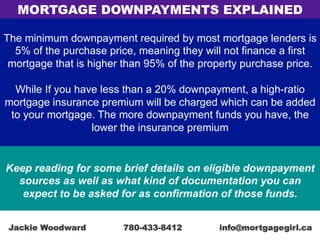

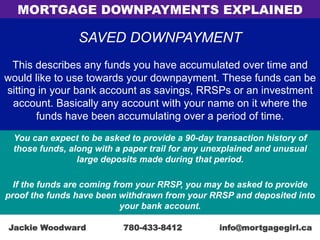

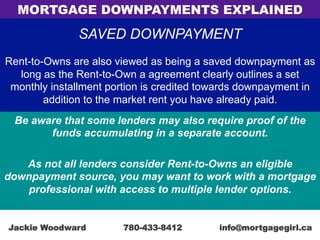

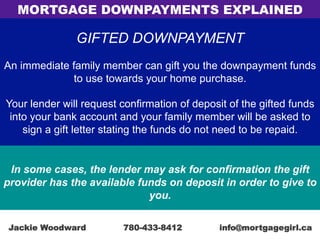

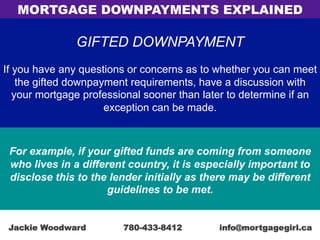

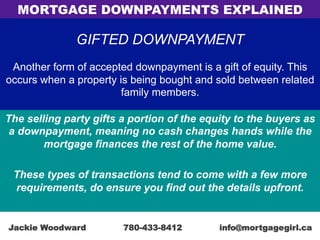

The document explains various sources for mortgage downpayments, which are essential when purchasing a home. It outlines acceptable downpayment sources such as saved funds, gifts from family, borrowings, and seller financing, detailing the documentation required for each option. The importance of consulting a mortgage professional to navigate these requirements and strategies for building equity is emphasized.