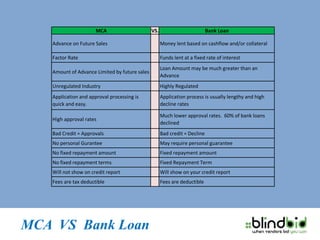

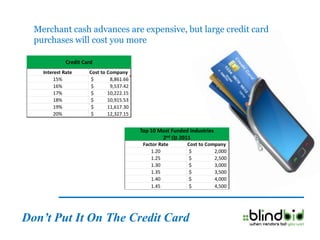

A merchant cash advance (MCA) provides capital based on a business's future sales, offering quicker approval than bank loans with less stringent credit requirements. However, MCAs are typically more expensive and can come with high daily retrieval rates and short payback periods. Businesses should carefully evaluate their needs and seek reputable providers to avoid pitfalls associated with MCAs.