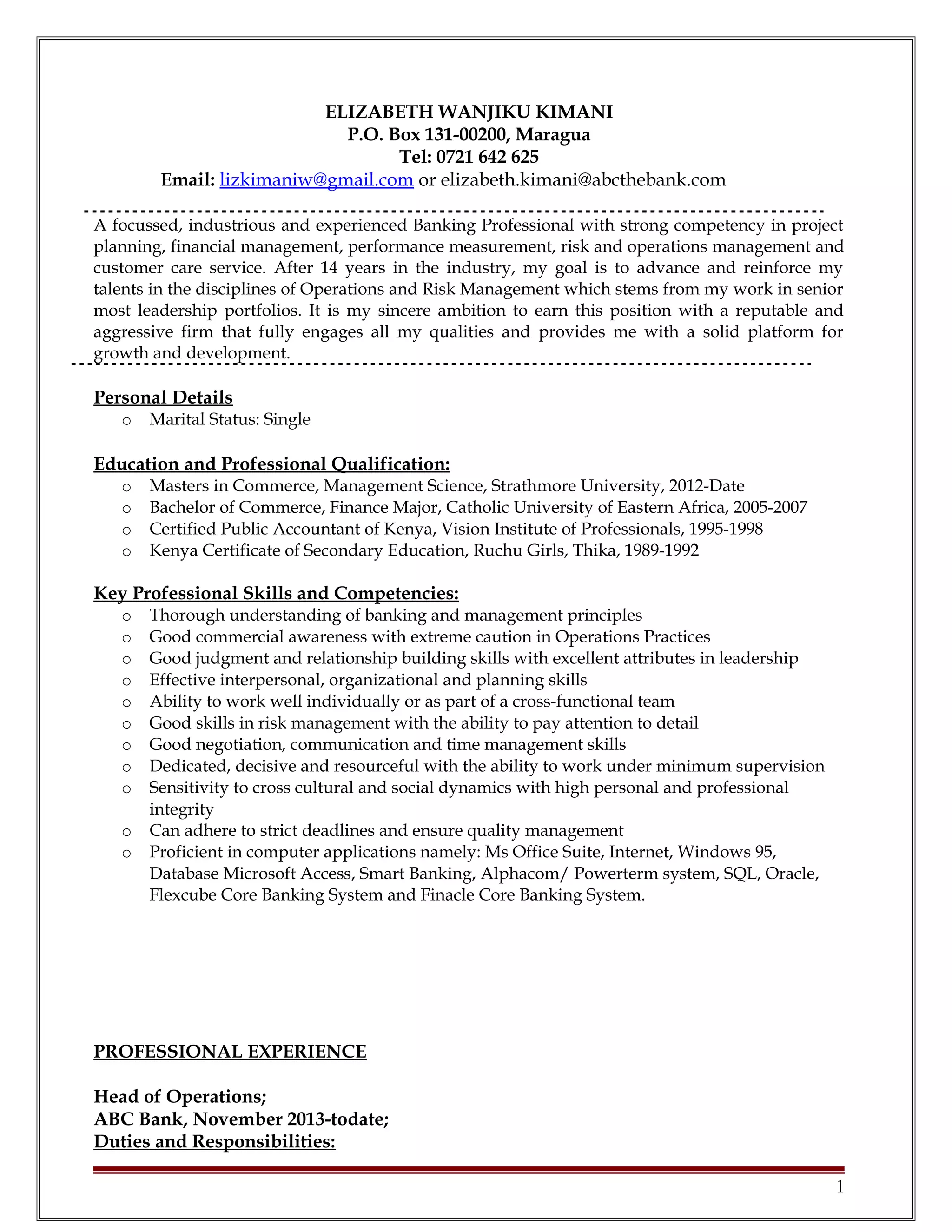

Elizabeth Kimani has over 14 years of experience in banking, primarily in operations and risk management roles. She is currently the Head of Operations at ABC Bank, where she manages various operations departments to ensure compliance and deliver excellent customer service. Previously, she held senior roles such as Acting Head of Risk and Compliance and Head of Operations at Family Bank. She has a strong track record of streamlining processes, implementing new systems, and training staff. Her education includes a Master's degree in Commerce and she is a Certified Public Accountant.