The document summarizes Malaysia's vision and strategy for e-commerce development. Key points include:

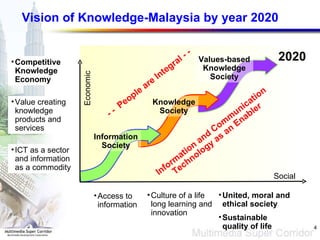

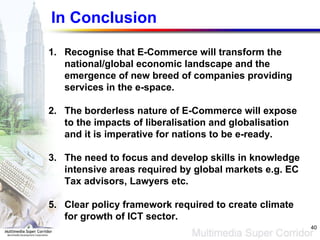

- Malaysia aims to become a knowledge-based economy by 2020 with ICT as an enabler under its Vision 2020 and Multimedia Super Corridor plans.

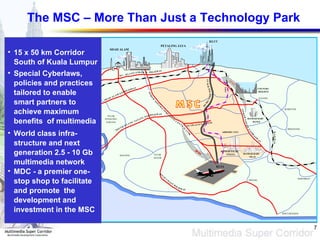

- The Multimedia Super Corridor was established to attract high-tech investment and catalyze the growth of Malaysian multimedia companies.

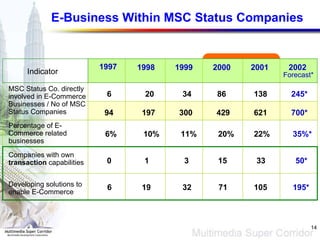

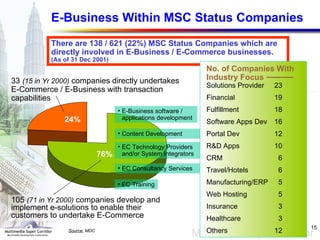

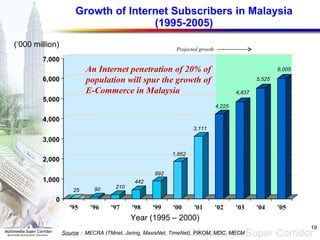

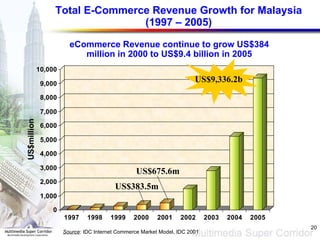

- E-commerce in Malaysia has grown rapidly, with over 600 MSC status companies directly involved in e-business by 2001 and total e-commerce revenue projected to reach $9.4 billion by 2005.

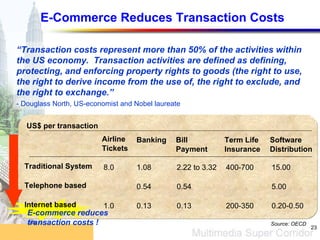

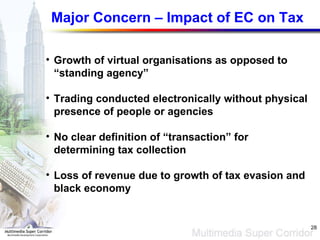

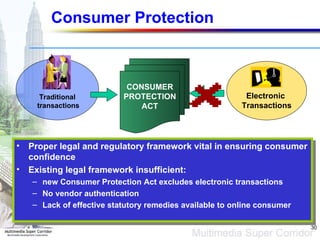

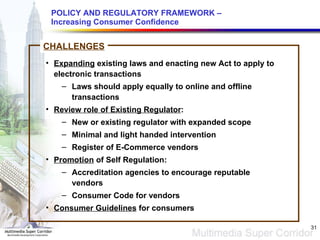

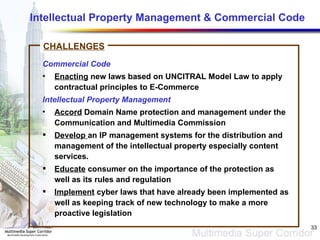

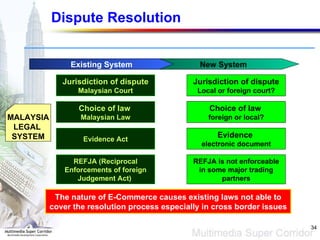

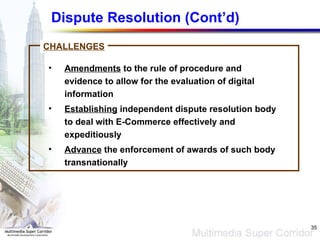

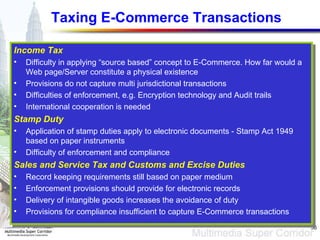

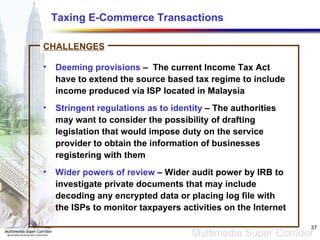

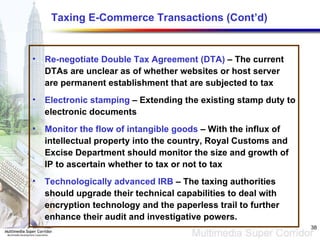

- Challenges for Malaysia include developing policies and regulations to address issues like taxation, intellectual property,

![W T O R E G I O N A L S E M I N A R O N E L E C T R O N I C C O M M E R C E Geneva, Switzerland 22 April 2002 Revenue Implications Of E-Commerce Government and Private Sector Experiences MALAYSIA Presentation by: Suhaimi Nordin Senior Manager - Borderless Marketing / E-Business Multimedia Development Corporation [email_address]](https://image.slidesharecdn.com/nordinmalaysia-100204060255-phpapp01/85/Nordin-Malaysia-1-320.jpg)