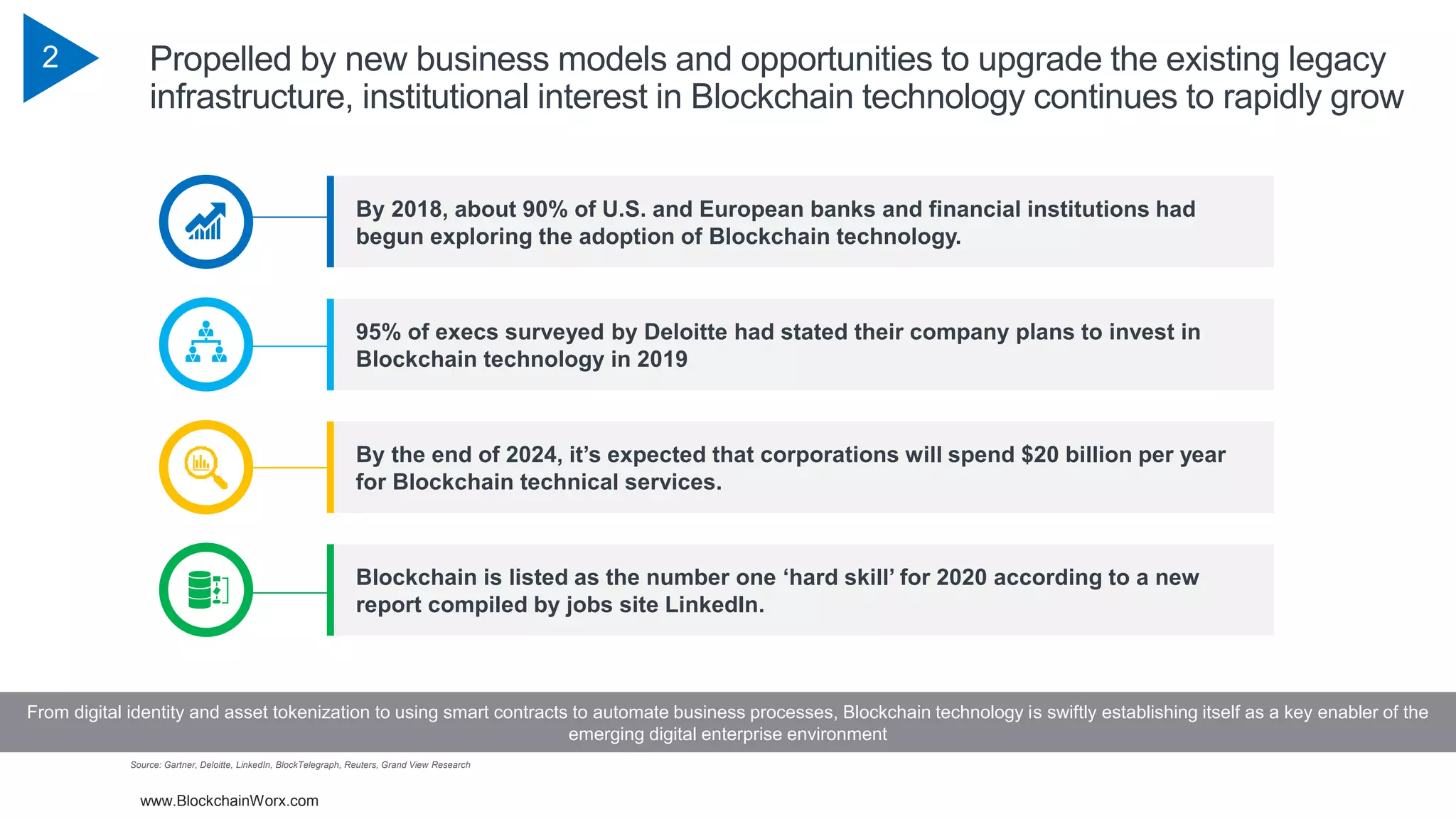

