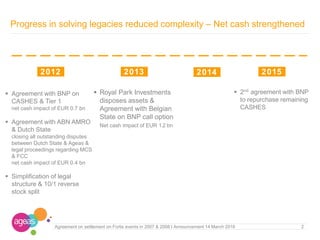

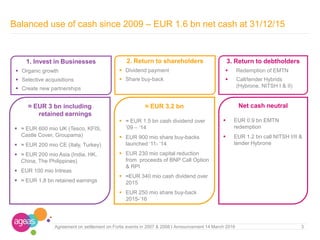

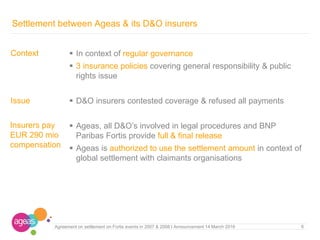

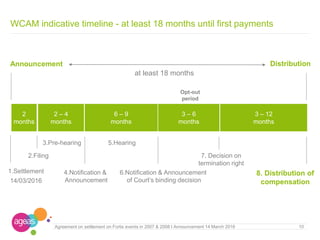

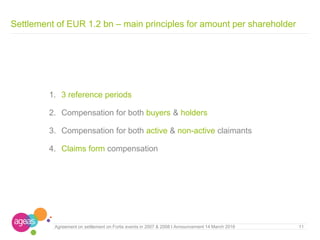

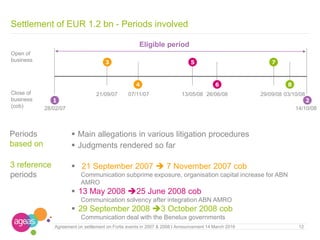

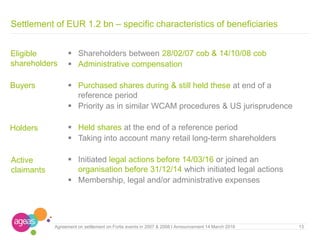

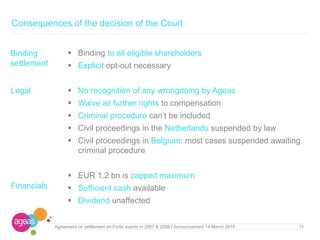

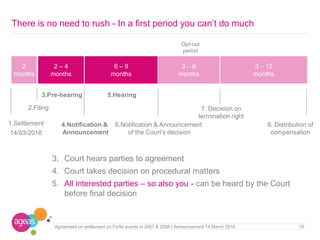

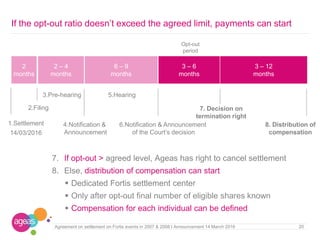

This document summarizes Ageas's announcement of a settlement regarding legal proceedings related to events at Fortis in 2007 and 2008. It announces a EUR 1.2 billion settlement that includes compensation for eligible shareholders. It describes the timeline and process for filing the settlement with the court, determining eligible shareholders, allowing for opt-outs, and distributing compensation. It also summarizes how Ageas has addressed legacy legal issues since 2009 and believes this settlement is the right solution to move forward.