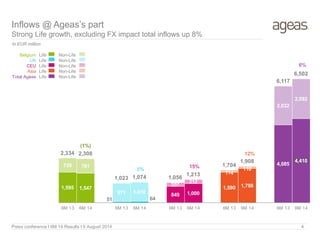

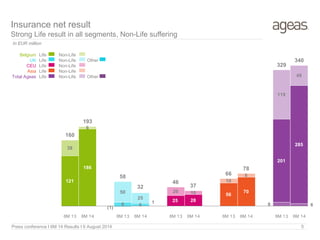

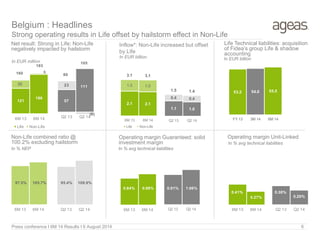

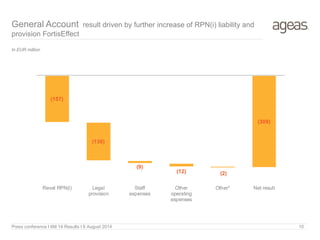

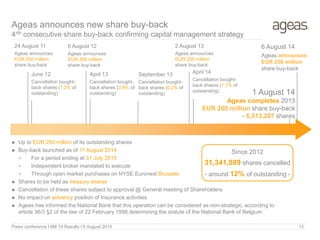

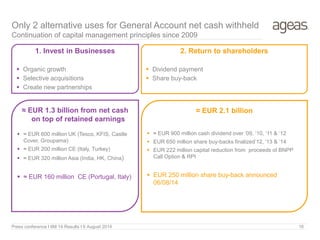

Ageas posted solid 6M 2014 insurance results, with a net profit of EUR 340 million in Non-Life (+3%) offset by losses in the General Account. The Group net result was EUR 31 million (-93%). Shareholders' equity increased due to unrealized gains and losses. Ageas also announced a new EUR 250 million share buy-back program.