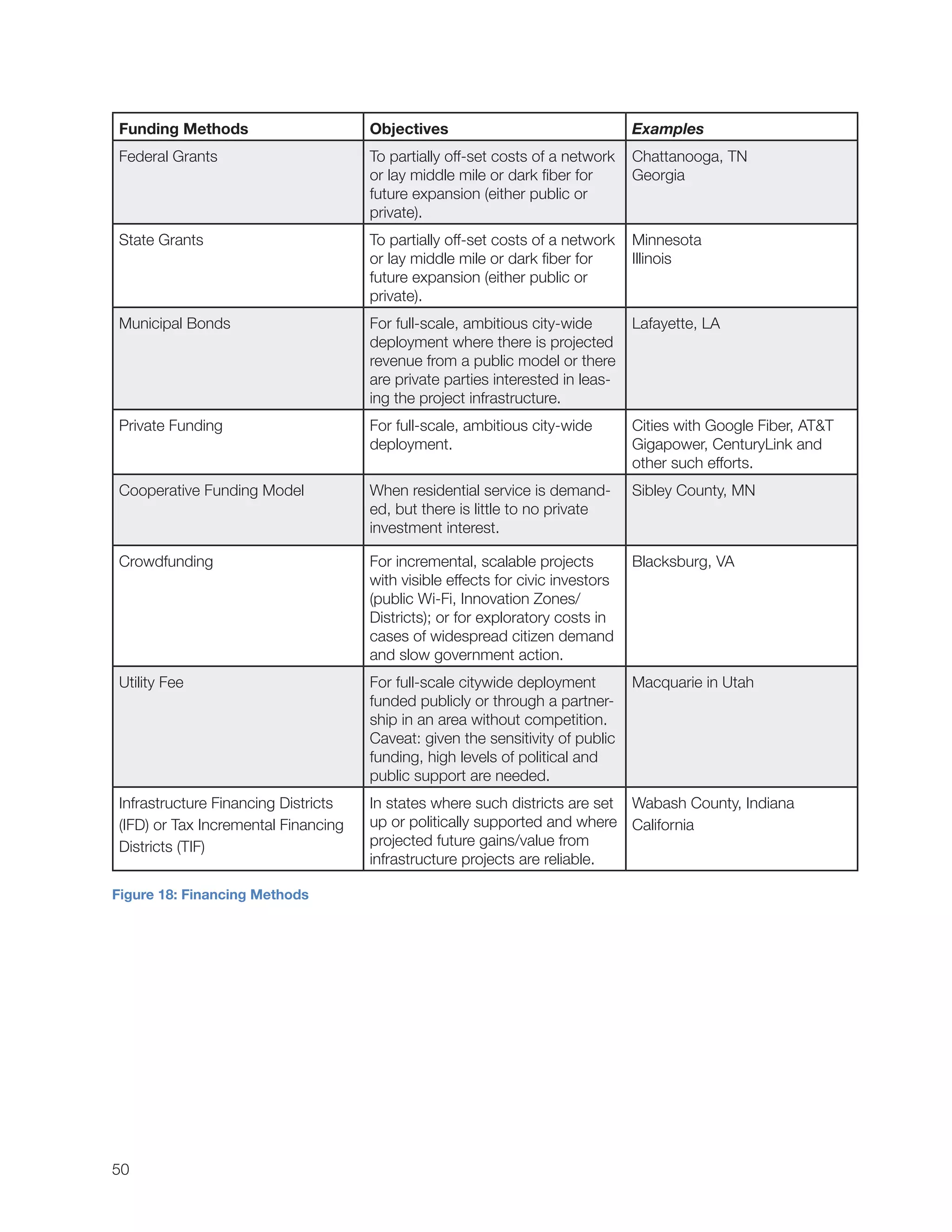

This handbook provides guidance for city officials seeking to improve broadband access and affordability in their communities. It reviews the current broadband landscape and outlines best practices and models. The handbook aims to help lower informational barriers for cities just starting to address broadband issues. It covers topics such as the economic and quality of life benefits of faster broadband, examples of successful municipal broadband projects, preliminary steps for cities to take, key issues in developing public-private partnerships, and potential funding opportunities and challenges. The overall goal is to help cities understand how to accelerate deployment of next-generation broadband networks.

![44

“The City will provide diligent and expeditious

review and determinations of all applications for

permits submitted by AT&T and will attempt…to

approve or respond within one week from the date

of the submission of the request.”