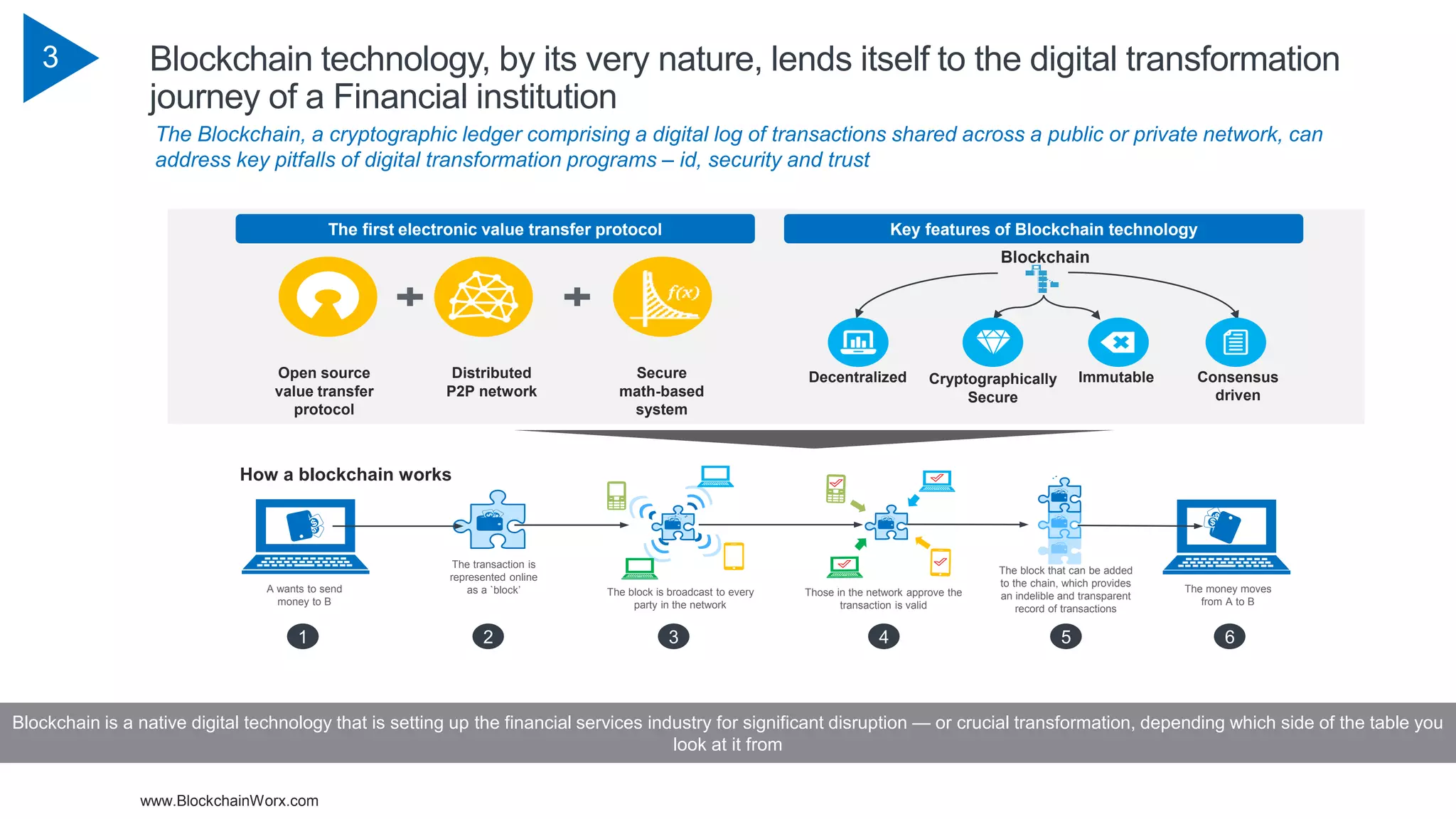

