Maria Agranovskaya presented on blockchain legal aspects and regulation. The presentation covered:

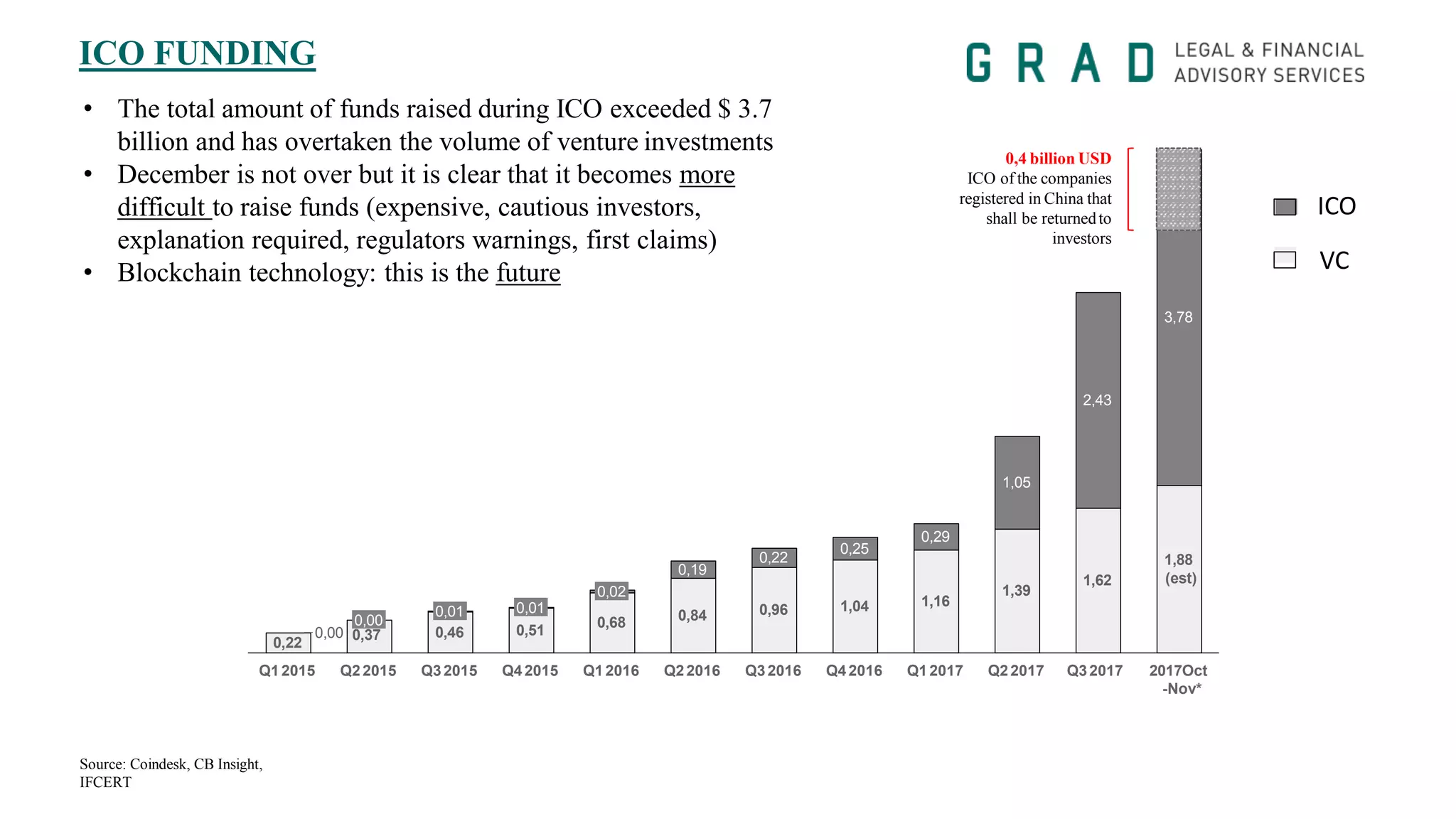

