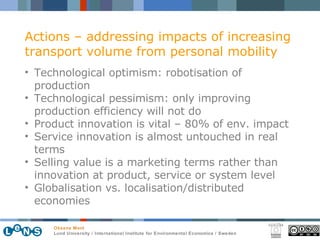

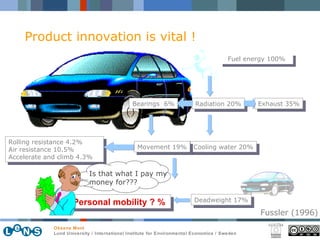

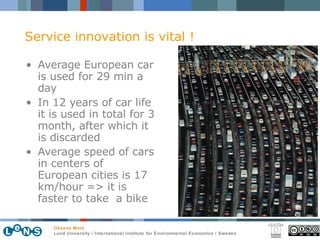

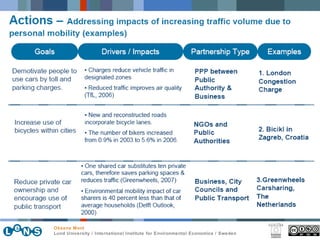

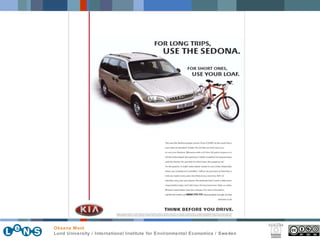

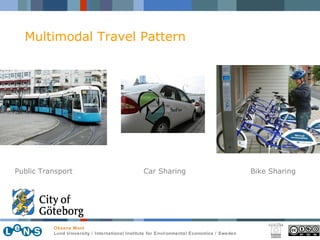

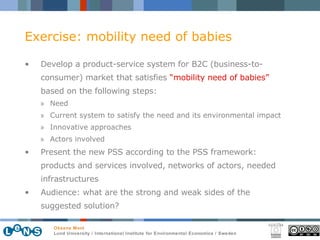

The document discusses sustainable mobility and product-service systems (PSS) related to mobility. It focuses on car sharing as an alternative to private car ownership. Specifically, it describes three types of car sharing organizations: 1) those run by automotive manufacturers, 2) independently run profit-oriented organizations, and 3) citizen-run non-profit cooperatives. It notes that car sharing can reduce the number of cars used and miles driven while increasing selective car use and cost transparency for users.