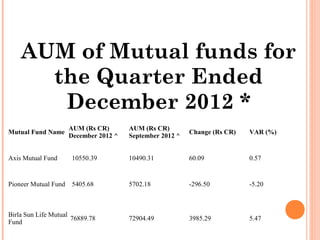

A mutual fund is a trust that pools savings from investors and invests it in instruments like shares and debentures. Investors share the income and capital appreciation from these investments proportional to their units. The document discusses that mutual fund assets under management increased in the quarter ending December 2012 led by inflows into debt funds. It attributes the growth to expectations of lower interest rates and profit booking in equities. HDFC, Reliance and ICICI Prudential retained the top three positions by average AUM for the quarter.