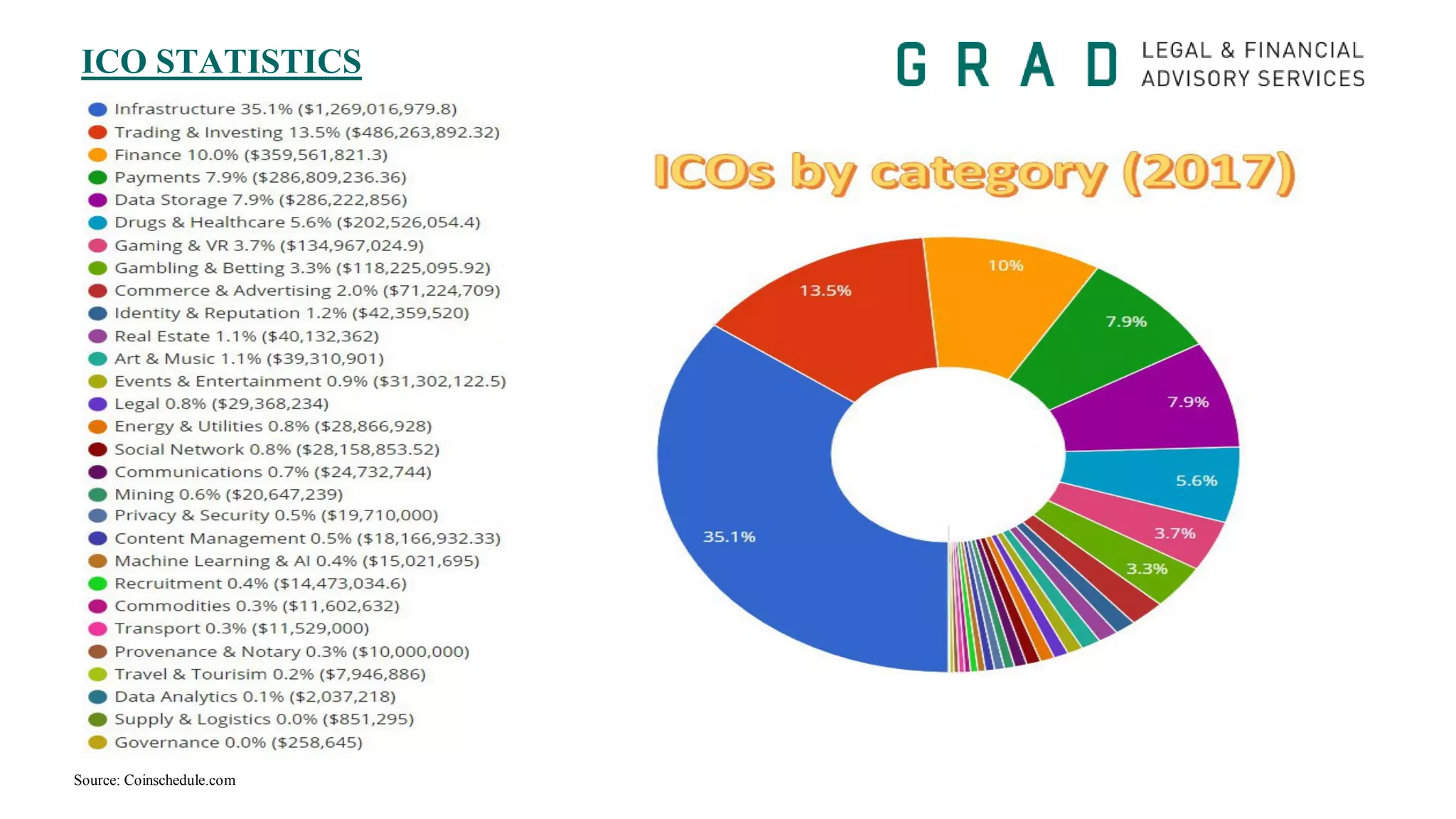

1. Growth in cryptocurrency prices and ICO funding in recent years.

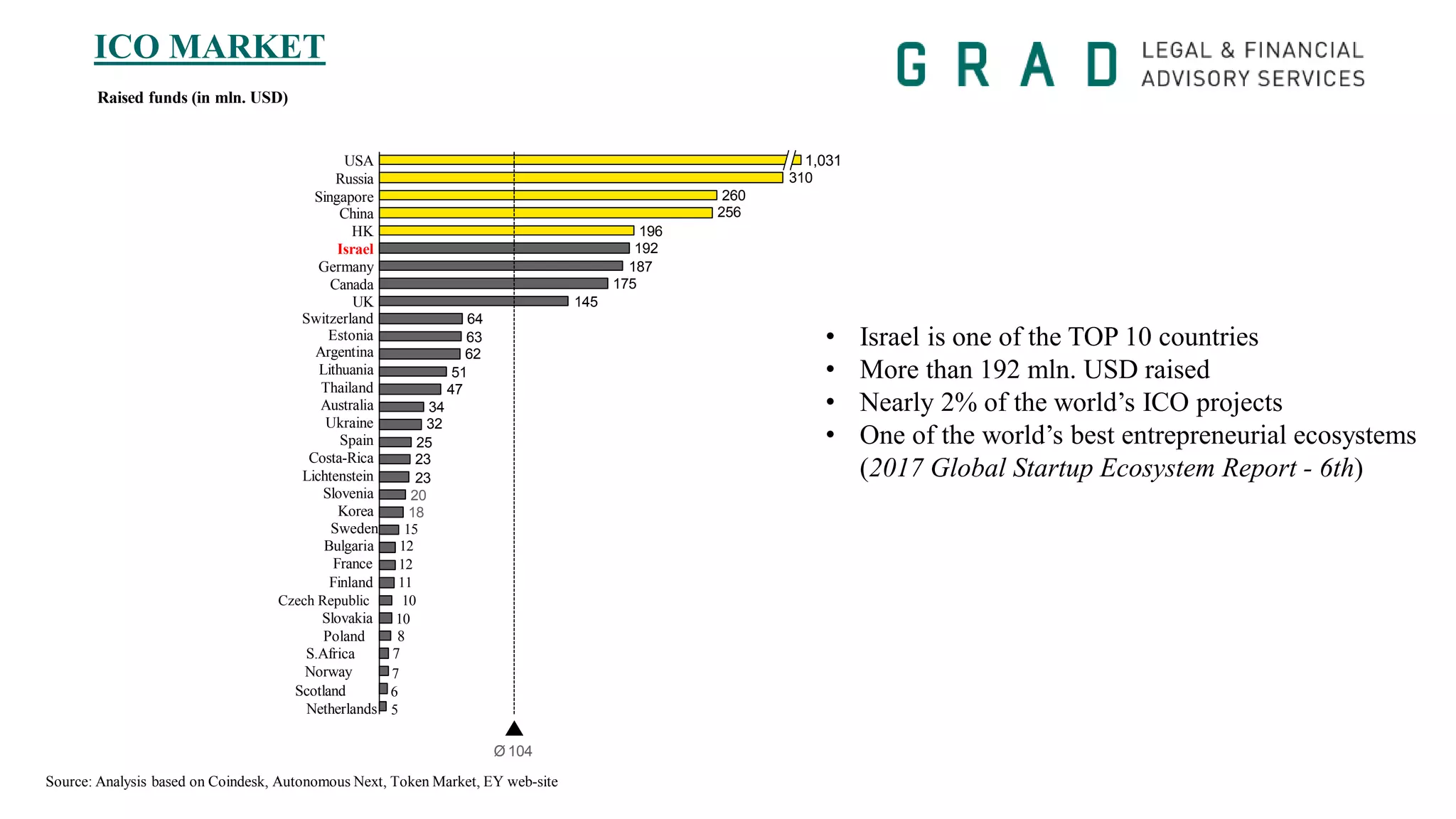