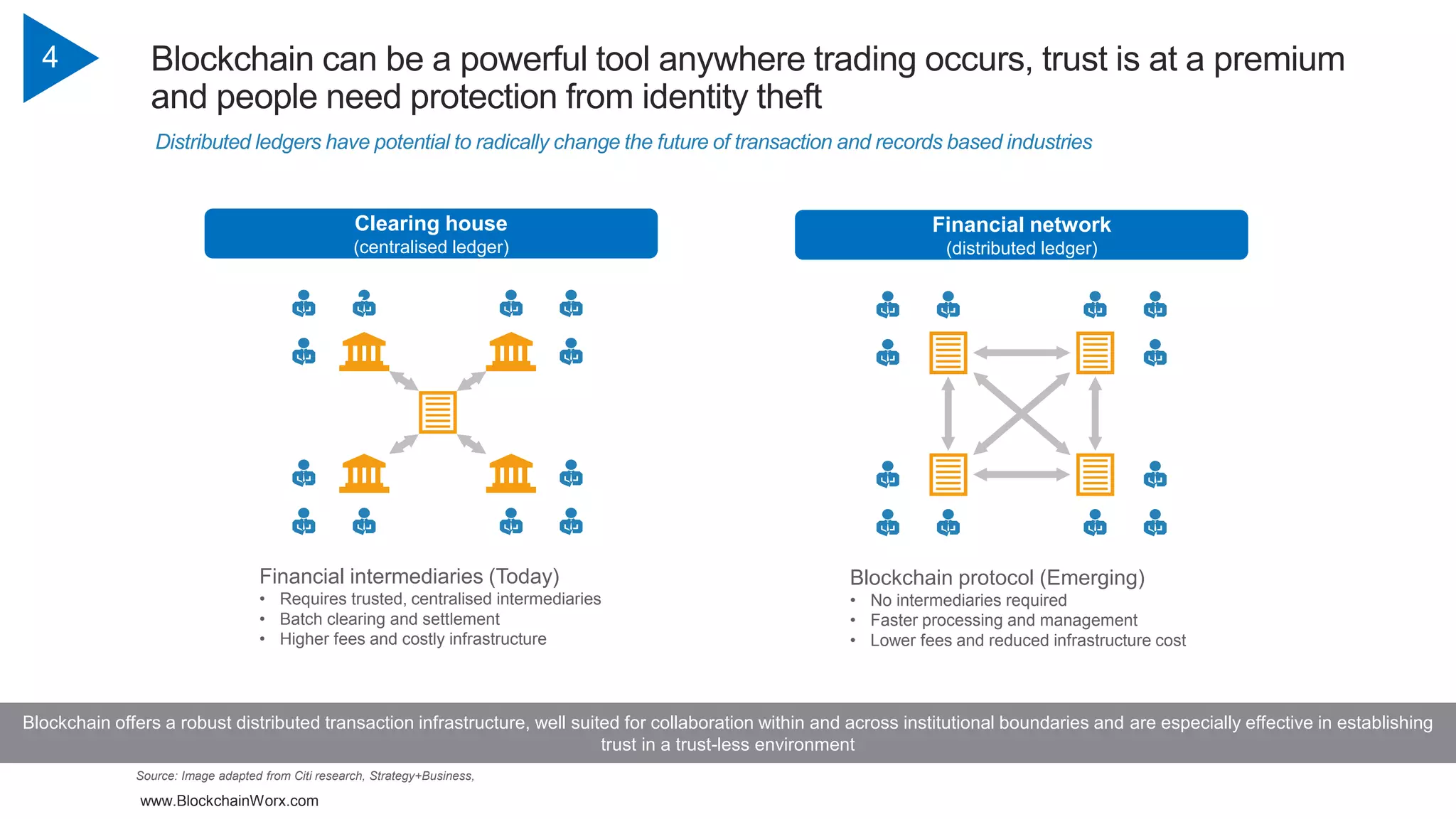

