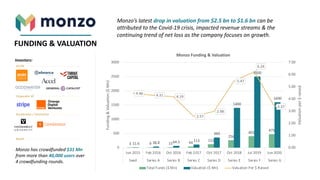

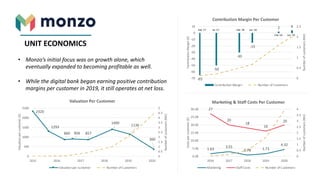

Monzo is a UK-based digital bank that provides banking services through its mobile app. It has grown to over 4 million customers since launching in 2015. While initially focusing on growth, Monzo is now aiming for profitability. It has raised $497 million in funding at a $1.6 billion valuation. Monzo offers current accounts, savings accounts, and other services either directly or through partnerships. It continues to invest heavily in technology and marketing to acquire more customers while working to improve its contribution margin per customer and achieve net profit.