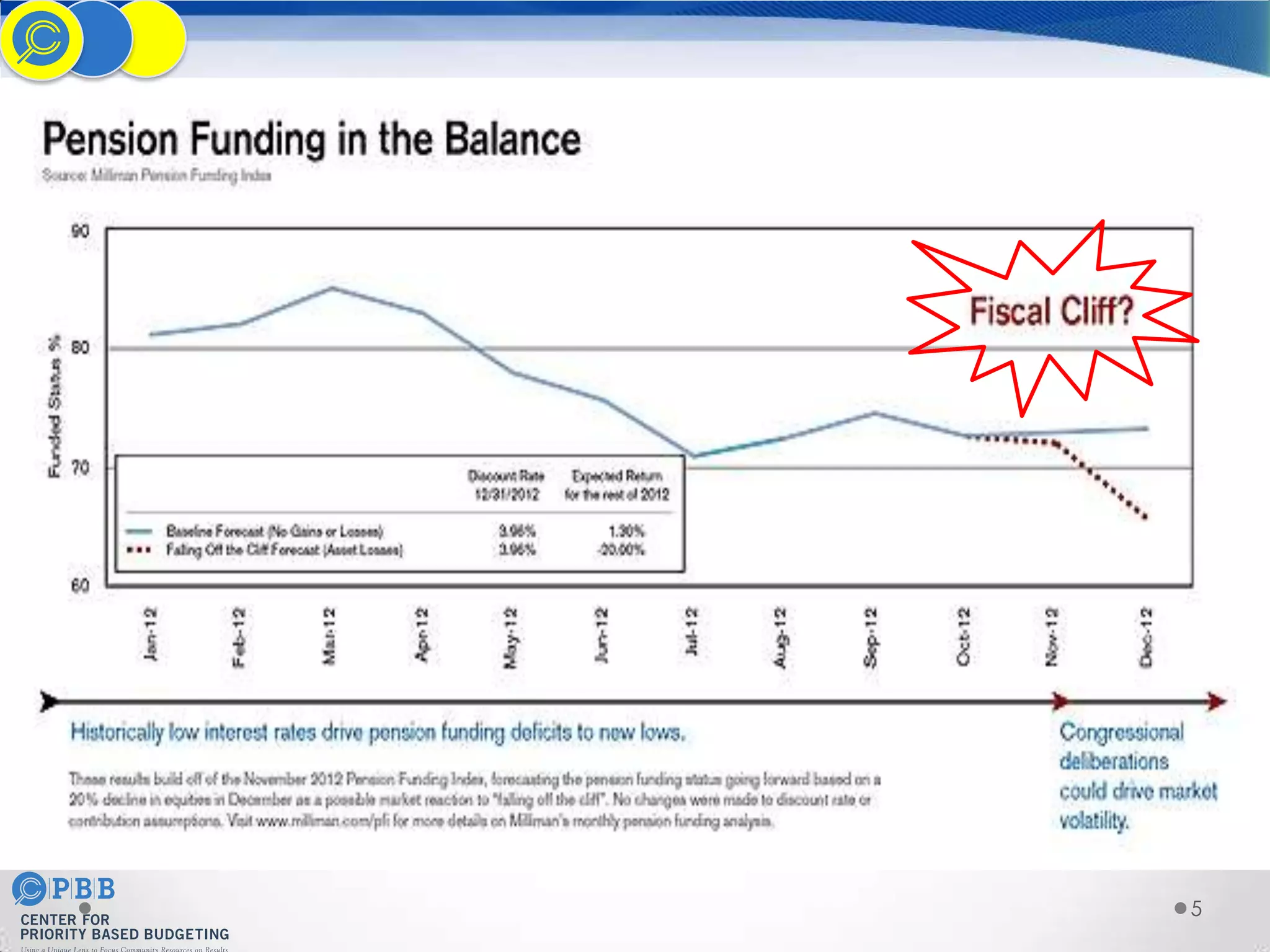

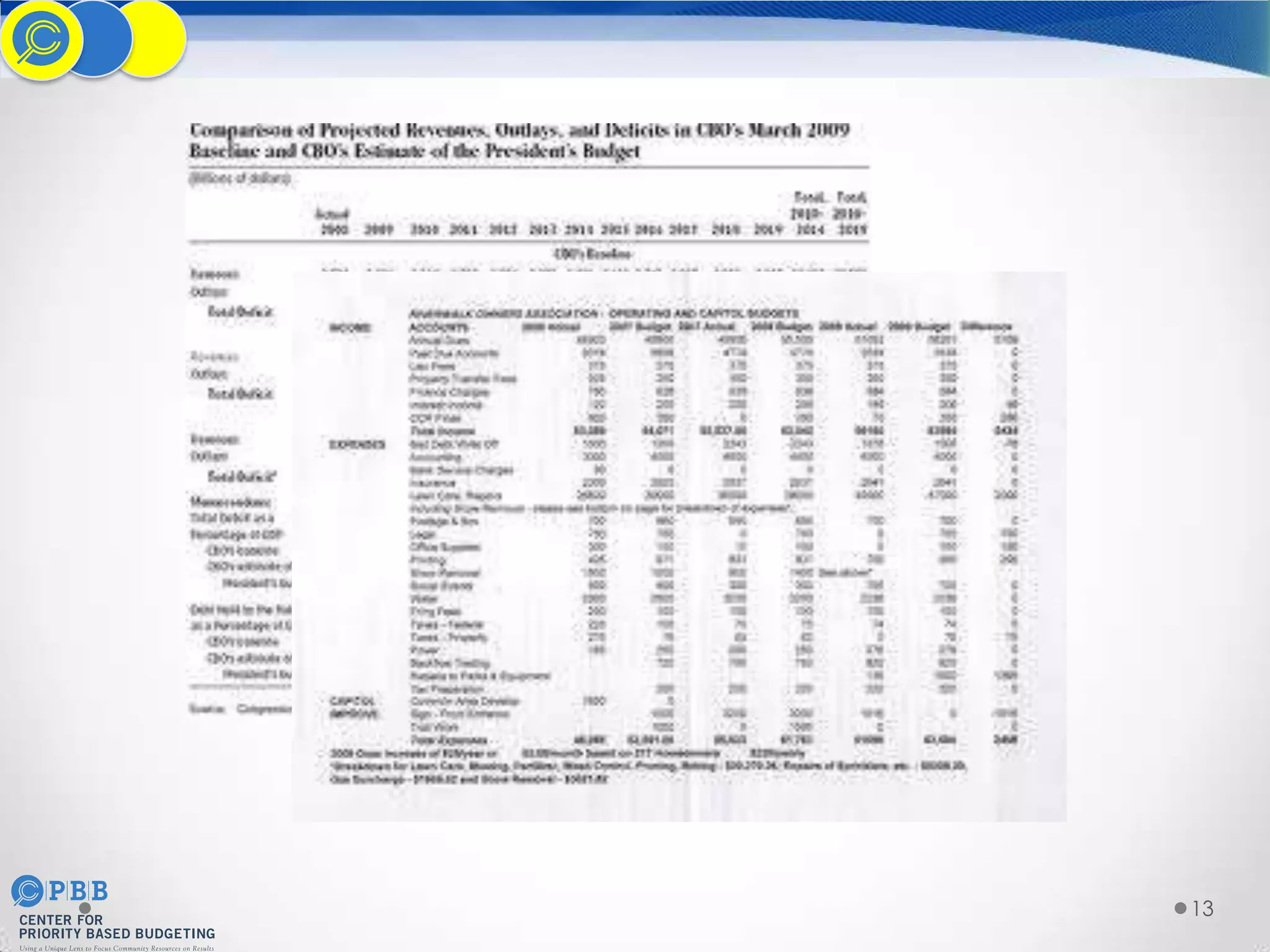

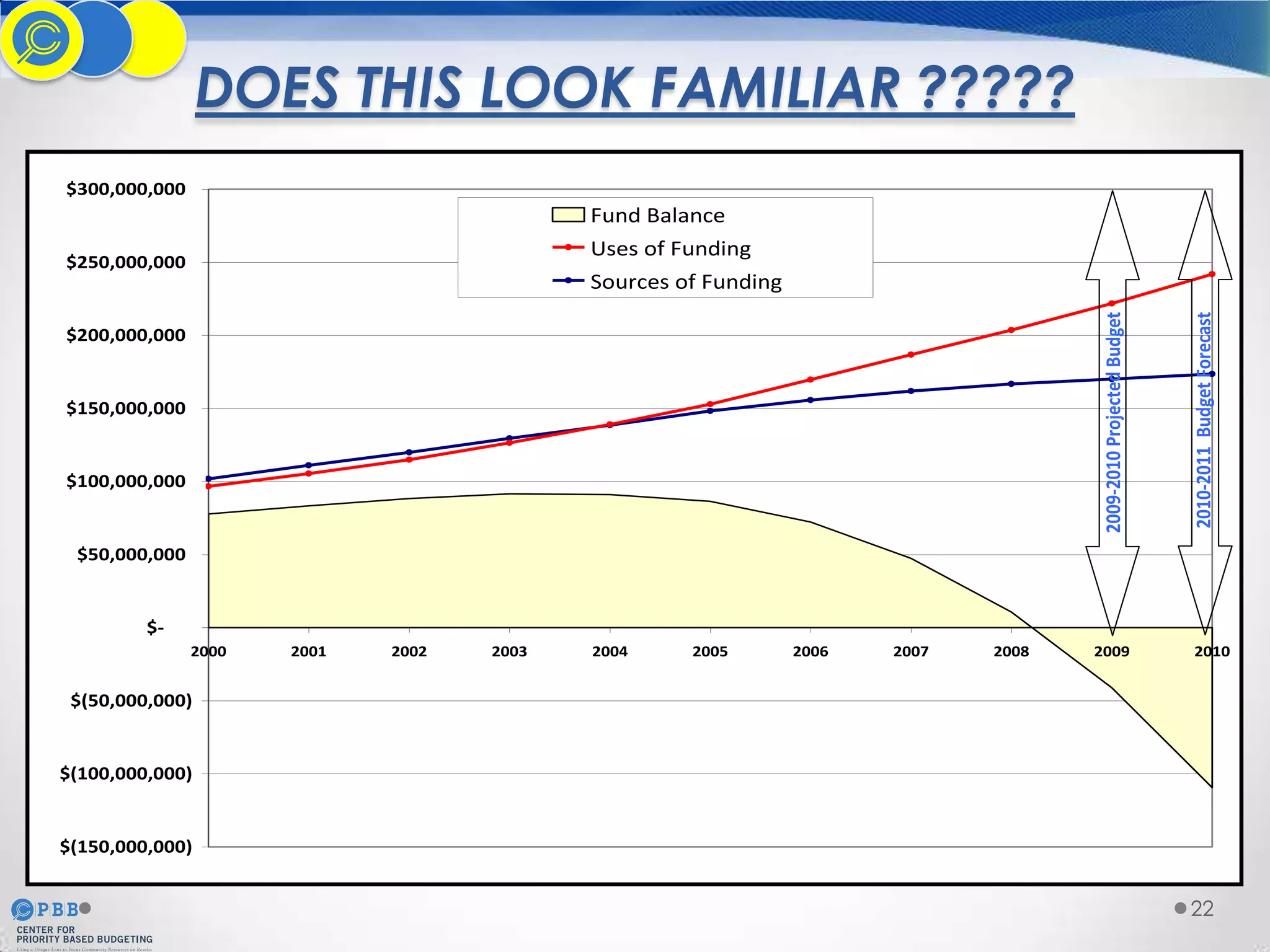

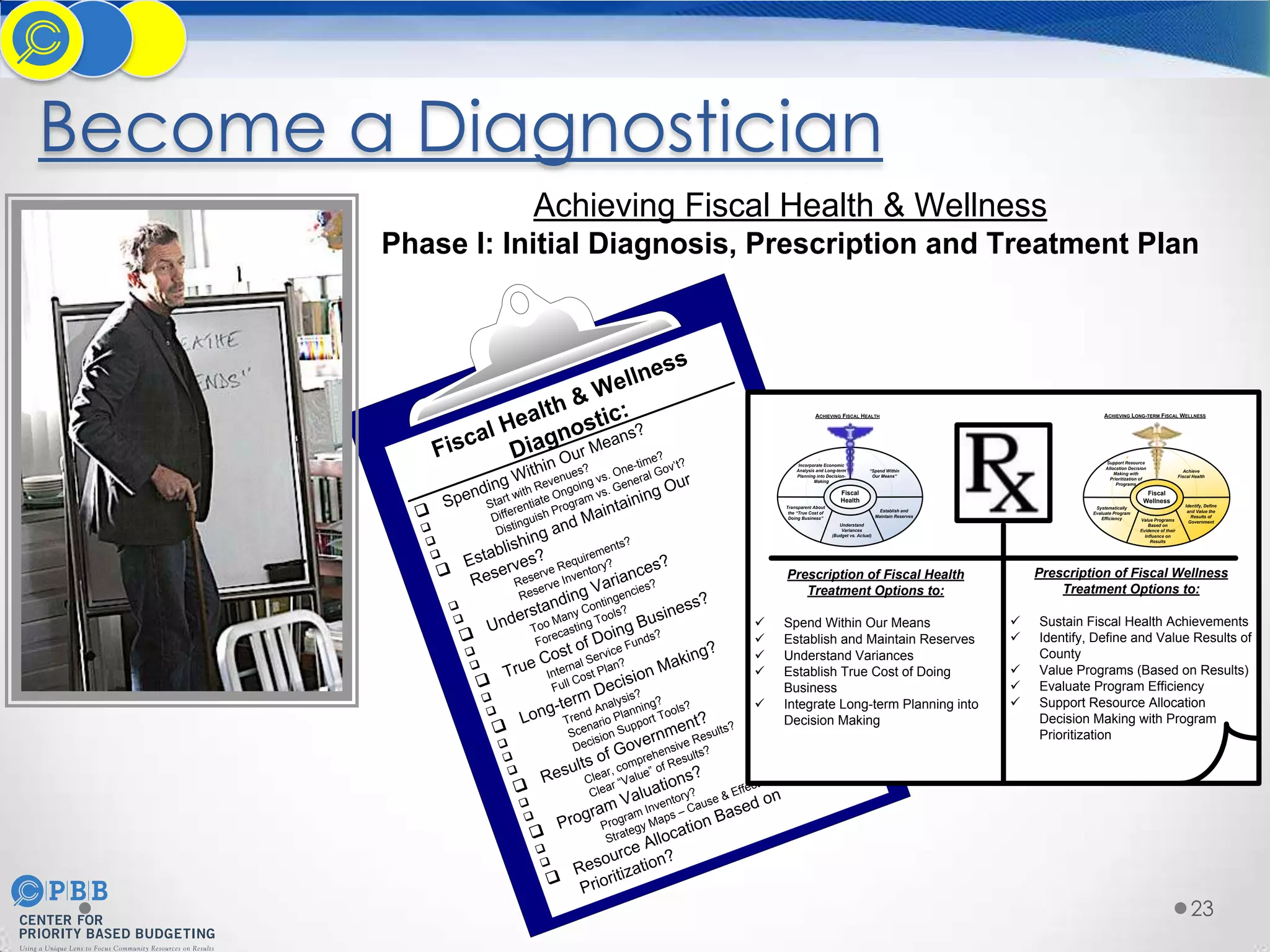

