This document summarizes findings from the 2016 OpenStack User Survey. It shows that:

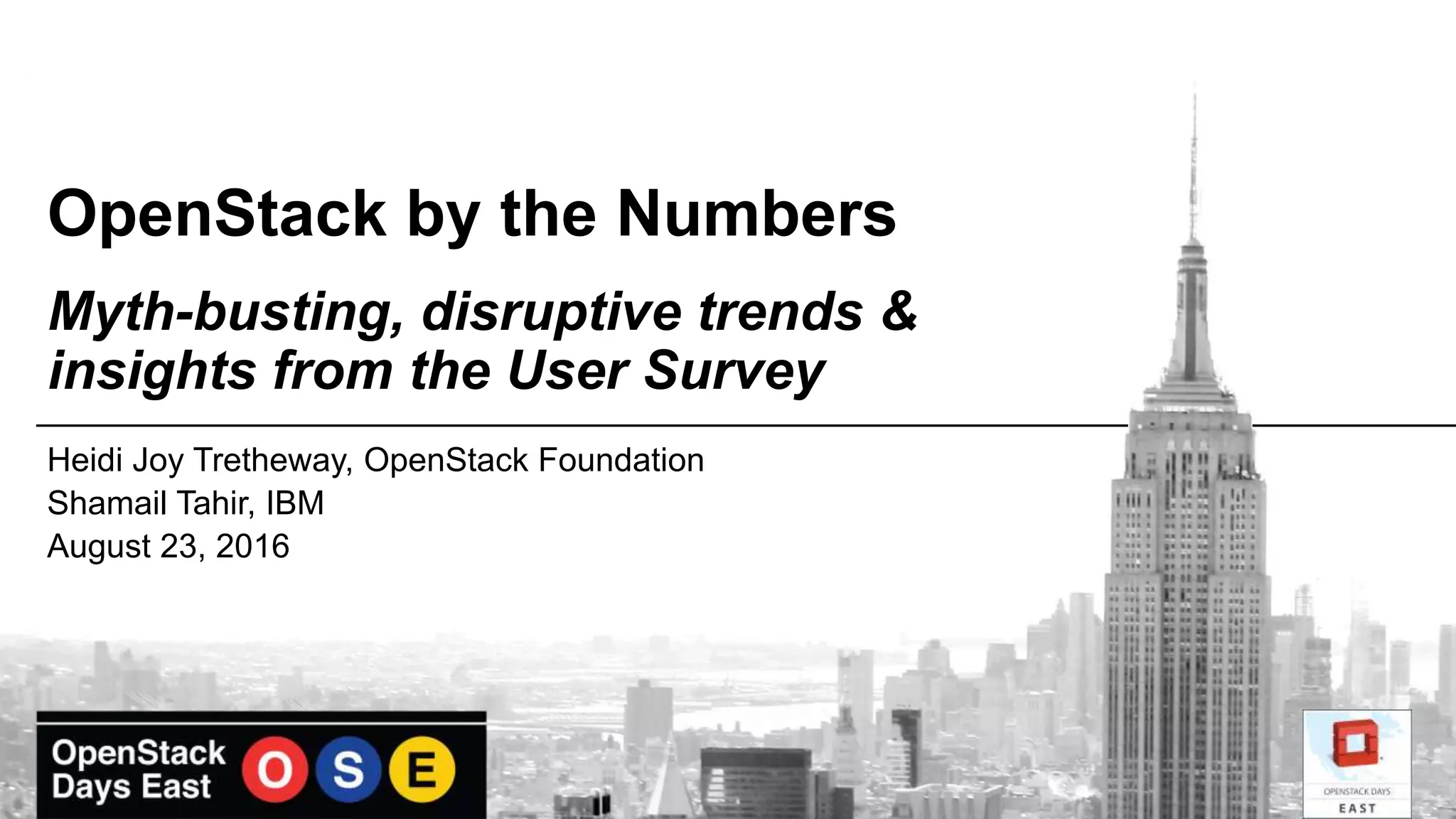

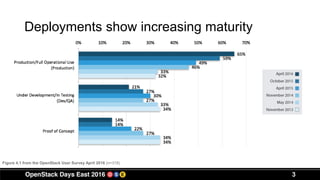

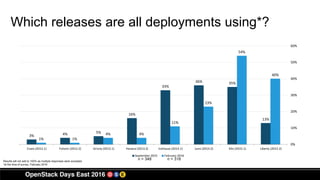

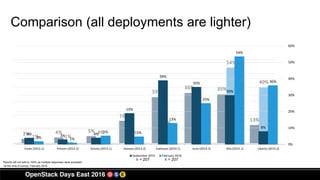

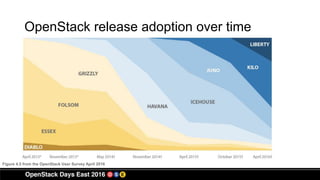

1) OpenStack deployments are becoming more mature, with over half of production deployments now using releases from 2015 or later.

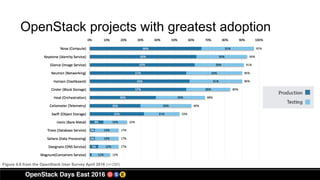

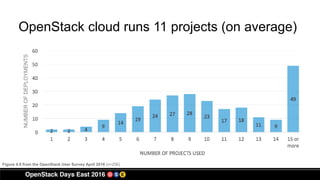

2) On average, OpenStack clouds run 11 projects, with Compute and Identity being the most widely adopted. Storage, Networking and Image projects are also popular.

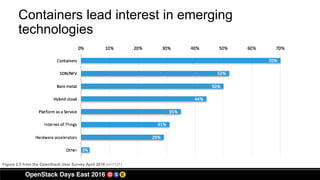

3) Users see Containers and Network Functions Virtualization as important emerging technologies, though many felt they were not ready for production use in 2016.

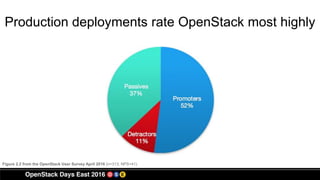

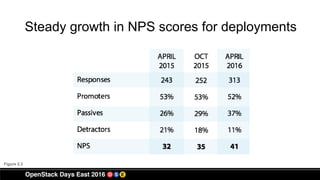

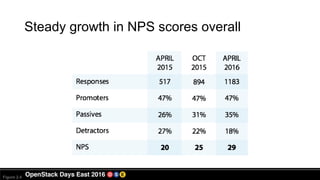

4) User satisfaction with OpenStack has steadily increased over time, with production deployments rating it highly compared to commercial alternatives.