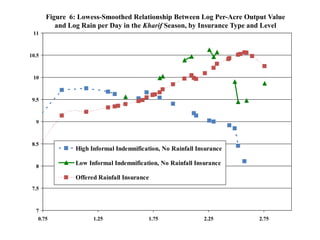

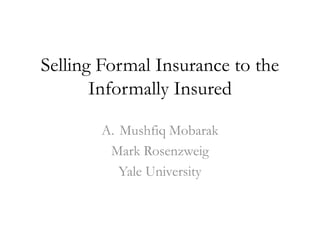

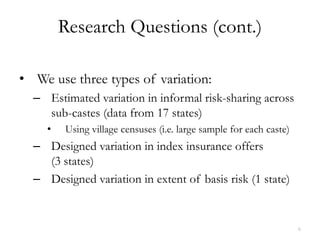

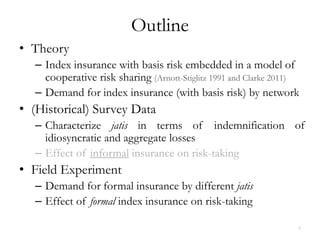

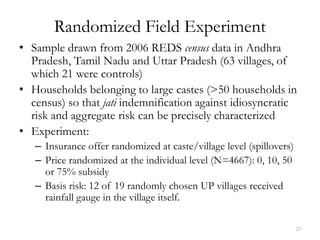

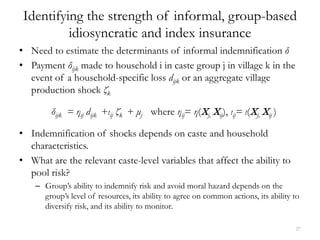

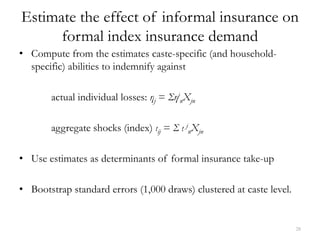

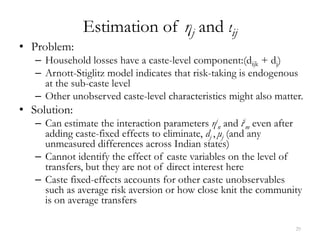

1) The document describes a field experiment that randomized offers of index insurance to agricultural households in India to study the interaction between formal insurance and informal risk-sharing networks.

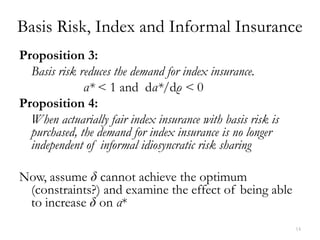

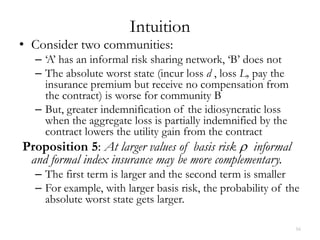

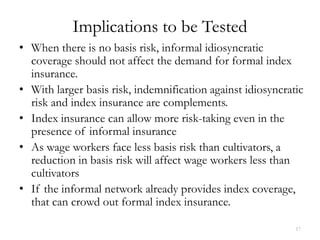

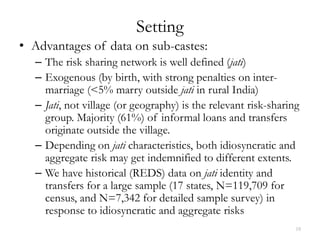

2) It finds that the presence of strong informal risk-sharing networks through castes/jatis reduces demand for formal insurance, and that basis risk, where payouts do not perfectly correlate with losses, also reduces demand.

3) However, informal and formal insurance can be complements when basis risk is high, as both provide partial coverage against different risks. The study uses detailed survey and rainfall data on castes/jatis to characterize their risk-sharing practices.