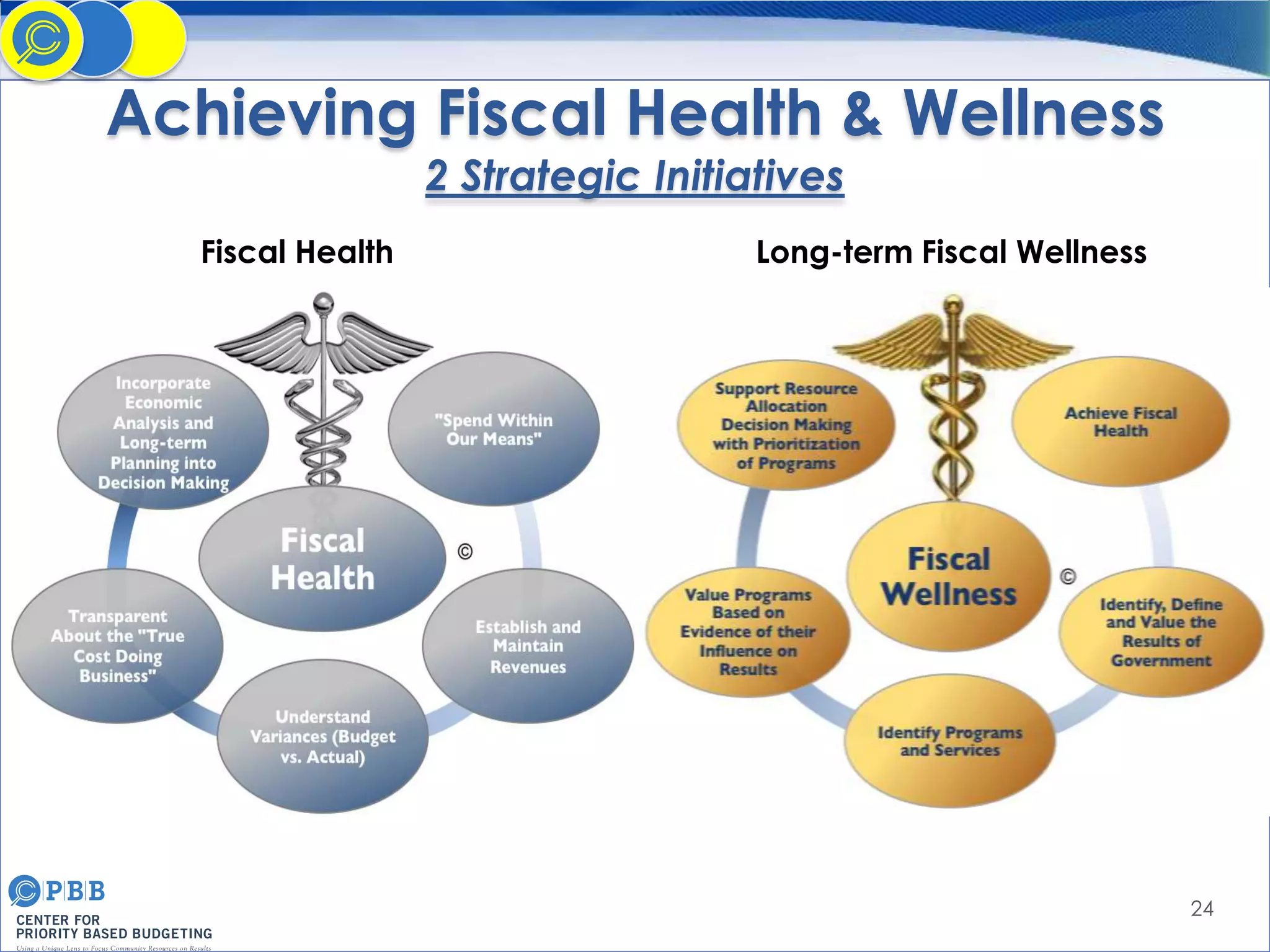

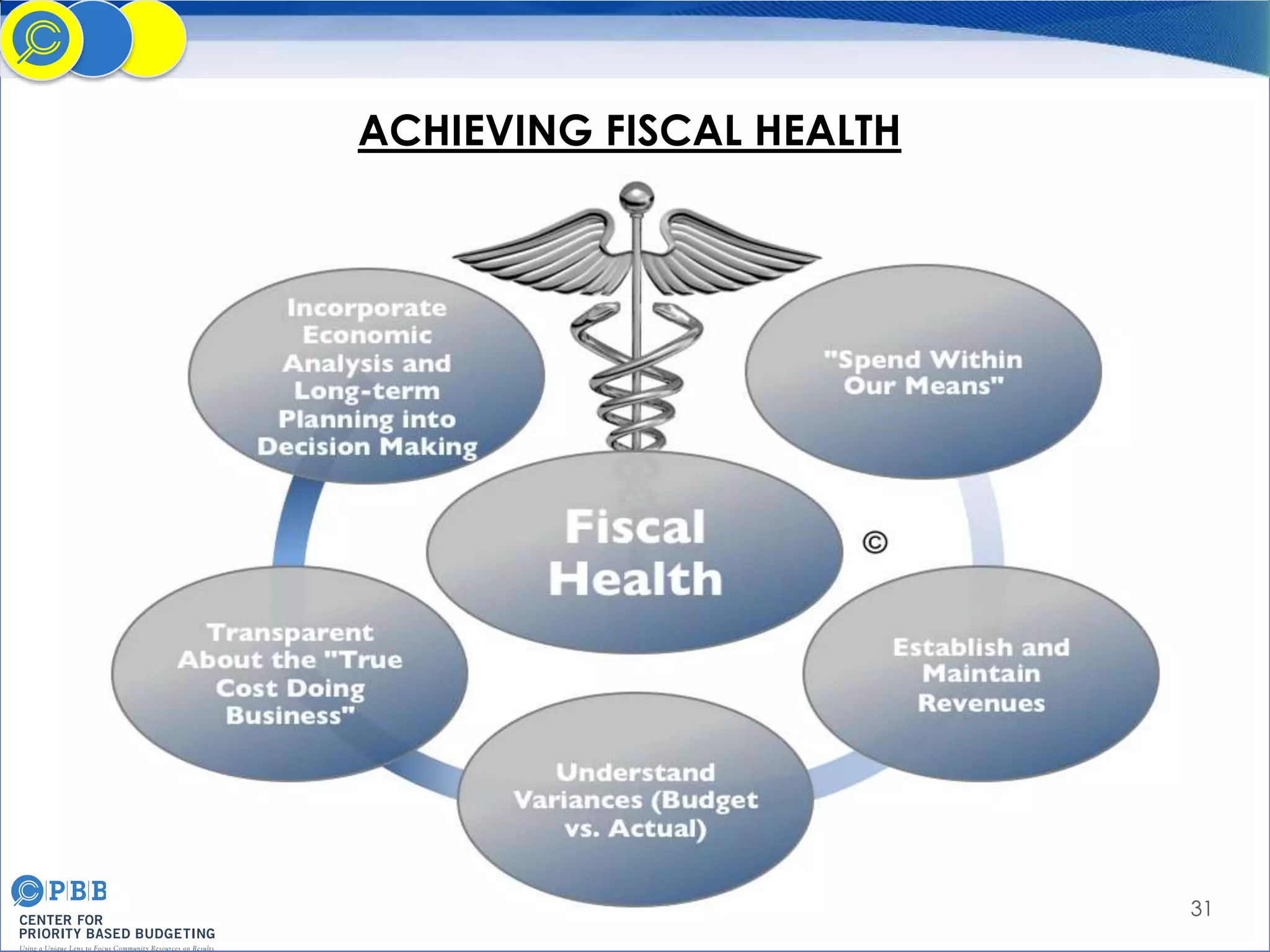

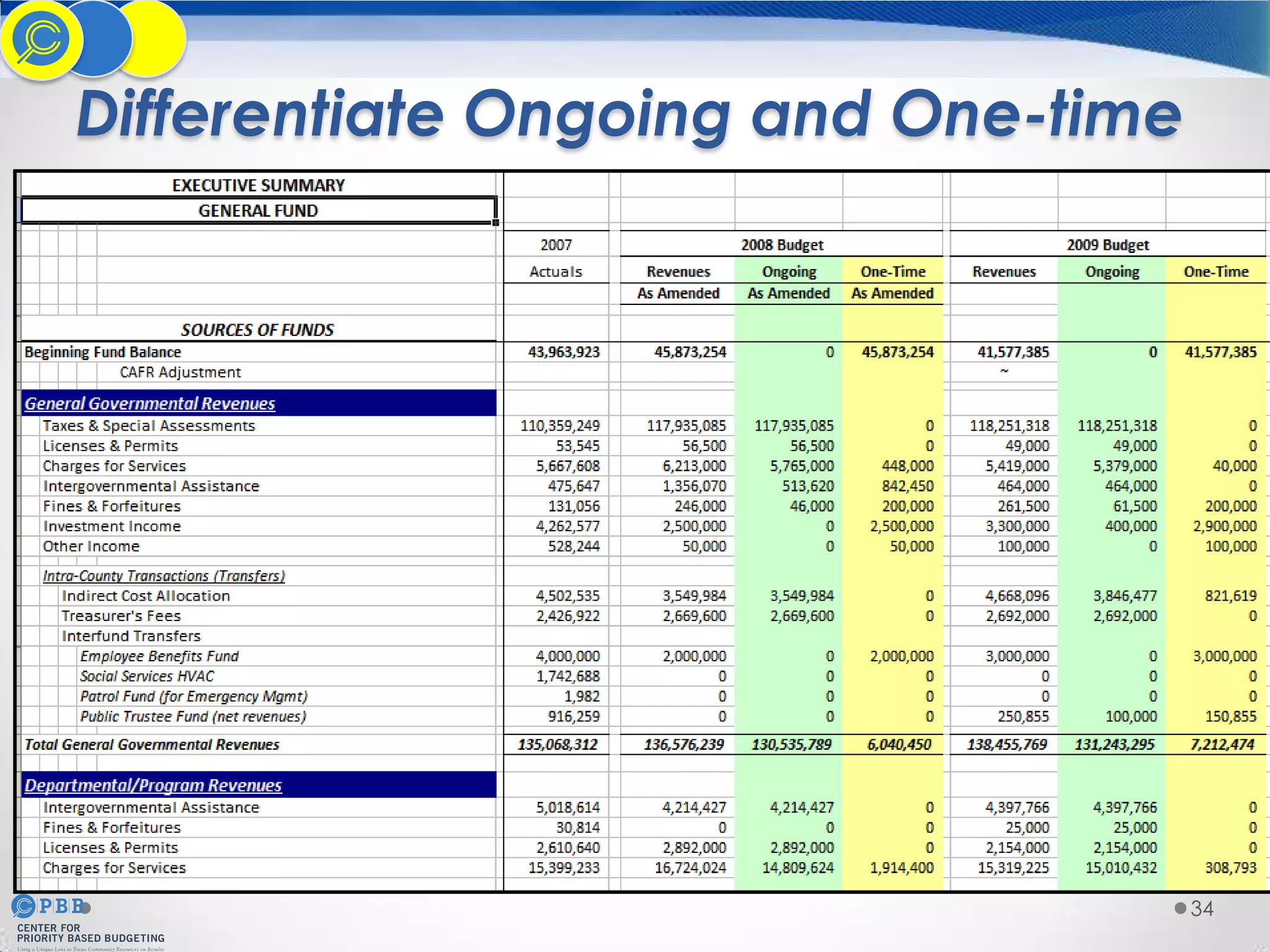

