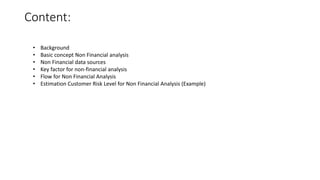

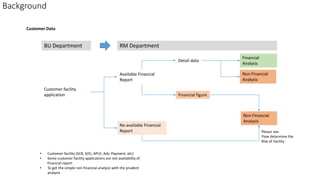

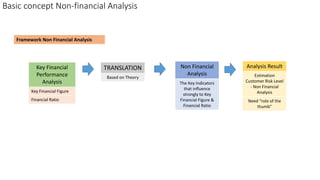

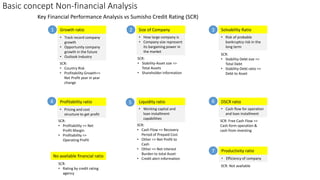

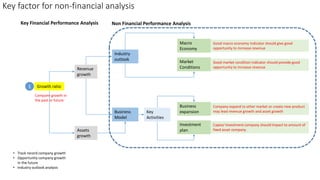

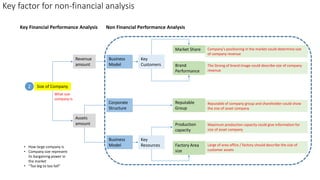

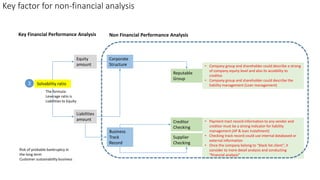

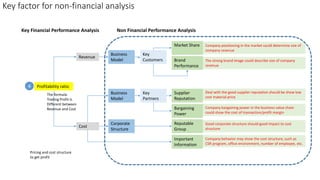

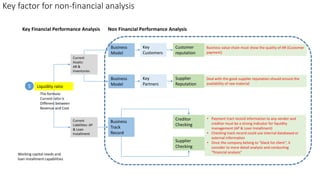

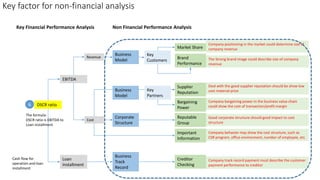

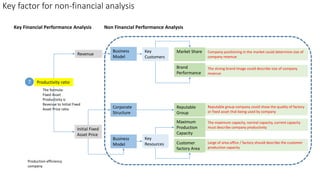

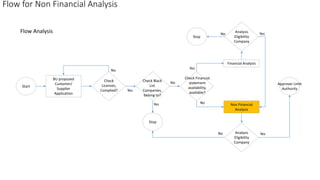

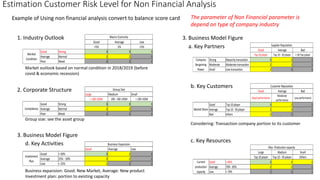

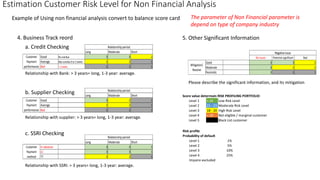

This document provides guidance on conducting non-financial performance analysis based on key financial performance. It outlines sources of non-financial data, key factors to consider in non-financial analysis such as industry outlook, corporate structure, business model figures, business track record, and frameworks for estimating customer risk levels based on non-financial analysis. An example is provided showing how non-financial analysis can be converted to a balanced scorecard to determine a customer's risk profile and probability of default. The goal is to conduct prudent non-financial analysis for customers where financial reports are not available.