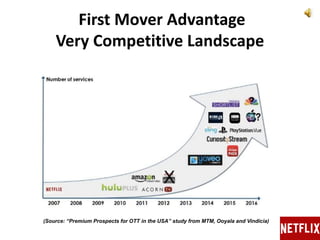

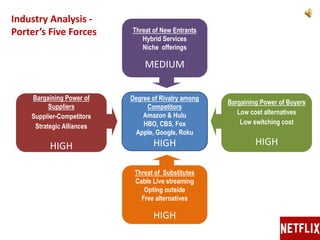

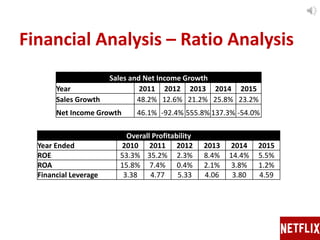

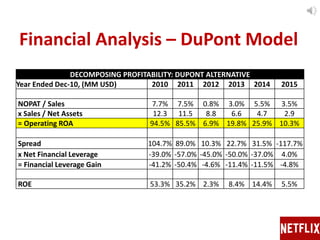

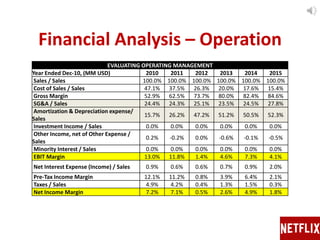

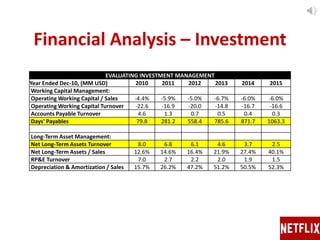

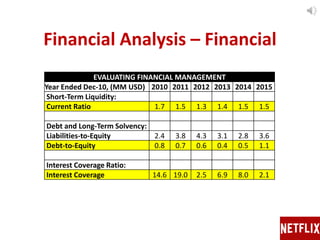

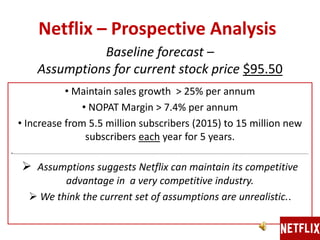

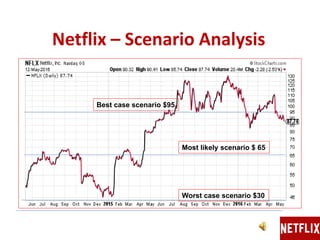

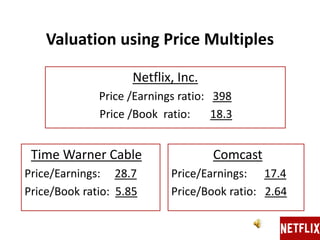

Netflix is the leading online TV provider with 75 million subscribers globally and a competitive strategy focused on content differentiation and customer preference analytics. The company's market position faces challenges from increased competition, rising costs, and negative cash flows, prompting a sell rating with a fair value estimate of $65 per share. Despite previous high profitability, Netflix's stock trades at a premium that may not be sustainable as it expands internationally and confronts a competitive landscape.