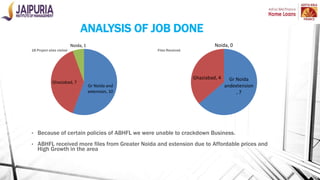

The document provides an overview of Aditya Birla Housing Finance Limited (ABHFL), a non-banking financial company (NBFC) that is a subsidiary of Aditya Birla Financial Services. It discusses the internship role of mapping the mortgage/home finance market in Delhi-NCR, including analyzing competitor activity, builder projects, and direct sales agents. Key findings were that ABHFL received more applications from areas with affordable prices and high growth. Suggestions included lowering interest rates to improve competitiveness and easing policies to improve relations with builders.