Mostafa Bahgat is seeking a position that allows him to utilize his communication skills and experience. He has over 8 years of experience in banking operations and trade finance at Arab African International Bank. He is currently the Head of Operations Cash and has held prior roles as a Teller and Operations Officer. Mostafa has a Bachelor's degree in Commerce from Ain Shams University and specialized banking certifications.

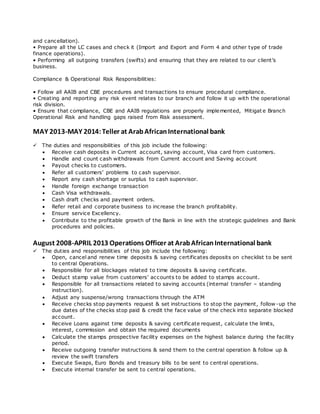

![ Execute standing instruction ( internal transfer – outgoing transfer)

Responsible for CBE reports concerning incoming & outgoing transfer

Calculate the duty stamp for personal loans

Review all transactions concerning cash, transfers …etc. to ensure there is no money

laundry transactions

Prepare on monthly basis money laundry status report to be delivered to compliance

division

Ensure service Excellency.

Contribute to the profitable growth of the Bank in line with the strategic guidelines and Bank

procedures and policies.

Refer retail and corporate business to increase the branch profitability

Personal Skills

Ability to work as an individual and as part of a team.

Ability to work in different environments and under stress.

Good communication skills, quick learner, Self-motivated and reliable.

Computer Skills

Excellent Knowledge of Microsoft Office (MS Word, Excel, Access, MS Front page and MS Power

Point)

Professional Internet and computer user.

Language

Native Arabic Language

English 1st language [Reading and Writing fluency]

References

Available upon request.](https://image.slidesharecdn.com/e112197f-ace3-447a-90b4-acb870329626-160727094246/85/MY-C-V-3-320.jpg)