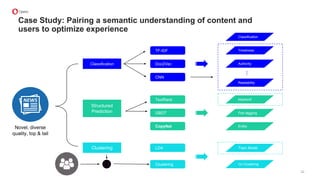

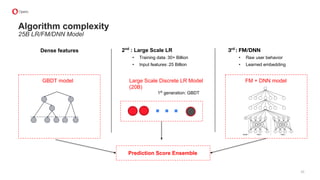

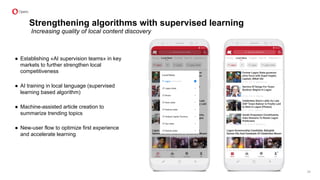

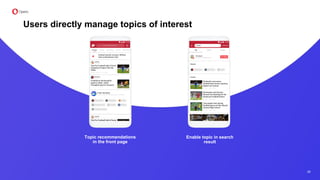

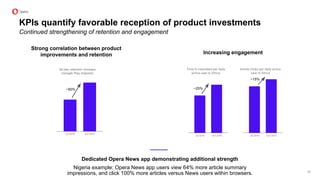

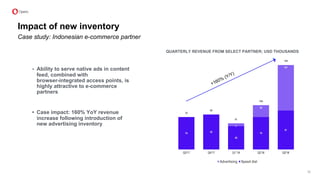

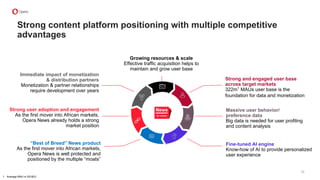

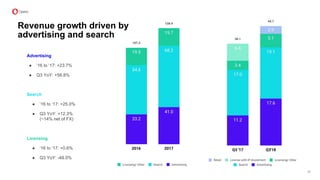

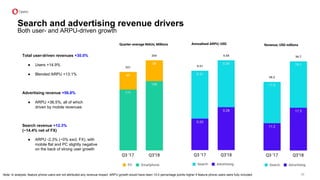

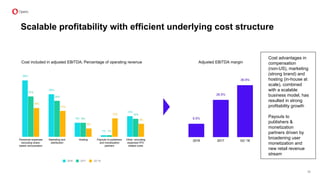

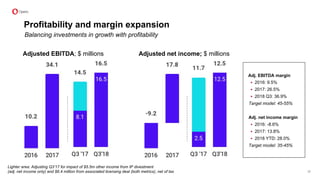

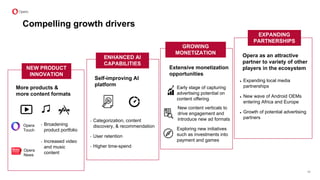

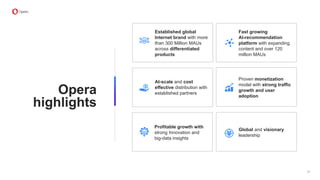

Opera Limited's investor presentation from December 2018 highlights its strong growth trajectory, with an expected revenue increase of 33-37% year-over-year, driven by its AI-driven content platform and browser services. The company has over 320 million monthly active users and boasts significant profitability, along with forecasts for future expansion amid various market uncertainties. The presentation emphasizes the risks associated with financial outlooks and the importance of ongoing innovation and partnerships in sustaining growth and user engagement.