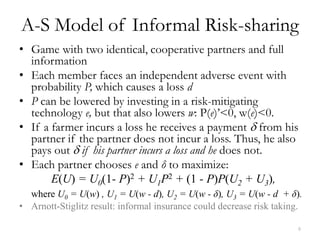

![FOC:

e: P'[-2(1 - P)U0 + 2PU1 + (1 - 2P)(U2 + U3)] =

-w'[U0'(1- P)2 + U1'P2 + (1 - P)P(U2' + U3 ')

δ: (-U2' + U3')P(1 - P) = 0

So, optimal δ, δ*, is

δ* = d /2 where -U2' + U3 = 0 (A-S result)

9](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-9-320.jpg)

![Aggregate Risk and Index Insurance

Now introduce a new aggregate risk and index insurance (No basis risk)

Probability that an adverse event causes losses for all participants = q

Loss from aggregate shock = L Index insurance payout = i

Actuarially-fair index insurance premium = qi

Assume q and P are independent. P is now idiosyncratic risk

E(U) = q [U0(1 - P)2 + U1P2 + (1 - P)P(U2 + U3)]

+ (1-q) [u0(1 - P)2 + u1P2 + (1 - P)P(u2 + u3)]

where U0 = U(w - L + (1 – q)i), U1 = U(w - d - L+ (1 - q)i),

U2 = U(w - δ - L + (1 -q)i), U3 = U(w - d - L + δ + (1 - q)i),

u0 = u(w - qi) , u1 = U(w - d - qi),

u2 = u(w - δ - qi), u3 = u(w - d + δ - qi)](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-10-320.jpg)

![Proposition 2:

If there is no basis risk and index insurance is actuarially fair,

the partners will choose full index insurance. The demand for

index insurance is independent of δ.

The FOC’s for δ and i:

δ: q(-U2’+ U3’)P(1-P)+(1-q)(-u2’+u3’)P(1-P) = 0

i: q(1-q){[U0’(1-P)2+U1’P2+(U2’+U3’)P(1-P)]

+ [u0’(1-P)2+u1’P2+ (u2’+u3’)P(1-P]}=0

Thus

δ * = d/2 Optimal private individual insurance remains the same

i* = L Full index insurance (if actuarially fair) is optimal

So aggregate risk or index insurance does not affect optimal informal payout

Informal individual insurance does not crowd out index

insurance – in the absence of basis risk

Intuition: index insurance and informal risk-sharing address

two separate, independent risks.](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-11-320.jpg)

![E(U) = (r - ρ)[U0(1 - P)2 + U1P2 + (1 - P)P(U2 + U3)]

+ ρ[u0(1 - P)2 + u1P2 + (1 - P)P(u2 + u3)]

+ (q + ρ - r)[U4(1 - P)2 + U5P2 + (1 - P)P(U6 + U7)]

+ (1 - q - ρ)[u4(1 - P)2 + u5P2 + (1 - P)P(u6 + u7)],

where

U0 = U(w - L + (1 - q)αL), U1 = U(w - d - L+ (1 - q)αL),

U2 = U(w - δ - L + (1 -q)αL), U3 = U(w - d - L + δ + (1 - q)αL),

U4 = U(w + (1 - q)αL), U5 = U(w - d + (1 - q)αL),

U6 = U(w - δ + (1 - q)αL), U7 = U(w - d + δ + (1 - q)αL), and

u0 = u(w - L(1 - qα)) , u1 = U(w - d - L(1 - qα)),

u2 = u(w - δ - L(1 - qα)), u3 = u(w - d + δ - L(1 - qα)),

u4 = u(w - qαL), u5 = U(w - d - qαL),

u6 = u(w - δ - qαL), u7 = u(w - d + δ - qαL)

13](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-13-320.jpg)

![dα*/dδ =

{(1 - P)P{(r - ρ)(1 - q)(U3 - U2) - ρq(u3 - u 2)

+ (q + ρ - r)(1 - q)(U7 - U6) -

(1 - q - ρ)q(u7 - u6)}/Θ,

where Θ =

(1 - q)2{(r - ρ)[U0(1 - P)2 + U1P2 + (1 - P)P(U2+ U3)]

+ (q + ρ - r)[U4(1 - P)2 + U5P2 + (1 - P)P(U6 + U7)]}

+ q2{ρ[u0(1 - P)2 + u 1P2 + (1 - P)P(u2 + u 3)] + (1 - q - ρ)[u4(1 - P)2 +

u5P2 + (1 - P)P(u6 + u7)]}<0

Thus, dα*/dδ 0

but dα*/dδ can be either positive or negative

15](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-15-320.jpg)

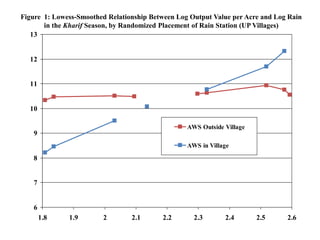

![Response to Aggregate Risk

ML Conditional Logit Estimates of the Determinants of Receiving Financial Assistance

(Informal Loans + Non-regular Transfers in Crop Year 2005/6)