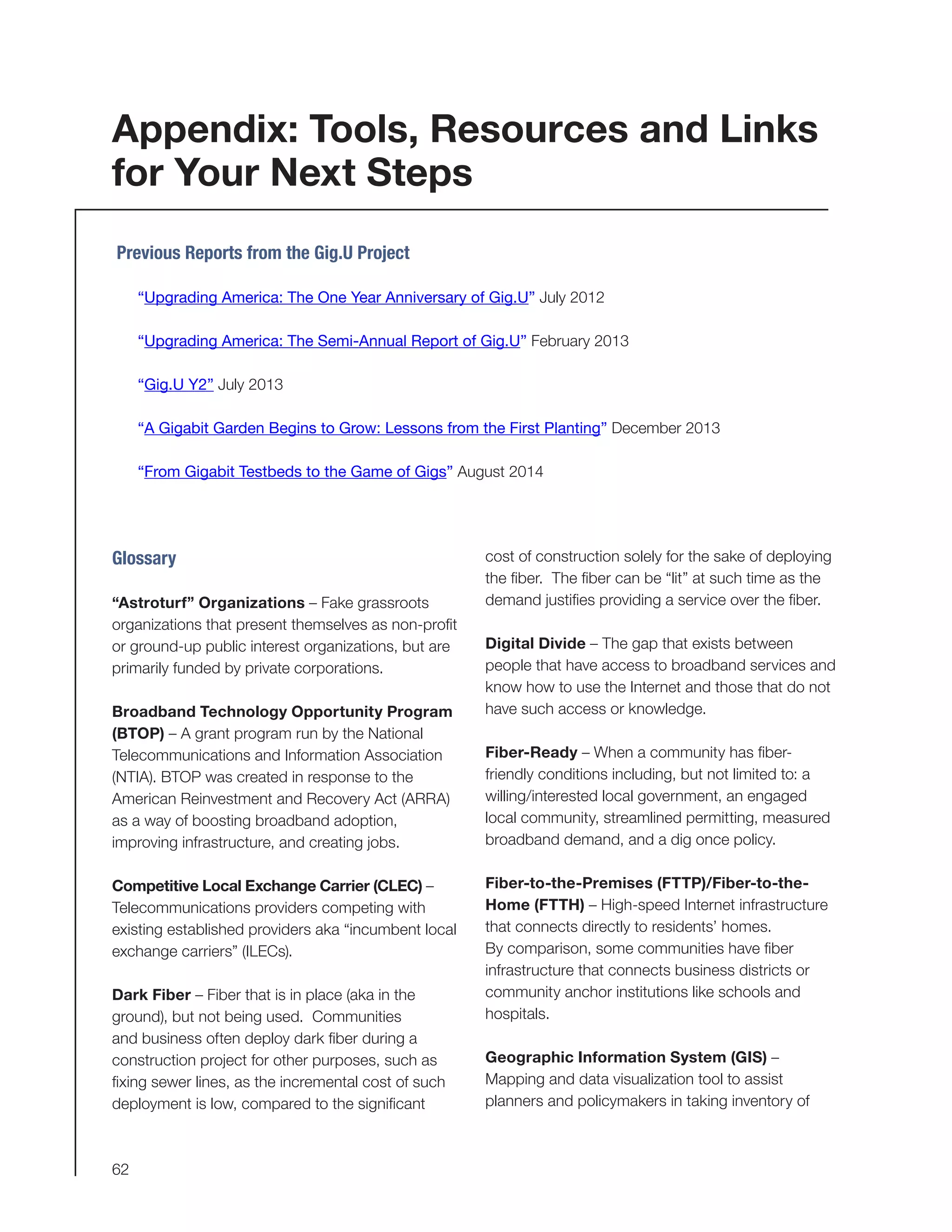

Similarly, Google’s contract in Kansas City called for

“quick, diligent review of all applications for permits”

followed by “a commitment to review and respond to

any subsequent modifications or similar documents

that may require approval by City within five (5) work-

ing days of submission by Google.”

Waiving Permit Fees

Another way to streamline the permitting process is

to waive fees, although the obvious financial impli-

cations of this tactic should not be overlooked. The

Google contract reflects this approach, as seen in the

Fee Schedule that sets a fee of “None” for “Permits.”

Before adopting this approach, city officials should

review internally how its payment processing affects

permit process timing. If the effect is negligible, so too

will be the benefit.