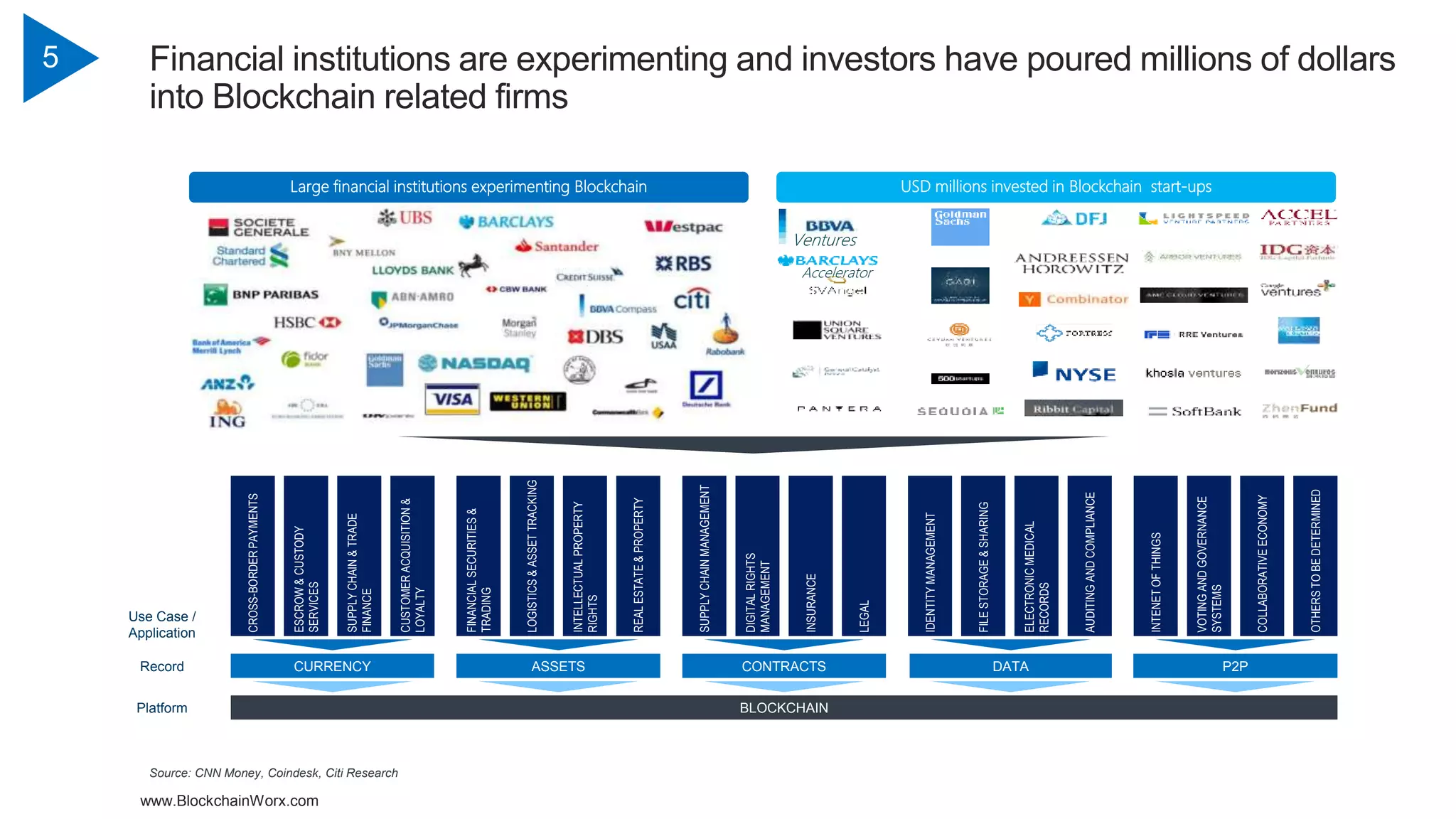