Variable/Coefficient type Log-Odds P Log-Odds P

-0.00183 -0.00046 -0.00179 0.00045

Adverse village rain deviation in 05/06

[2.41] [2.41] [2.35] [2.35]

0.000256 0.00006 0.000274 0.00007

×Caste’s mean land holdings

[1.64] [1.64] [1.71] [1.71]

0.00139 0.00035 0.00165 0.00041

×Caste’s proportion landless

[1.35] [1.35] [1.68] [1.68]

×Caste’s proportion hh’s with in non-ag. 0.0206 0.00513 0.0207 0.0052

occupations [3.29] [3.29] [3.32] [3.32]

×Caste’s standard deviation of land -0.00232 0.000579 -0.00426 0.0011

holdings (x10-3) [0.18] [0.18] [0.32] [0.32]

×Number of same-caste households in 0.00109 -0.000273 0.00114 0.00028

village (x10-3) [0.90] [0.90] [0.93] [0.93]

31](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-32-320.jpg)

![Response to Idiosyncratic Risk

-0.833 -0.204251 -0.794 -0.195

Any individual household loss from distress event in 05/06

[2.49] [2.61] [2.38] [2.48]

0.144 0.036024 0.165 0.0412

×Caste’s mean land holdings

[1.68] [1.68] [1.98] [1.98]

1.37 0.341520 1.22 0.305

×Caste’s proportion landless

[2.40] [2.40] [2.01] [2.01]

3.05 0.761193 3.25 0.81

×Caste’s proportion hh’s with in non-ag. occupations

[1.47] [1.47] [1.53] [1.53]

-16.5 -4.1194 -18.8 -4.69

×Caste’s standard deviation of land holdings (x10-3)

[1.84] [1.84] [2.12] [2.12]

1.77 0.4415 1.73 0.00043

×Number of same-caste households in village (x10-3)

[2.38] [2.38] [2.37] [2.37]

32](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-33-320.jpg)

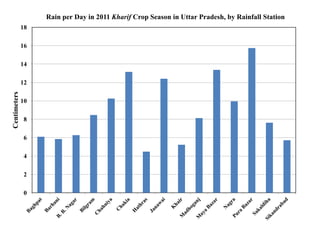

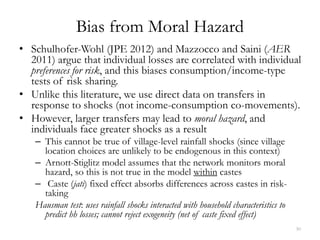

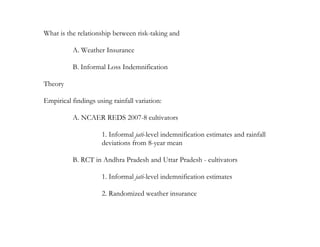

![Is there basis risk in this sample?

Variable Uttar Pradesh (randomized) UP+AP

Rain per day 0.16516 0.30169 0.13937 0.23606

[1.32] [2.20] [1.40] [2.09]

Distance to aws (km) 0.12483 0.08460

[2.40] [1.92]

Rain per day x Distance to aws -0.02231 -0.01673

[3.53] [2.81]

Number of cultivators 945 936 1,459 1,418

33](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-34-320.jpg)

![Fixed-Effects Estimates: Determinants of Formal Insurance Take-up (bootstrapped t -ratios)

FE-State FE-Caste

Three Two States Two States

Variable/Est. Method States (AP and UP) UP only AP only (AP and UP)

0.125 0.151 0.0228 -0.523 -0.029 - -

η j [Informal idiosyncratic coverage]

[0.56] [0.61] [0.07] [0.73] [0.06]

- - 0.151 0.174 0.153 0.139 0.157

η j × Distance to AWS

[3.42] [1.34] [1.16] [2.55] [2.31]

-198 -209.6 -209.7 -78.2 -121.7 - -

ι j [Informal aggregate coverage]

[1.71] [1.28] [0.94] [0.48] [0.33]

- - - - - - -18.6

ι j × Distance to AWS

[-0.528]

- - -0.0254 -0.029 -0.025 -0.0246 -0.019

Distance to AWS (km)

[3.50] [1.67] [0.90] [2.63] [1.50]

-0.0343 -0.0341 -0.028 -0.047 -0.018 -0.0238 -0.0379

Agricultural laborer

[2.19] [2.13] [1.58] [1.41] [0.92] [1.49] [1.43]

Agricultural laborer × Distance - - - - - - 0.0033

to aws [0.797]

-0.00143 -0.0016 -0.0017 -0.003 -0.001 -0.0015 -0.0016

Actuarial price

[2.07] [2.07] [2.40] [1.46] [1.81] [2.14] [2.14]

