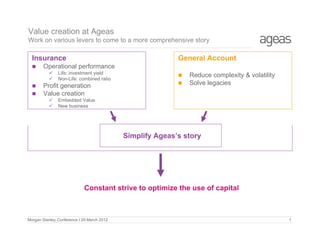

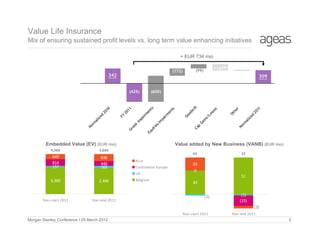

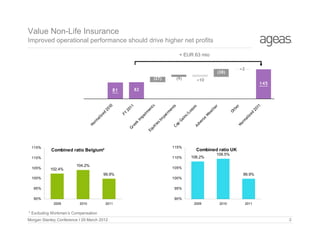

1) Ageas aims to create value through improving operational performance in life and non-life insurance, reducing complexity and volatility in its general account, and generating new business growth.

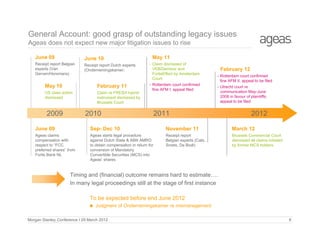

2) In 2011, Ageas increased its embedded value and value of new business primarily through strong performance in Asia, and reduced volatility in its general account by settling legacy issues.

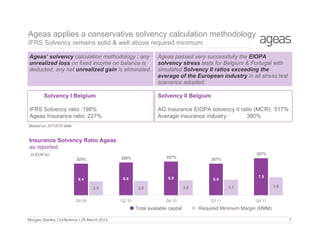

3) Going forward, Ageas will focus on further improving operational performance, unwinding remaining legacy legal issues, managing capital prudently, and preparing for upcoming regulatory changes.