Embed presentation

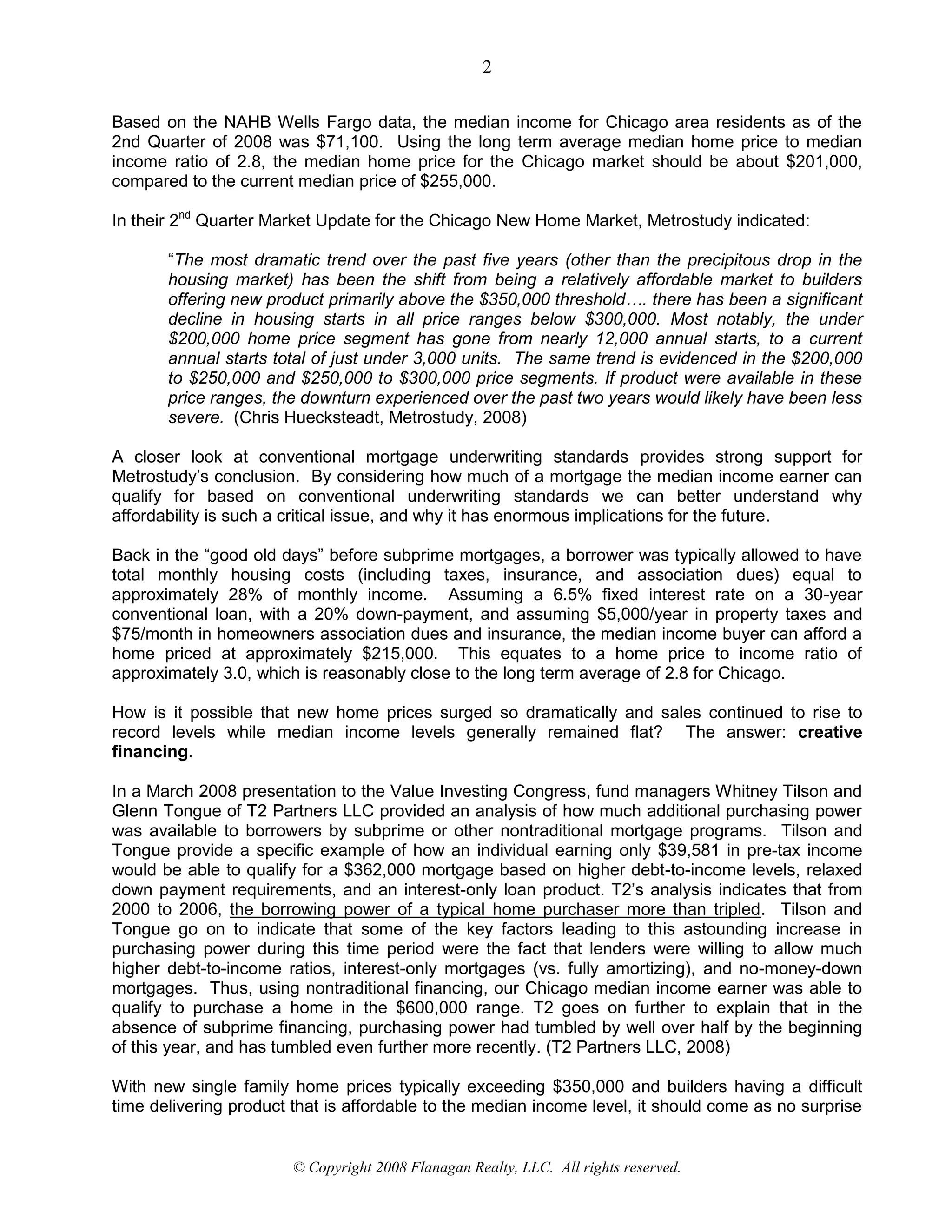

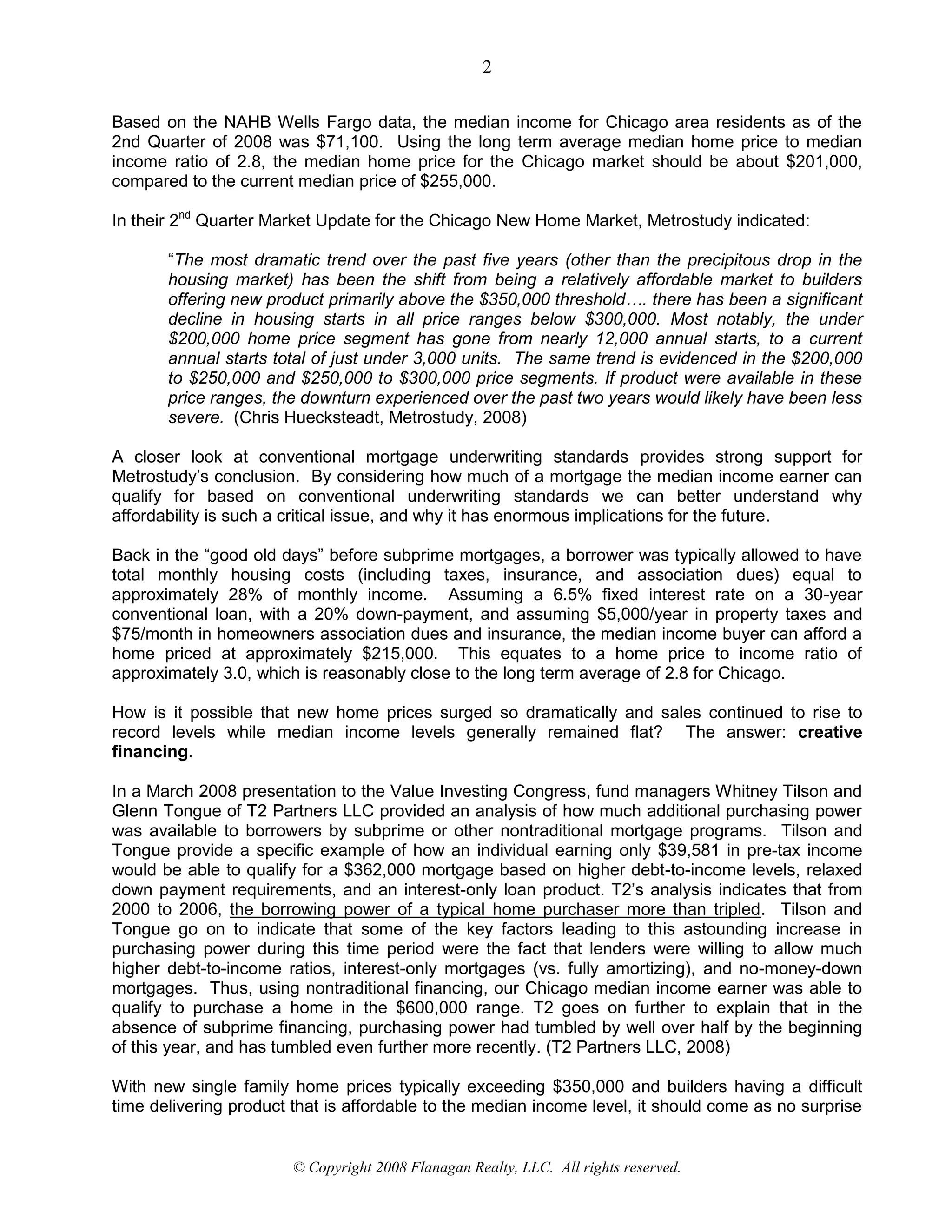

The document discusses the causes of the housing market downturn in Chicago and nationally. It argues that the primary cause was a lack of housing affordability as home prices grew much faster than incomes from 2004-2007. Creative financing using subprime mortgages allowed home prices to surge far beyond affordable levels for median income earners. Now that subprime lending has collapsed, home prices remain too high and sales have dropped dramatically as traditional lending standards have returned. The recovery will require a shift to more affordable home prices aligned with median incomes.