0.389 0.355 0.35 0.187 0.447 0.376 0.372

Subsidy

[3.38] [2.86] [3.10] [0.68] [3.95] [3.26] [3.20]

Village coefficient of variation, 0.523 0.751 0.747 1.050 0.267 0.874 0.908

rainfall [2.16] [2.89] [2.77] [2.93] [0.46] [2.92] [3.04]

N 4,260 3,338 3,338 1,693 1,645 3,338 3,338](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-36-320.jpg)

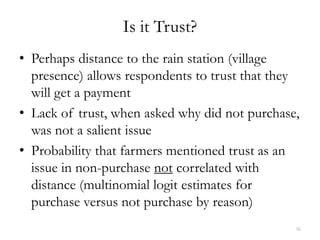

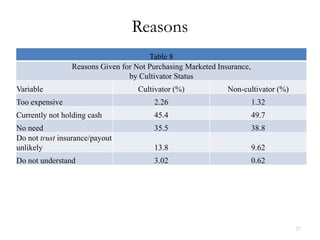

![AWS Distance and Trust

Table 9

Marginal Effects from Multinomial Logit Regression of Reasons for not Purchasing Insurance

[bootstrapped t-ratios]

Purchased Insurance Lack of Trust

-0.034 0.080

ηj

[0.23] [1.64]

0.200 0.007

ηj × Distance to aws

[3.40] [0.55]

213.879 14.481

ιj

[1.30] [0.33]

ιj × Distance to aws

-0.036 0.000

Distance to aws (km)

[3.67] [0.08]

38](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-39-320.jpg)

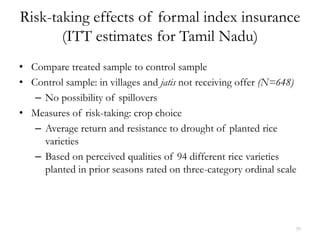

![Intent-to-Treat Caste Fixed-Effects Estimates of Index Insurance on Risk and Yield:

Proportion of Planted Crop Varieties Rated "Good" for Drought Tolerance and Yield, Tamil Nadu

Kharif Rice Farmers

Crop Characteristic: Good Drought Tolerance Good Yield

Variable (1) (1)

Offered insurance -0.0593 0.0519

[2.67] [1.93]

Owned land holdings 0.0000934 0.00056

[0.02] [0.12]

Village coefficient of variation, r 0.351 -0.516

[0.88] [0.81]

N 325 325

Absolute values of t-ratios in brackets, clustered by caste/village (because the randomized insurance

treatment was stratified at the caste/village level).](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-44-320.jpg)

![Partners behave cooperatively, choosing e and ä to maximize:

E(U) = U0(1- P)2 + U1P2 + (1 - P)P(U2 + U3),

where U0 = U(w) , U1 = U(w - d), U2 = U(w - ä), U3 = U(w - d + ä)

FOC:

e: P'[-2(1 - P)U0 + 2PU1 + (1 - 2P)(U2 + U3)] =

-w'[U0'(1- P)2 + U1'P2 + (1 - P)P(U2' + U3')

ä: (-U2' + U3')P(1 - P) = 0

So, optimal ä, ä*, is

ä* = d /2 where -U2' + U3 = 0 (A-S result)

Suppose that the group cannot attain “full” insurance ä*(limited commitment,

liquidity constraints), so that ä < ä*.](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-47-320.jpg)

![What is the effect of exogenous fall in ä at the optimum ä*, on risk mitigation

e?

Proposition 1: A decrease in the ability to informally indemnify individual

losses below the first-best constrained optimum, may increase risk-taking.

de/dä = -[(1 - 2P)(U2' + U3')P'+ (1 - P)P(-U2" + U3")w"]/Ö,

where Ö = (w')2[U0"(1 - P)2 + U1"P2 + (1 - P)P(U2" + U3")]

+ [U0'(1 - P)2 + U1'P2 + (1 - P)P(U2' + U3')][w" - P"W'/P']

+ 2(P')2[U0 + U1 - U2 - U3] < 0

and -U2' + U3 > 0, -U2" + U3"<0 for ä < ä*

For P $ ½, decreased coverage unambiguously decreases risk-mitigation,

but below ½, the effect may be negative as well.

More effective informal risk-sharing may be associated with lower risk-taking](https://image.slidesharecdn.com/mobarakrosenzweiginformalp-130208090617-phpapp02/85/02-07-2013-Mark-Rosenzweig-48-320.jpg)