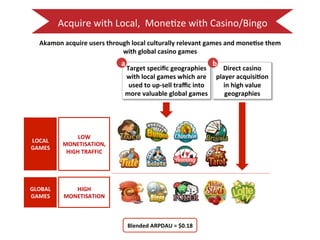

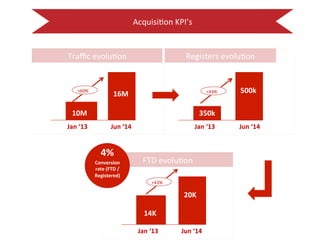

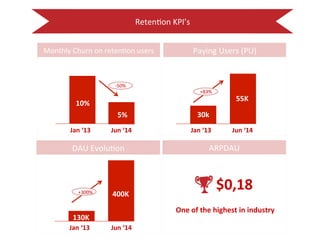

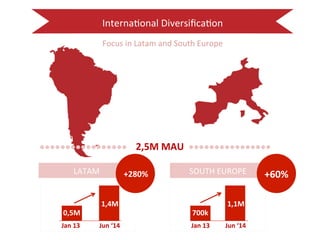

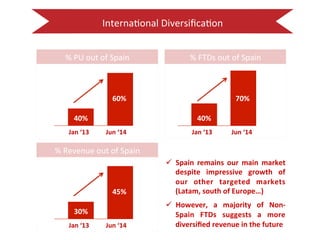

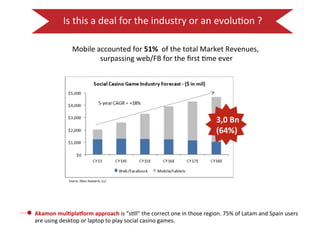

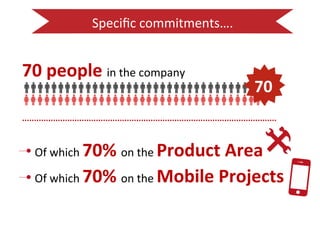

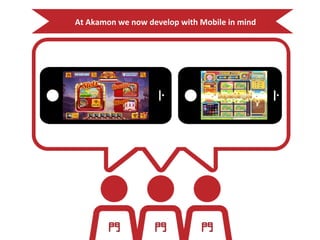

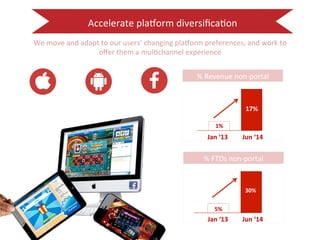

The document discusses the transition to mobile platforms in the social casino gaming industry. It provides an overview of Akamon, a social casino gaming company that started on Facebook but has increasingly focused on mobile. While Akamon had success on Facebook, generating over $0.18 ARPDAU, mobile is now accounting for over 50% of industry revenues as user preferences shift. The document outlines Akamon's strategy to avoid being "dead" by committing more resources to mobile game development and platform diversification in order to remain successful as the industry evolves.