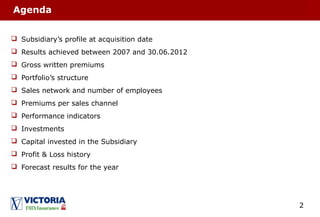

This document summarizes the financial performance of Victoria, a Bulgarian insurance subsidiary, between 2007-2012. Key points include:

- Gross written premiums grew 15.8% annually on average, increasing Victoria's market share and ranking.

- Net combined, loss, and expense ratios improved after portfolio restructuring in 2010-2011 toward more profitable lines.

- Investments grew significantly and shifted toward lower risk assets like bonds per the parent company's strategy.

- Net profits fluctuated but were positive in recent years, and forecasts predict over €2 million for full-year 2012.