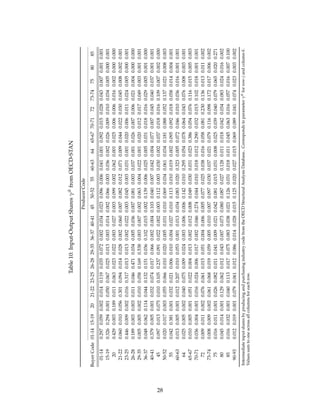

This document analyzes internal trade costs in Canada using detailed trade and output data. It finds:

1) Internal trade accounts for around 11% of Canadian output on average and is as important as international trade for some provinces.

2) Estimated internal trade costs are large (8-15% of trade value) and vary significantly across sectors and provinces, with poorer regions generally facing higher costs.

3) Reducing internal trade costs by liberalizing sectors could significantly increase Canada's GDP and welfare, with gains estimated between $50-130 billion or 3-7% of GDP depending on the policy experiment. Highly interconnected industries have the largest gains from liberalization.