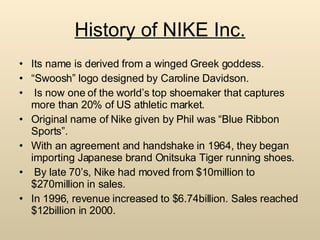

NIKE is one of the world's largest athletic shoe and apparel companies. It was founded in 1964 as Blue Ribbon Sports by Phil Knight and Bill Bowerman and began importing Japanese running shoes. By the 1970s, Nike had grown significantly in sales and changed its name. Today Nike captures over 20% of the US athletic shoe market and has expanded into various other sports equipment, apparel, and accessories. It sells products through retailers, owned stores, licensees, and its website. Nike has several subsidiaries and announced a quarterly dividend in 2008 while also putting its hockey equipment business Bauer up for sale.