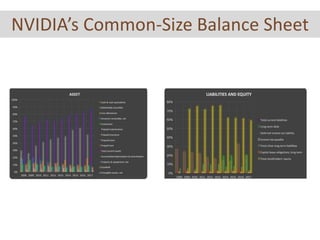

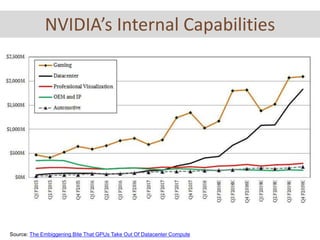

The document discusses NVIDIA's strategic management. It provides an overview of the company, including its founders and products. It then analyzes NVIDIA's business performance through financial metrics like revenue, profitability, and financial leverage. Next, it examines NVIDIA's internal capabilities, such as its focus on R&D, leadership in the GPU market, and strengths/weaknesses. It also reviews industry fundamentals using Porter's Five Forces model. Finally, it discusses NVIDIA's strategy and competitive advantage in growing markets like AI and competition from companies like AMD and Fujitsu. The conclusion notes NVIDIA's overall sales growth and decreasing costs, driven by gaming, with potential future growth from automotive.