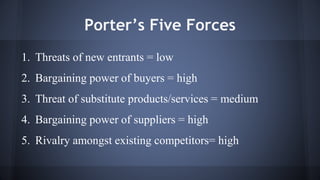

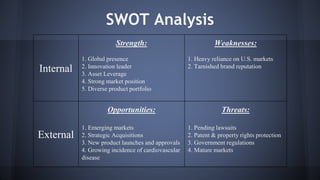

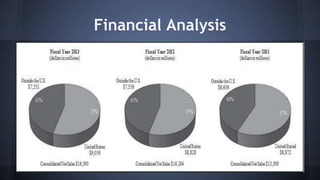

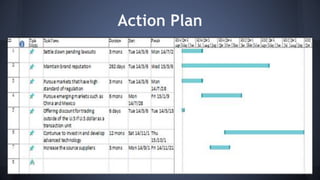

Medtronic Inc. is one of the largest medical device manufacturers in North America, founded in 1949 and headquartered in Minneapolis. It has two major business units: Cardiovascular and Restorative Therapies. The document analyzes Medtronic using Porter's Five Forces, a SWOT analysis, and discusses risks, technology applications, a McKinsey analysis, financial analysis, and social responsibilities. It makes recommendations, including settling lawsuits, maintaining brand reputation, pursuing emerging markets, and continuing investment in technology development.