This document analyzes video viewing trends in Q4 2011 based on data from Ooyala. Some key findings include:

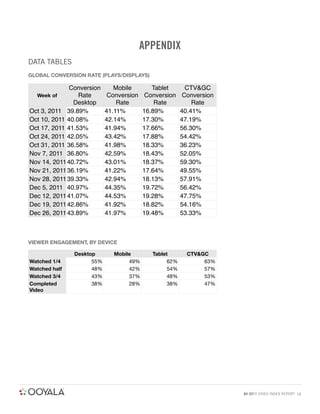

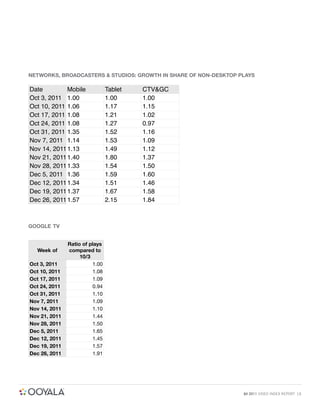

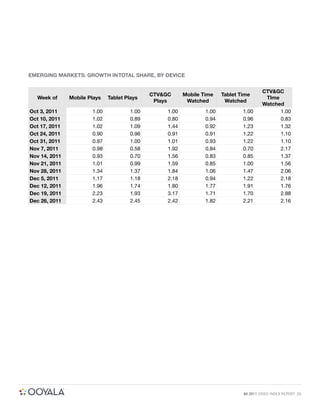

- Video plays on tablets, mobile devices, and connected TVs nearly doubled in Q4 from Q3. Engagement also increased across all devices as viewers watched longer videos per play.

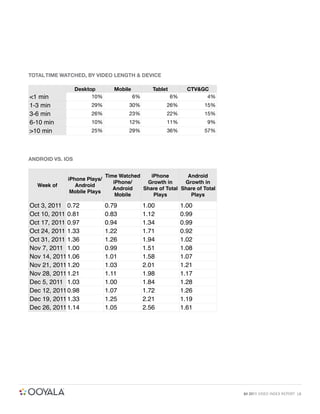

- Connected TV devices and gaming consoles saw the highest engagement, with viewers 70% more likely to watch 3/4 of longer videos (>10 min). Tablet viewers were also highly engaged.

- Both iOS and Android platforms grew significantly in Q4 for mobile video plays and hours watched. iPhone growth was boosted by the October release of the iPhone 4S.

- Facebook remained