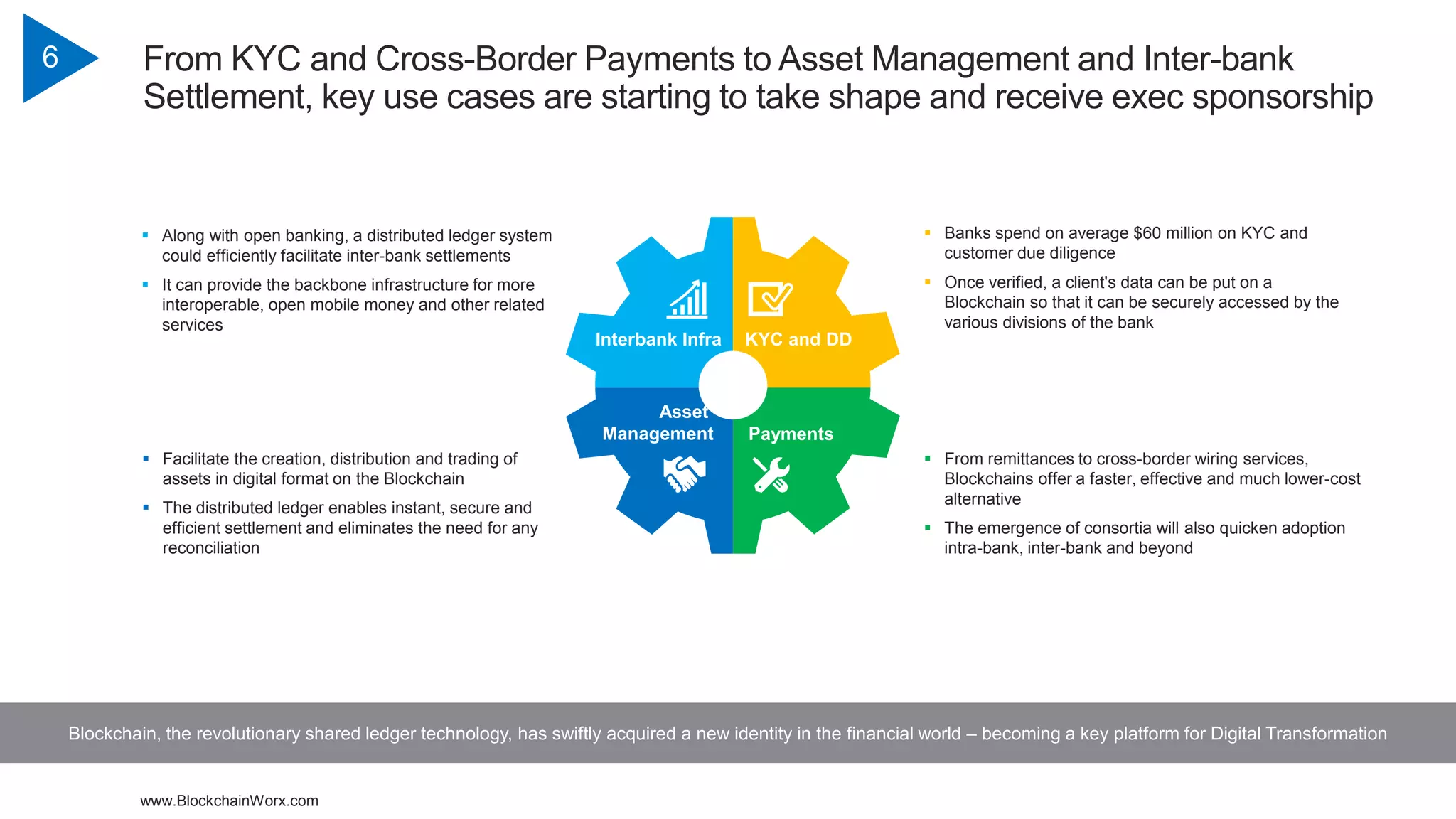