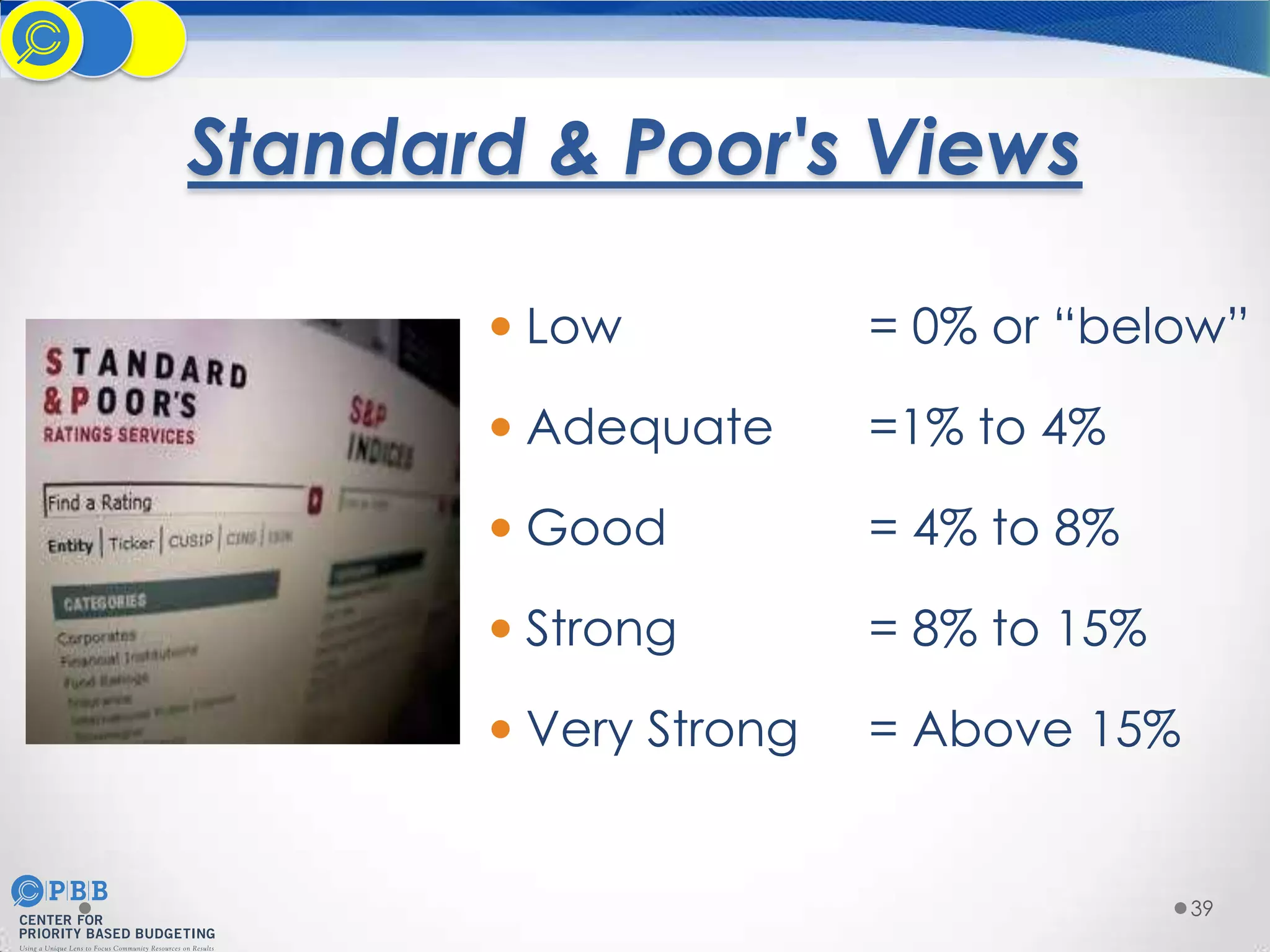

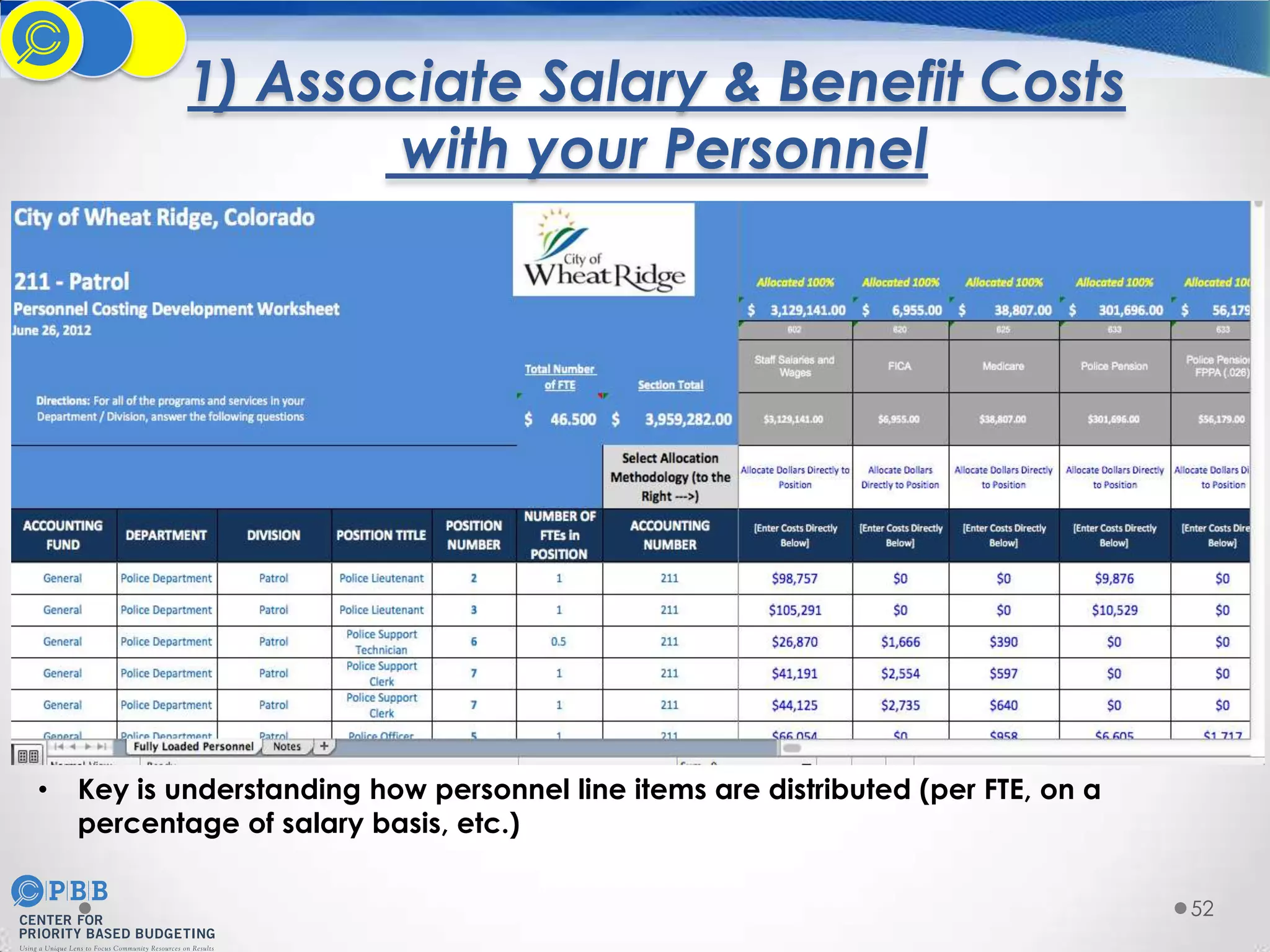

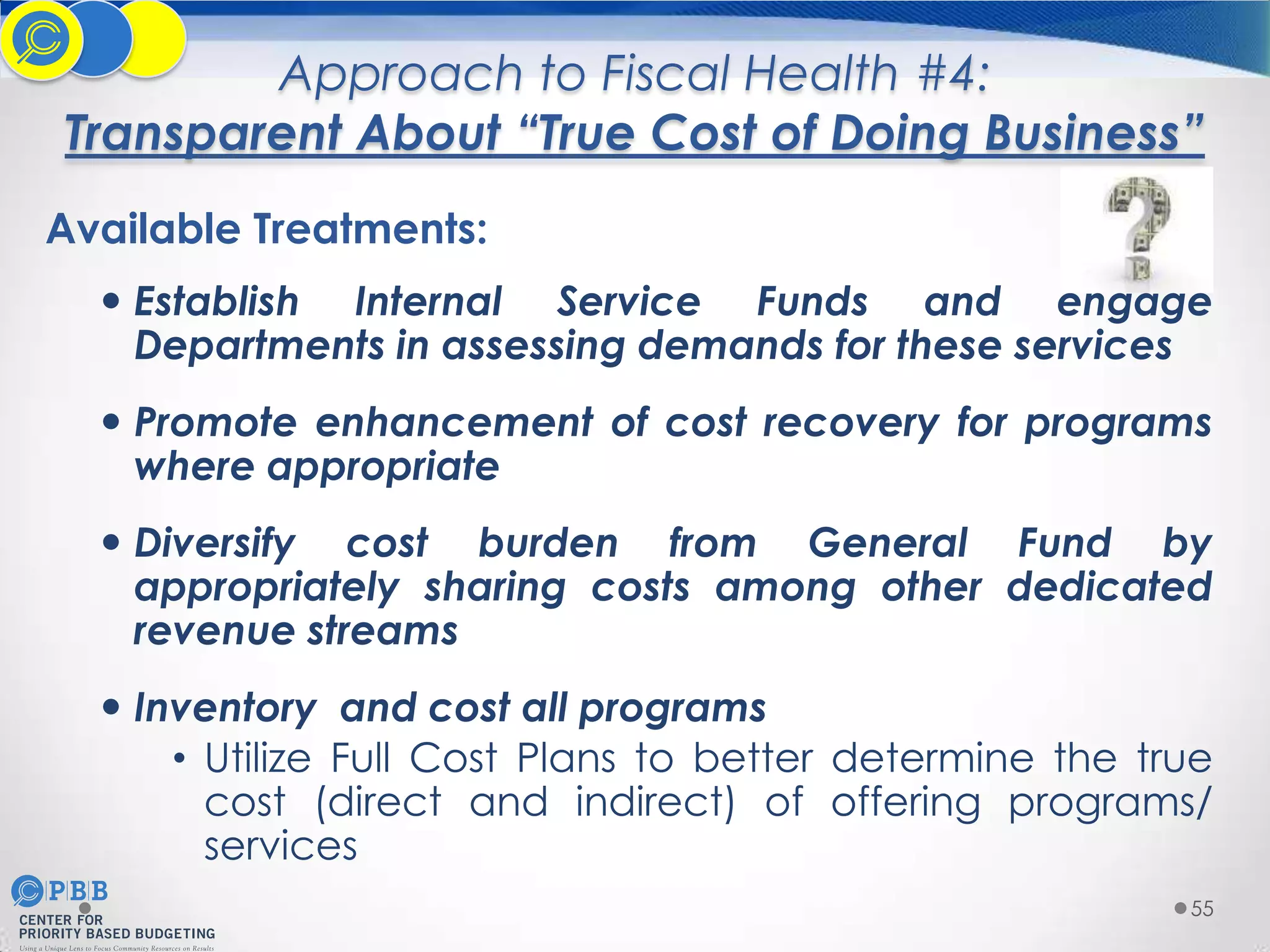

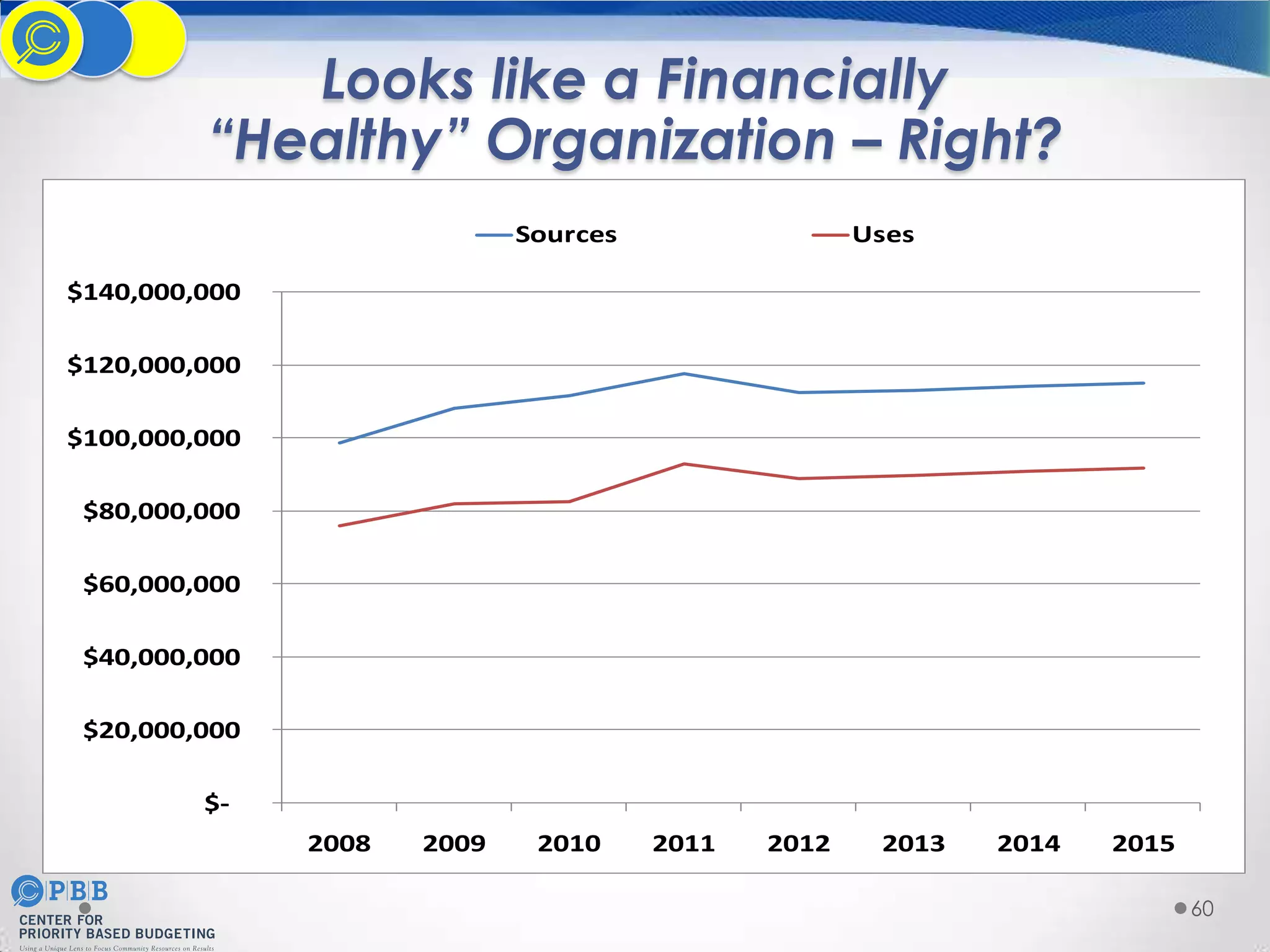

