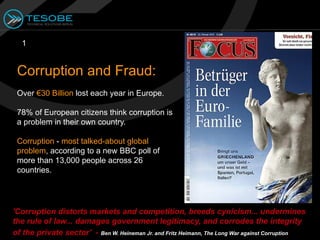

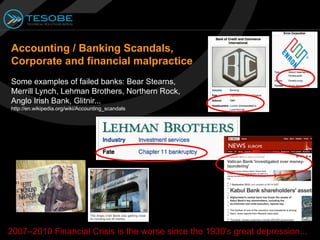

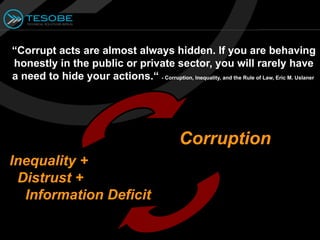

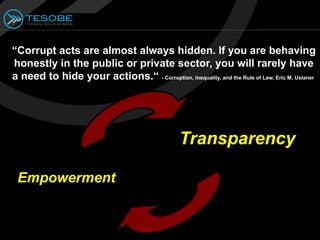

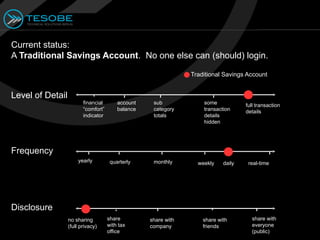

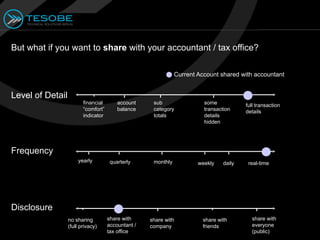

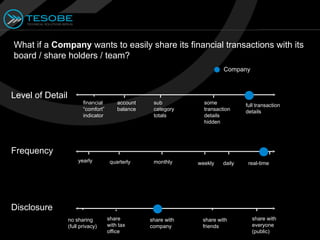

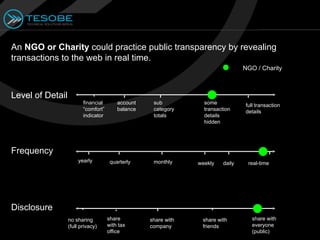

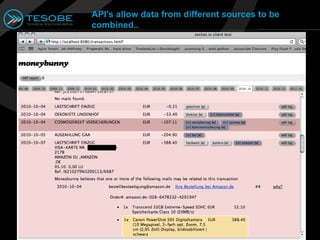

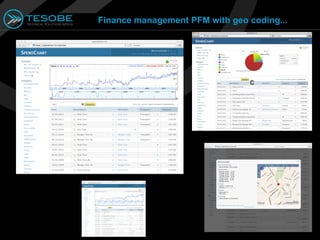

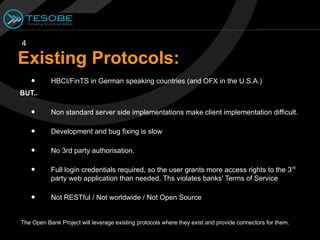

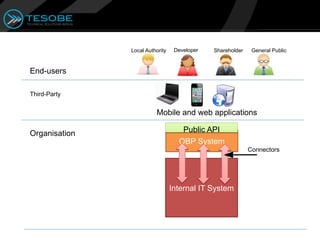

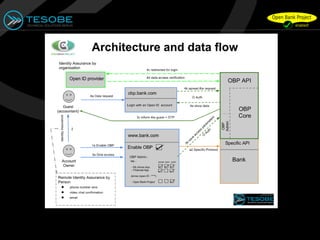

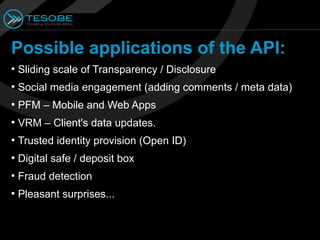

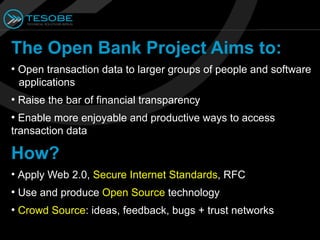

Tesobe is an agile team focused on enhancing financial transparency and combating corruption through innovative technology and open data solutions. The document highlights the challenges of financial disclosure and the need for better API integrations in banking to empower users and combat fraud. It outlines the Open Bank Project's goals of improving access to transaction data and enabling third-party applications for increased transparency and engagement.