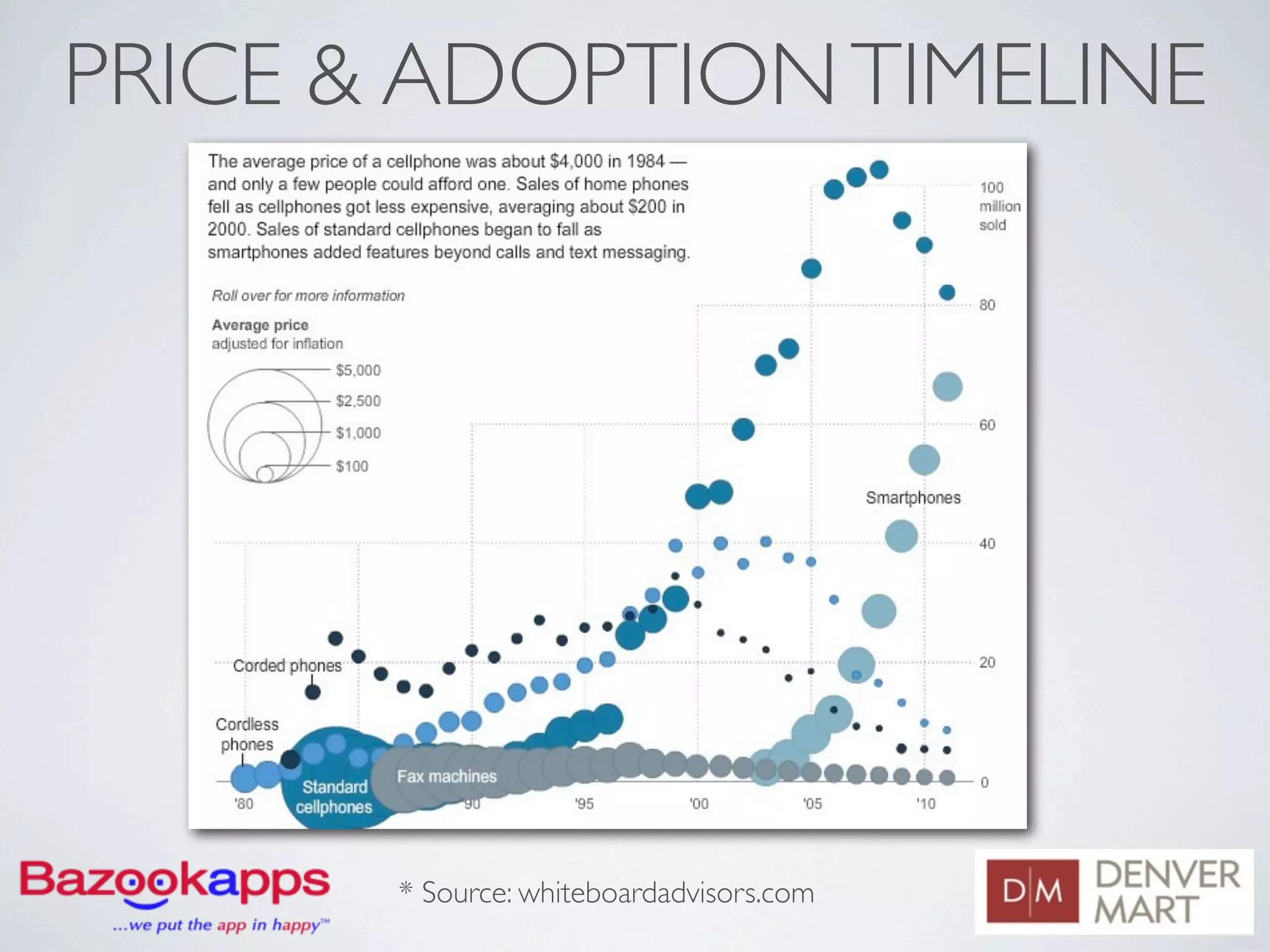

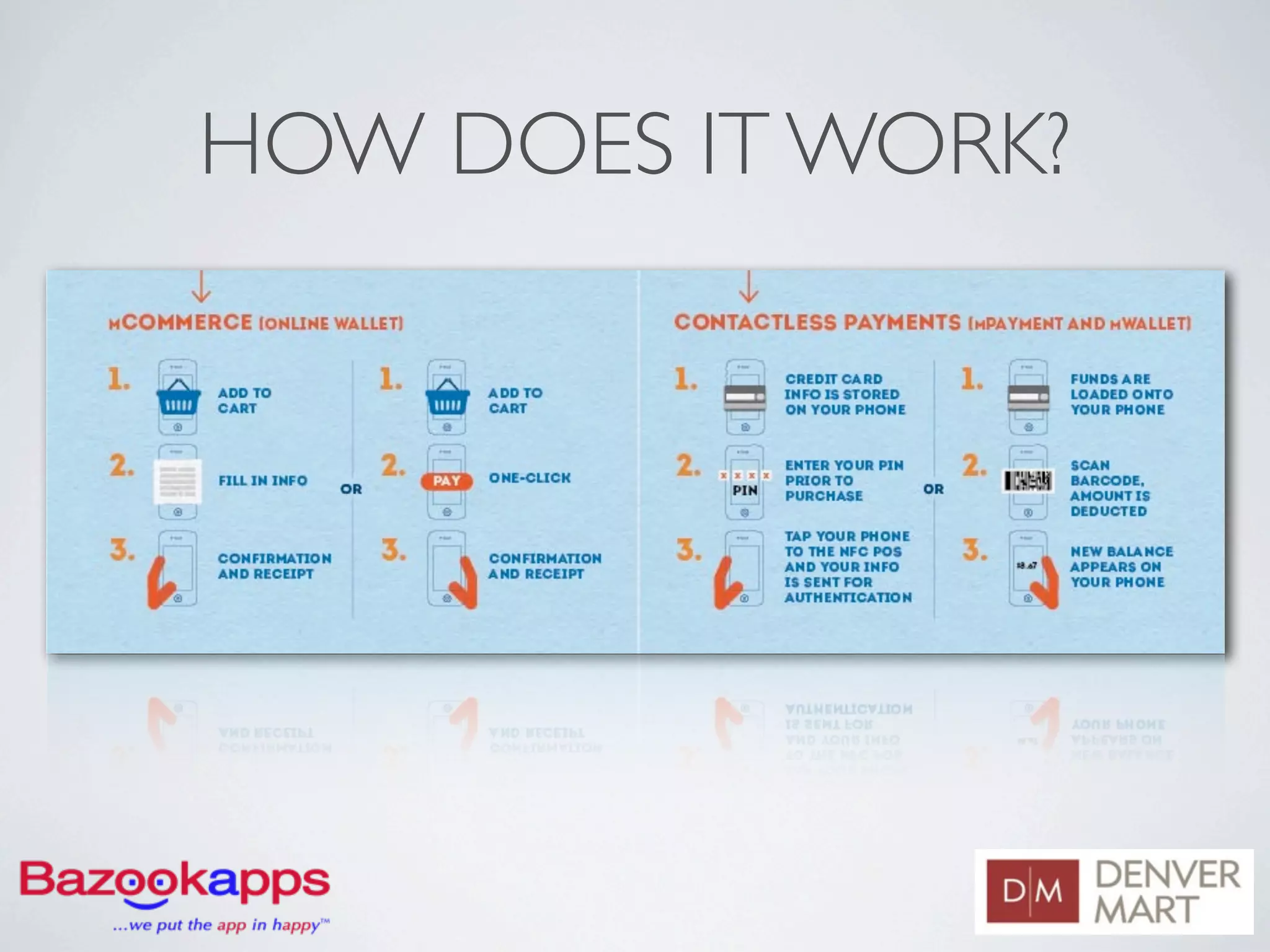

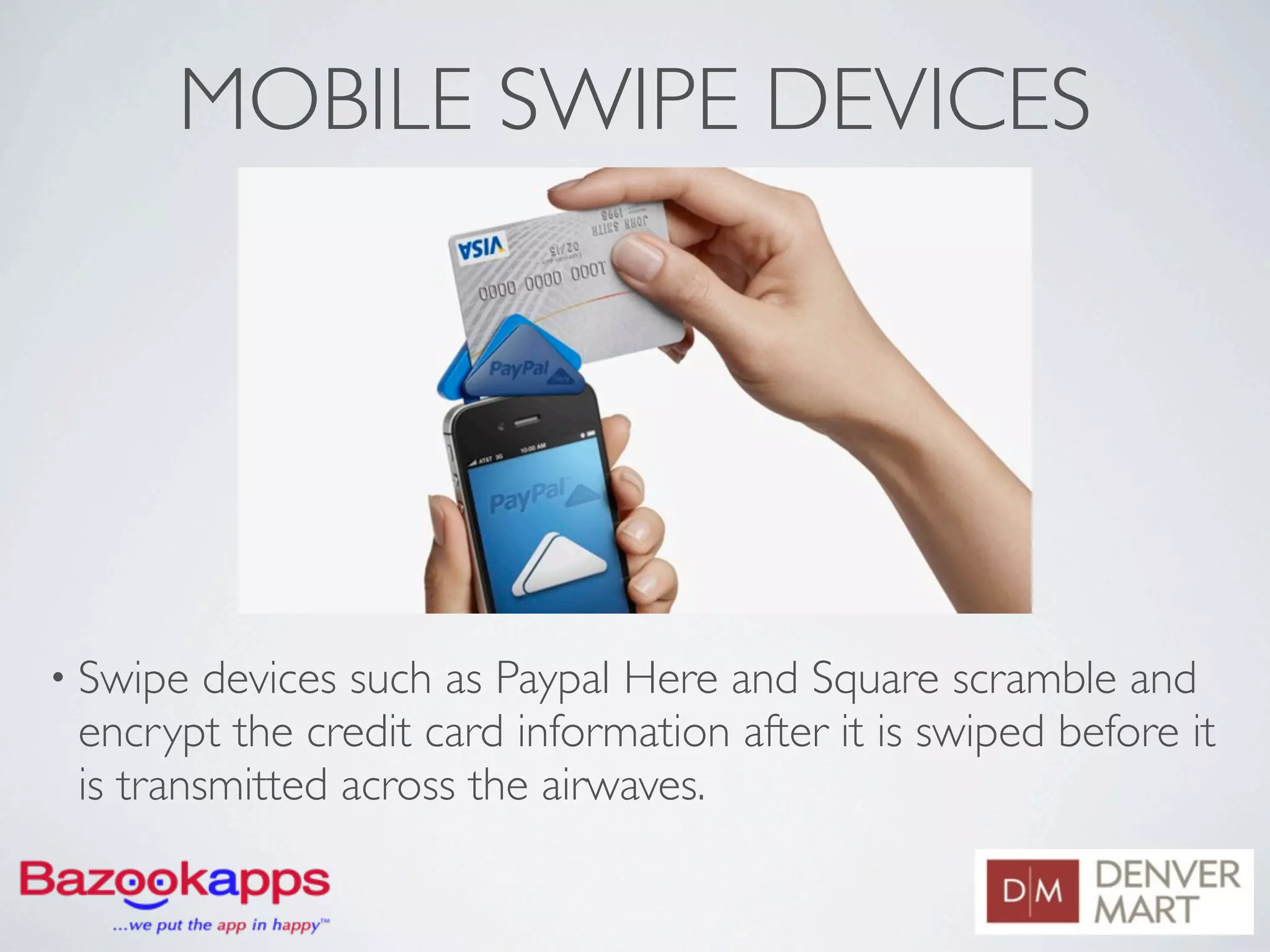

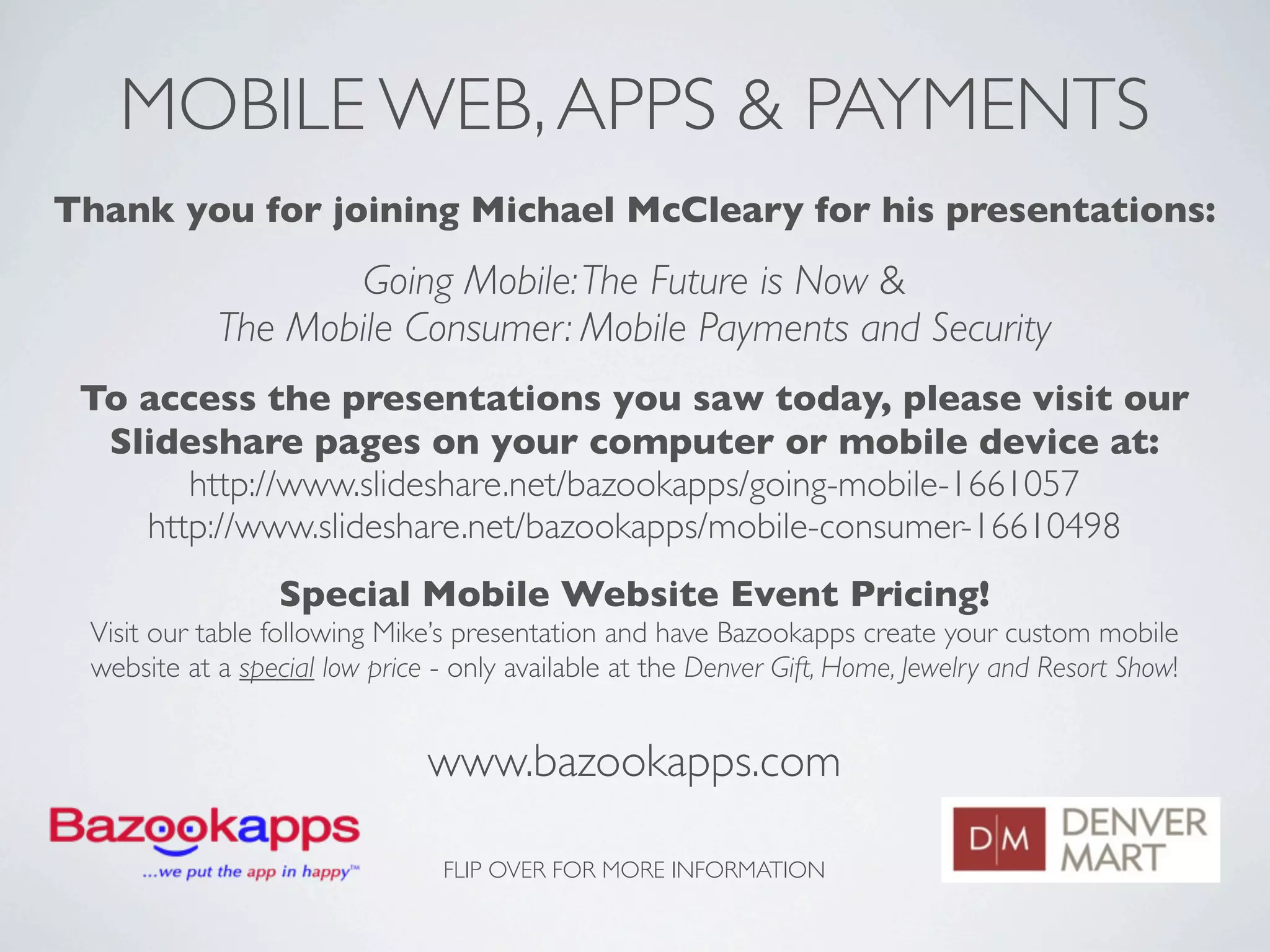

Michael McCleary gave a presentation on mobile payments and security. He discussed the history of mobile technology and the growth of mobile commerce. Mobile payments can be done through mobile web payments, direct mobile billing, online wallets, and near field communication (NFC). Security for mobile payments is ensured through encryption of credit card data during transmission. Trends show continued growth in mobile shopping and payments through smartphones and tablets.