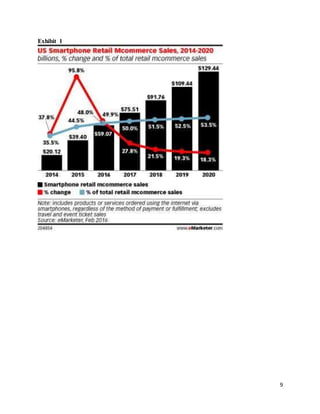

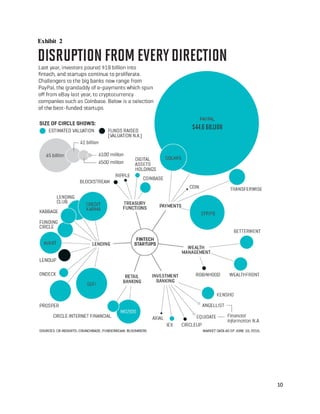

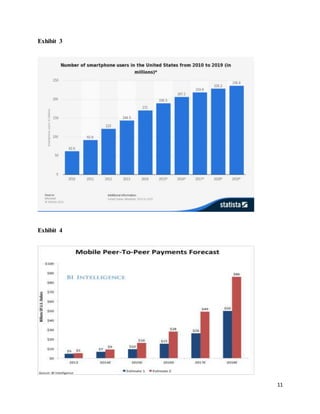

Venmo was founded in 2007 by students at the University of Pennsylvania to allow money transfers via text messaging. It was acquired by Braintree in 2009 for $26.2 million and then by PayPal in 2013 for $800 million. Venmo has grown rapidly, reaching $16 billion in transfers by 2016 with over 141% year-over-year growth in users. Mobile payments have also grown significantly globally with major players like Alipay in China and M-Pesa in Africa revolutionizing payments. In the US, PayPal has led the expansion of mobile payments and digital wallets as smartphone ownership rises.