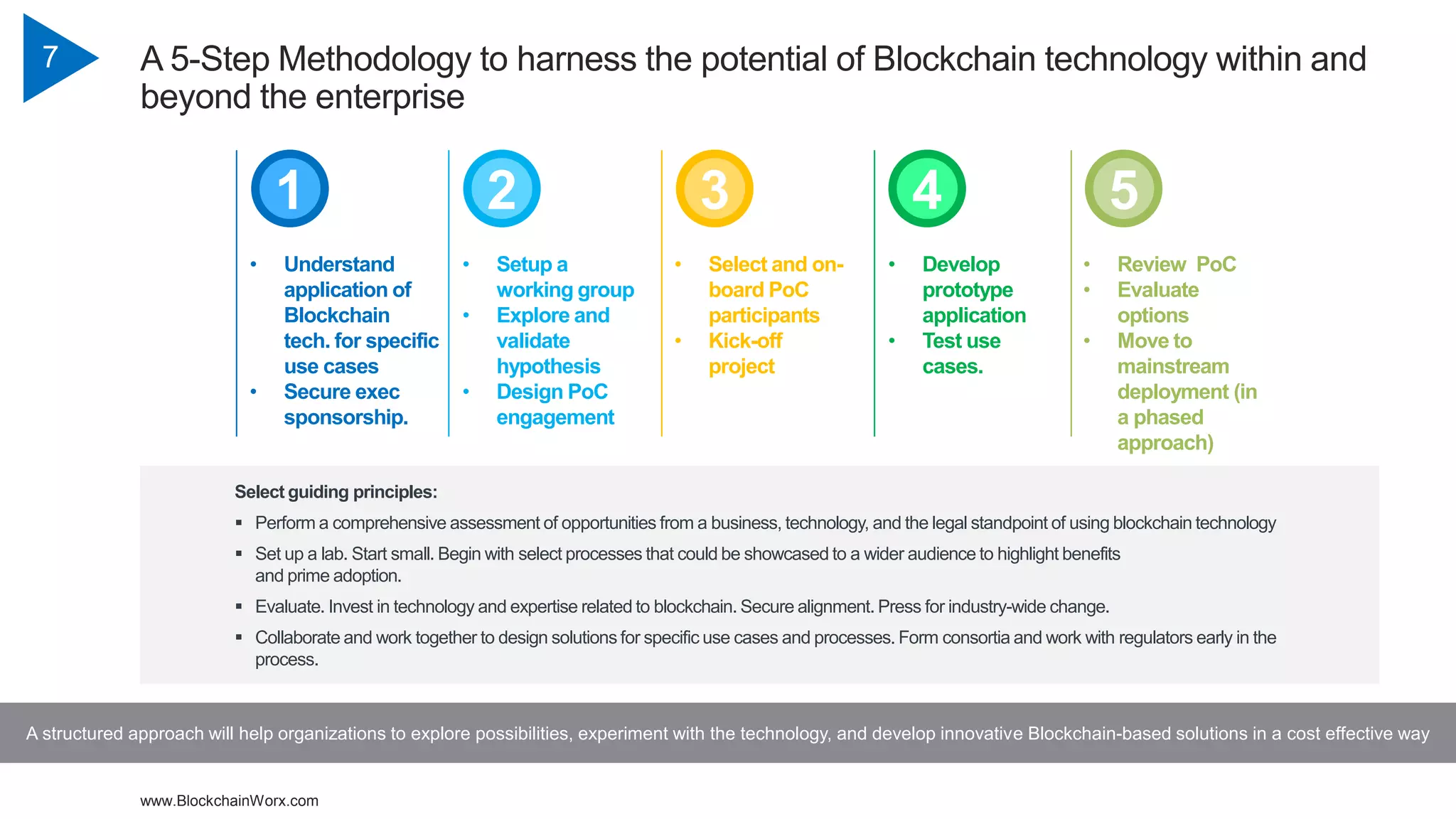

