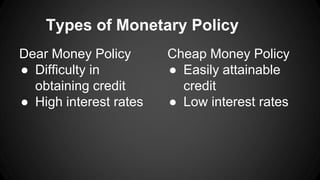

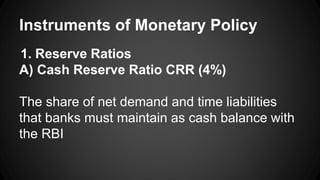

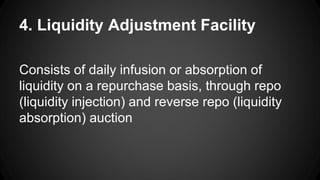

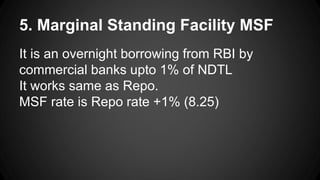

Monetary policy refers to the actions taken by central banks to control the supply of money and credit in an economy and influence interest rates and inflation. The main instruments of monetary policy include reserve ratios, open market operations, bank rates, liquidity adjustment facilities, and marginal standing facilities. Through these tools, central banks can pursue contractionary policies like increasing interest rates to reduce inflation or expansionary policies like decreasing rates to stimulate the economy. The goal overall is to use monetary policy to maintain price stability and control inflation and deflation.