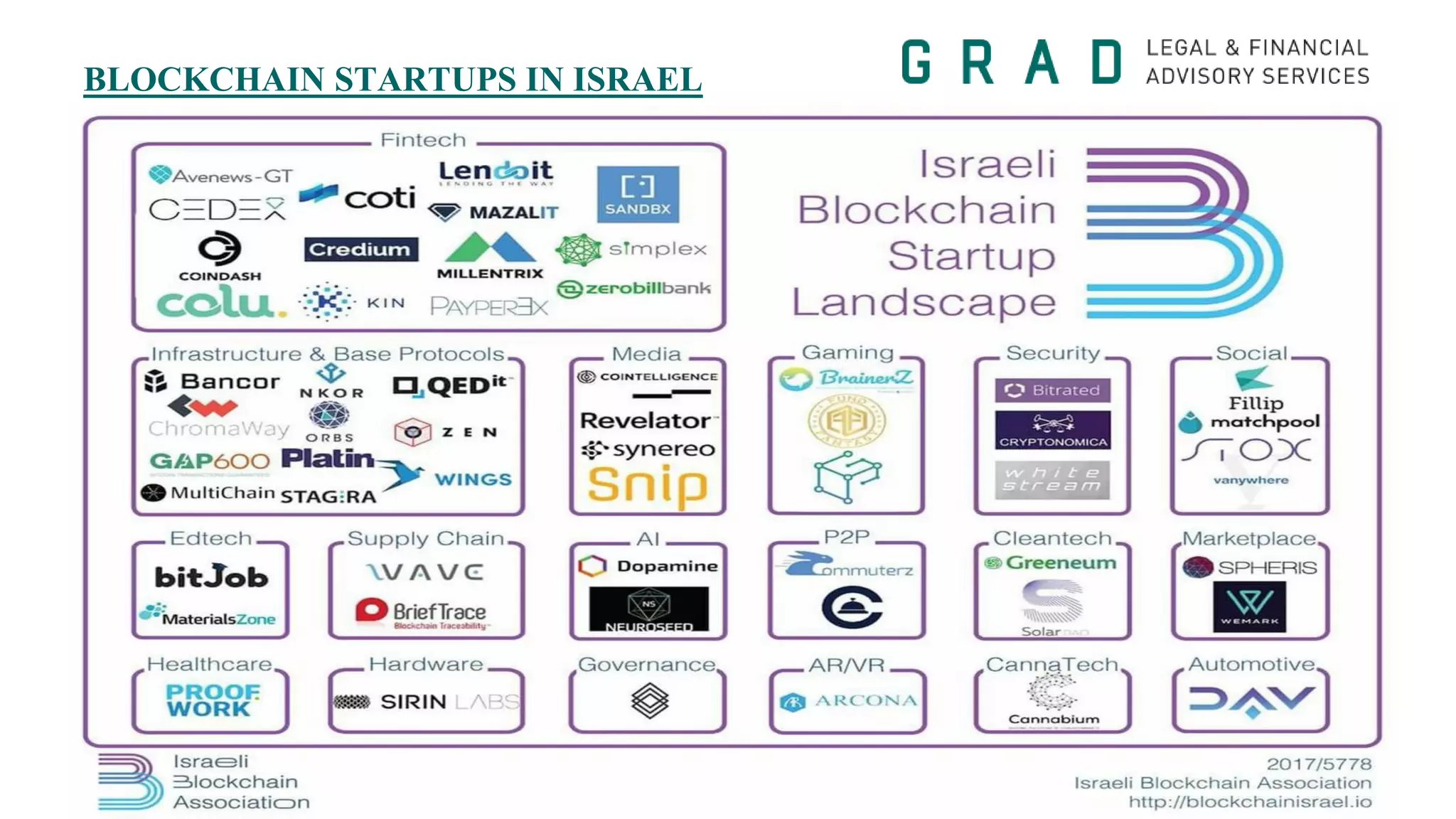

2. Israel emerging as a top country for ICO projects and blockchain startups.

3. Key terms in blockchain like