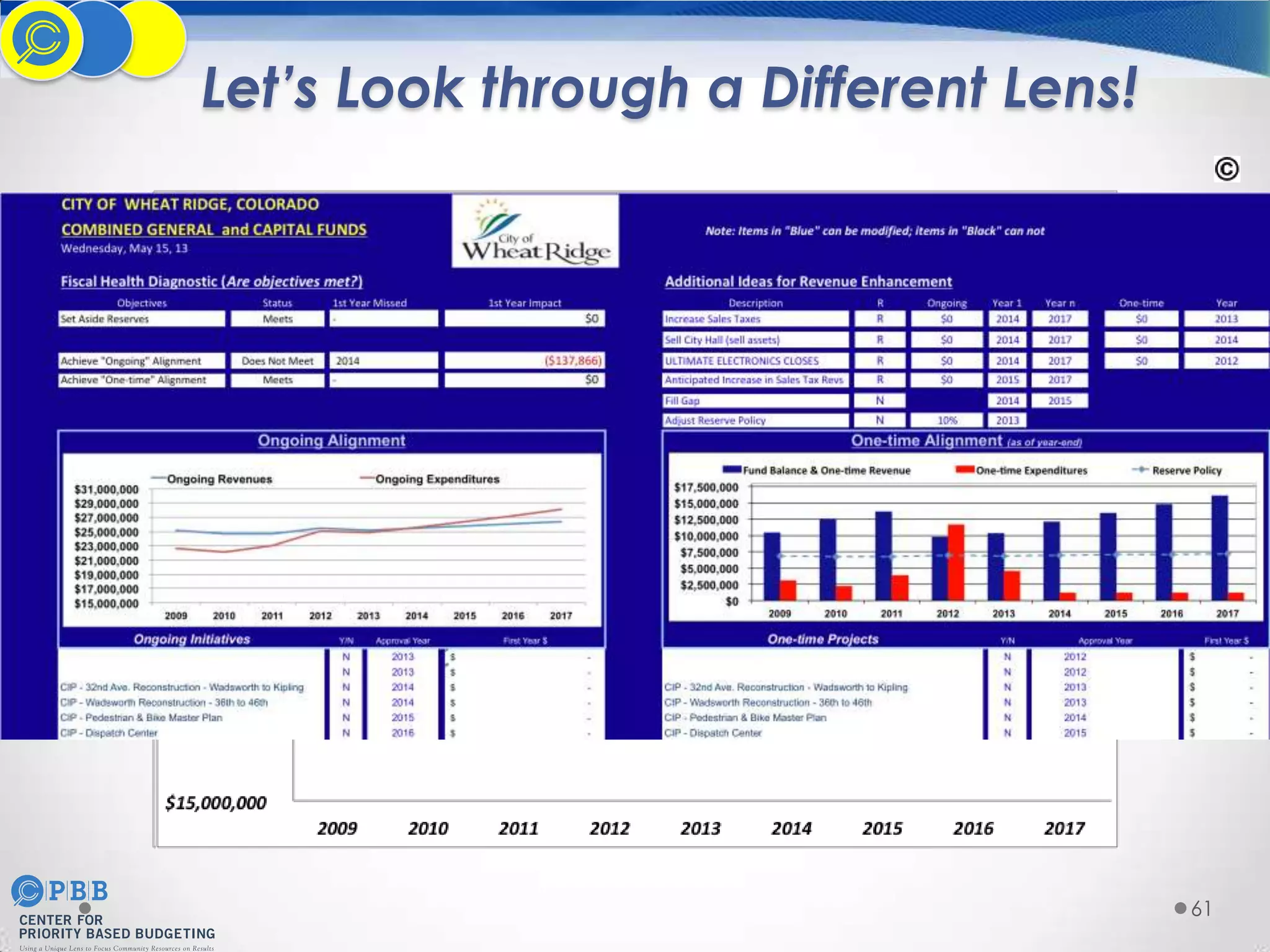

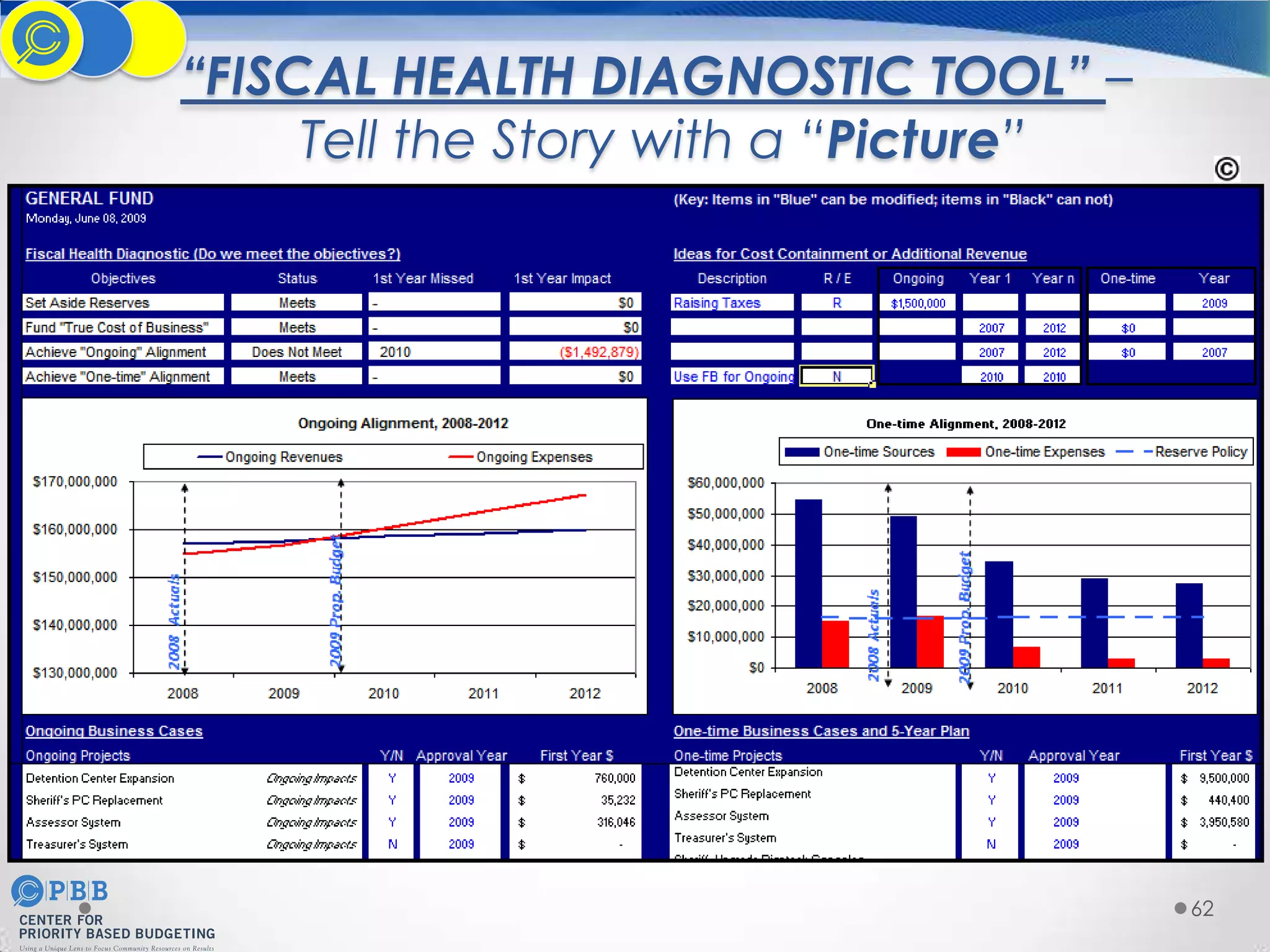

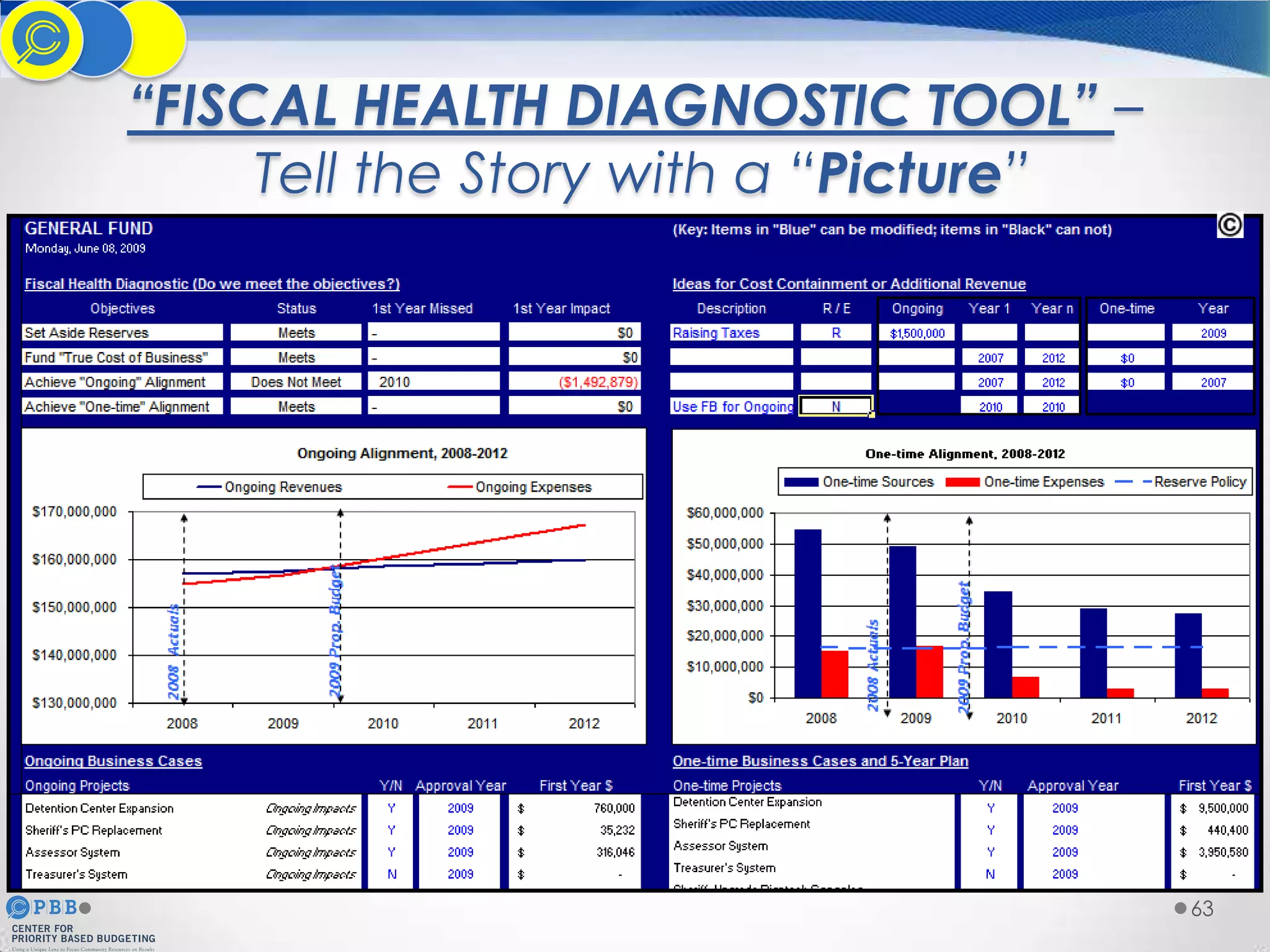