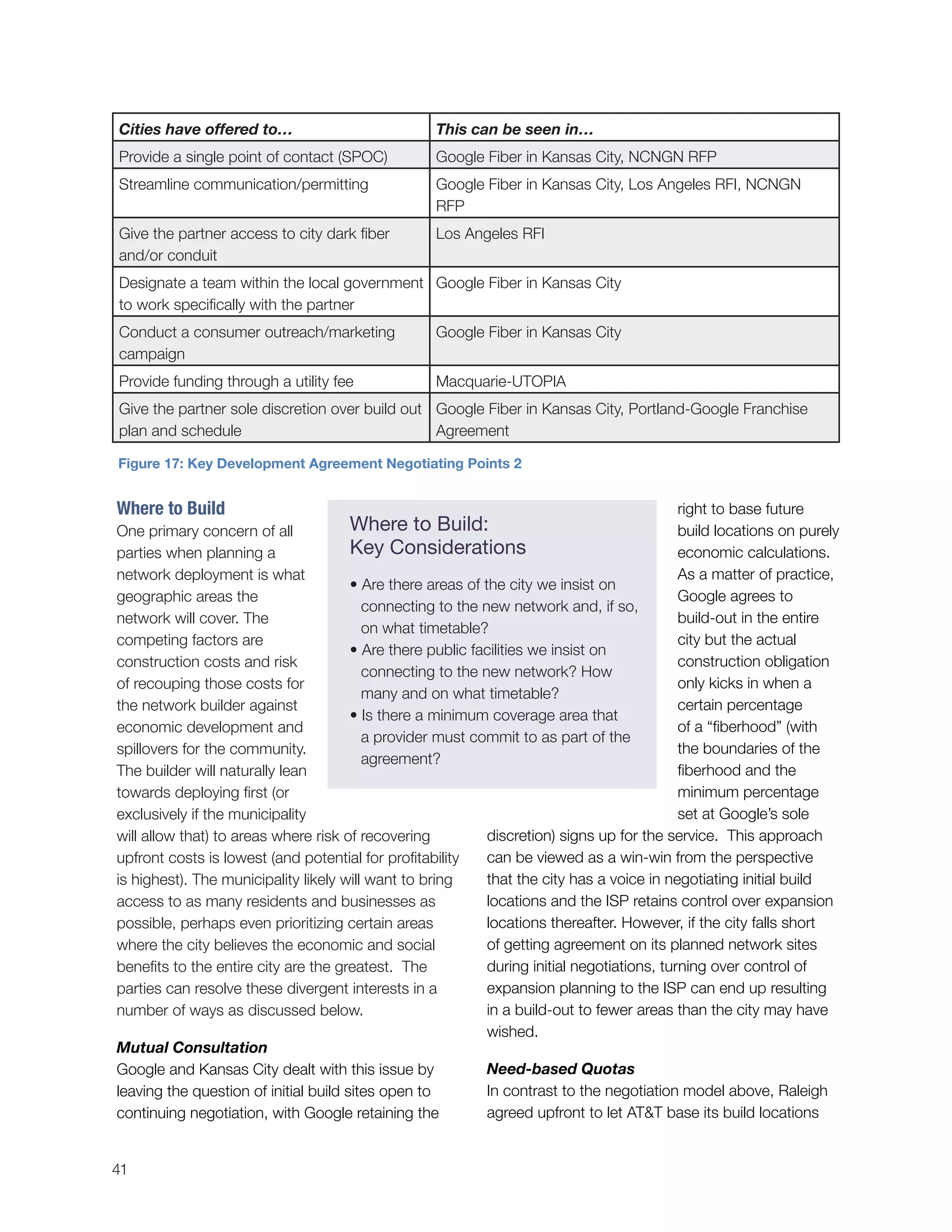

Personnel Commitments

Another way to streamline the permitting process and

network deployment more generally, is identifying spe-

cific city personnel who can focus partially or primarily

on network related issues. Having such a dedicated

team will speed up not only permit processing, but

also the resolution of the numerous diverse issues that

inevitably come up throughout long and complex con-

struction projects. The level of specificity in personnel

provisions can vary.

The contract between AT&T and Raleigh uses general

language:

“The City shall designate staff that will facilitate

communications between AT&T and City staff and

officials, and will coordinate between municipal

departments…City will designate inspectors and

supervisors with the collective authority to inspect

all construction for the Network, maintenance, and

related work in connection with each applicable

permit to be issued by the City to AT&T.”

In contrast, Google’s contract with Kansas City spells

out personnel requirements in more detail, going as

far as creating new job roles. For example, Google’s

contract requires the creation of an “Executive Spon-

sor for the Project at the most senior level of City” and

a “Single Point of Contact (SPOC)... responsible for ad-

dressing all issues related to the Project.” The Google

contract further requires “a City team dedicated to the

Project…the full cooperation of all City departments…

[the City] participate in regular status meetings (at least

weekly)... a dedicated inspection team as part of the

City Project team… [and] consulting assistance to

Google on planning and build of the Project.”

Open Access

The term “open access” refers to a network manage-

ment policy by which multiple service providers can

offer services over the same physical network. This

objective is reached by requiring the network owner

to offer access to its physical network on non-dis-

criminatory terms to any requesting service provider

who can plug their own equipment into the network

and begin offering services to customers. Stockholm,

Sweden, is the most notable example of an open

access fiber network. The South Portland, Maine,

and Champaign-Urbana, Illinois, efforts include open

access requirements.

Open Access:

Key Considerations

• Does the city want to try an open access

model?

• Have ISPs expressed initial interest in

working with the city to implement an open

access network policy?

Personnel Commitments:

Key Consideration

• How will dedicating such a team affect city

resources and other high priority construc-

tion processes?](https://image.slidesharecdn.com/val-nexgendesign7-150721141651-lva1-app6891/75/Next-Generation-Connectivity-Handbook-44-2048.jpg)