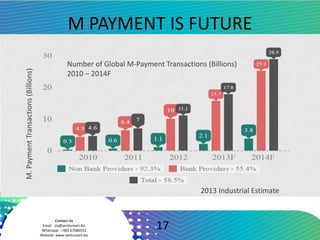

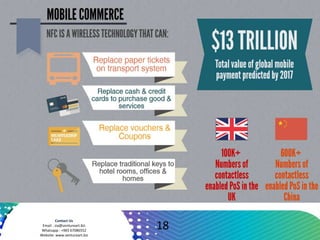

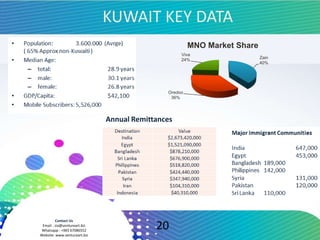

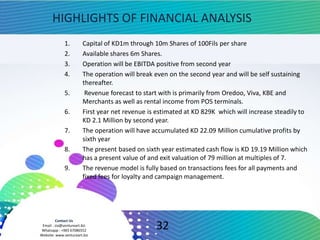

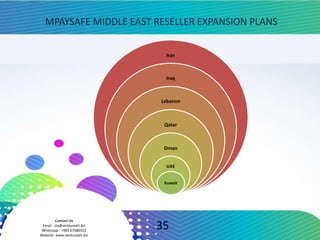

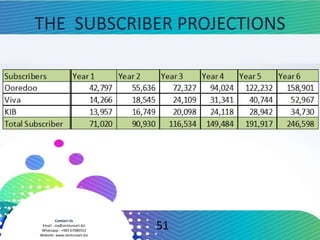

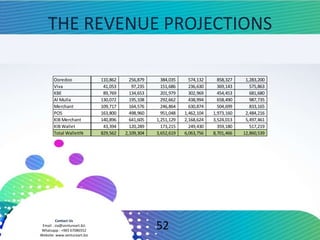

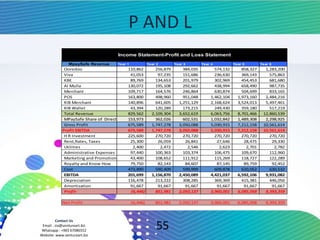

The document outlines the growing significance of mobile money, which encompasses a variety of electronic transactions via mobile phones, including mobile banking, peer-to-peer transfer, and mobile commerce. It highlights key trends in various regions, particularly Japan, South Korea, and Kenya, emphasizing the increasing adoption of mobile banking and the potential market for underserved populations. Additionally, it discusses the financial projections for a service in Kuwait, predicting significant revenue growth and addressing opportunities within the mobile payments sector.