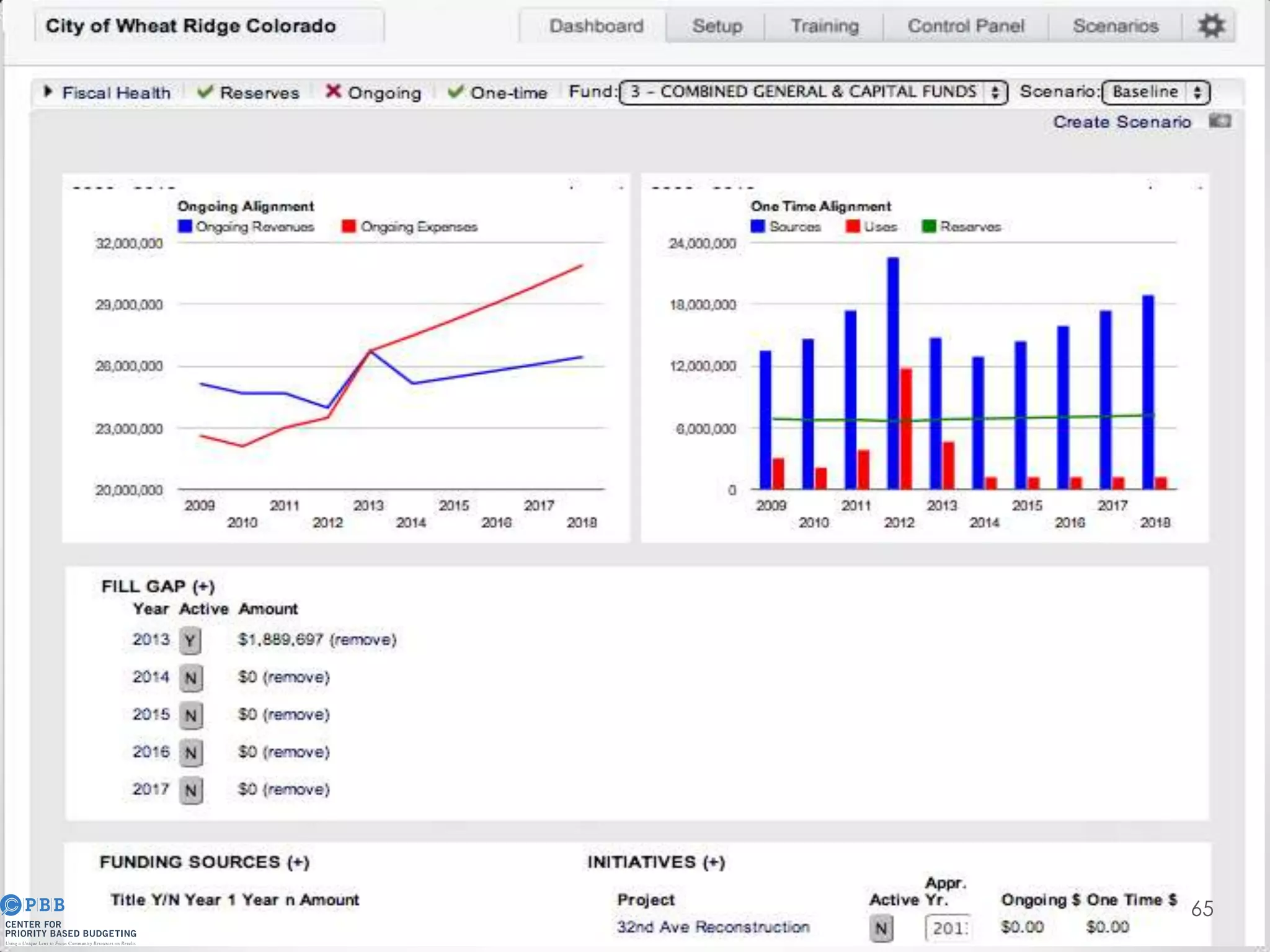

This document provides an overview of priority based budgeting and achieving fiscal health for elected officials. It discusses diagnosing a jurisdiction's financial situation and developing treatment plans to improve fiscal health. Key areas of focus include spending within available revenues, establishing and maintaining reserves, understanding variances between budgets and actuals, and ensuring transparency around the true costs of programs and services. The document aims to help elected officials make informed financial decisions for their communities.