distributed ledger, cryptocurrency, utility tokens, and security tokens.

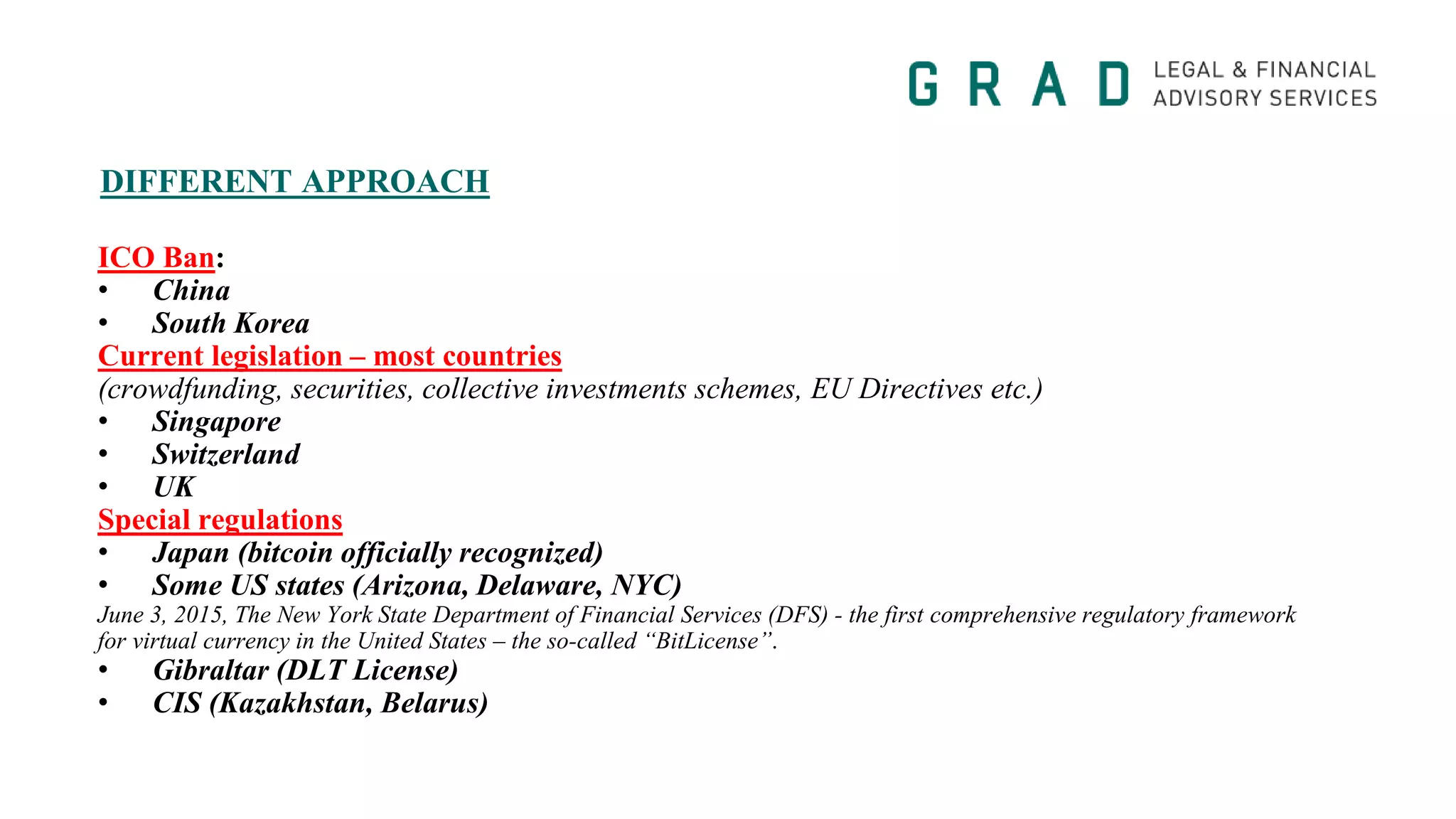

4. Approaches to token classification in different jurisdictions like Switzerland, US, and Singapore.

5. Smart contracts, their advantages and limitations from a legal perspective.

6.