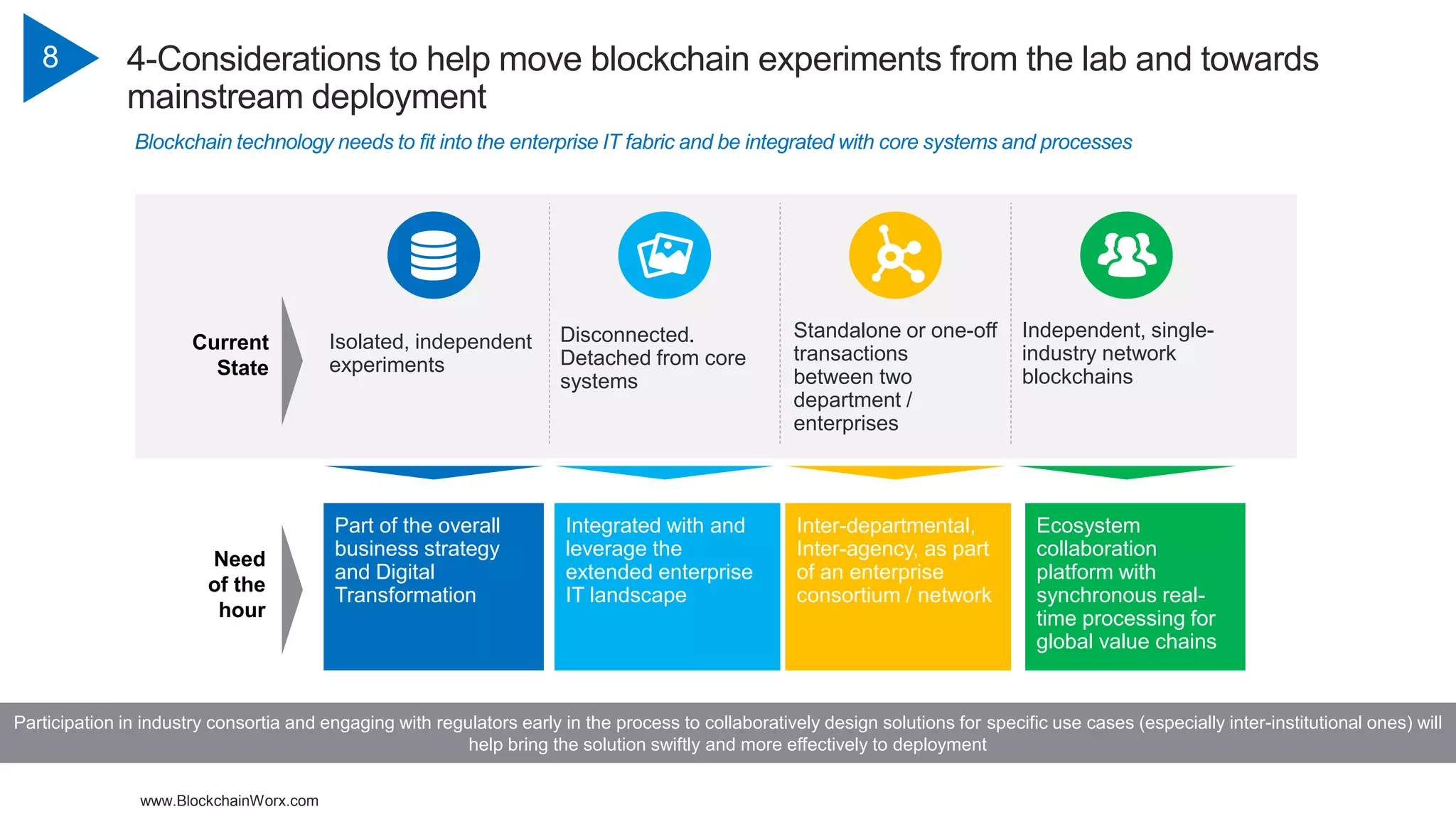

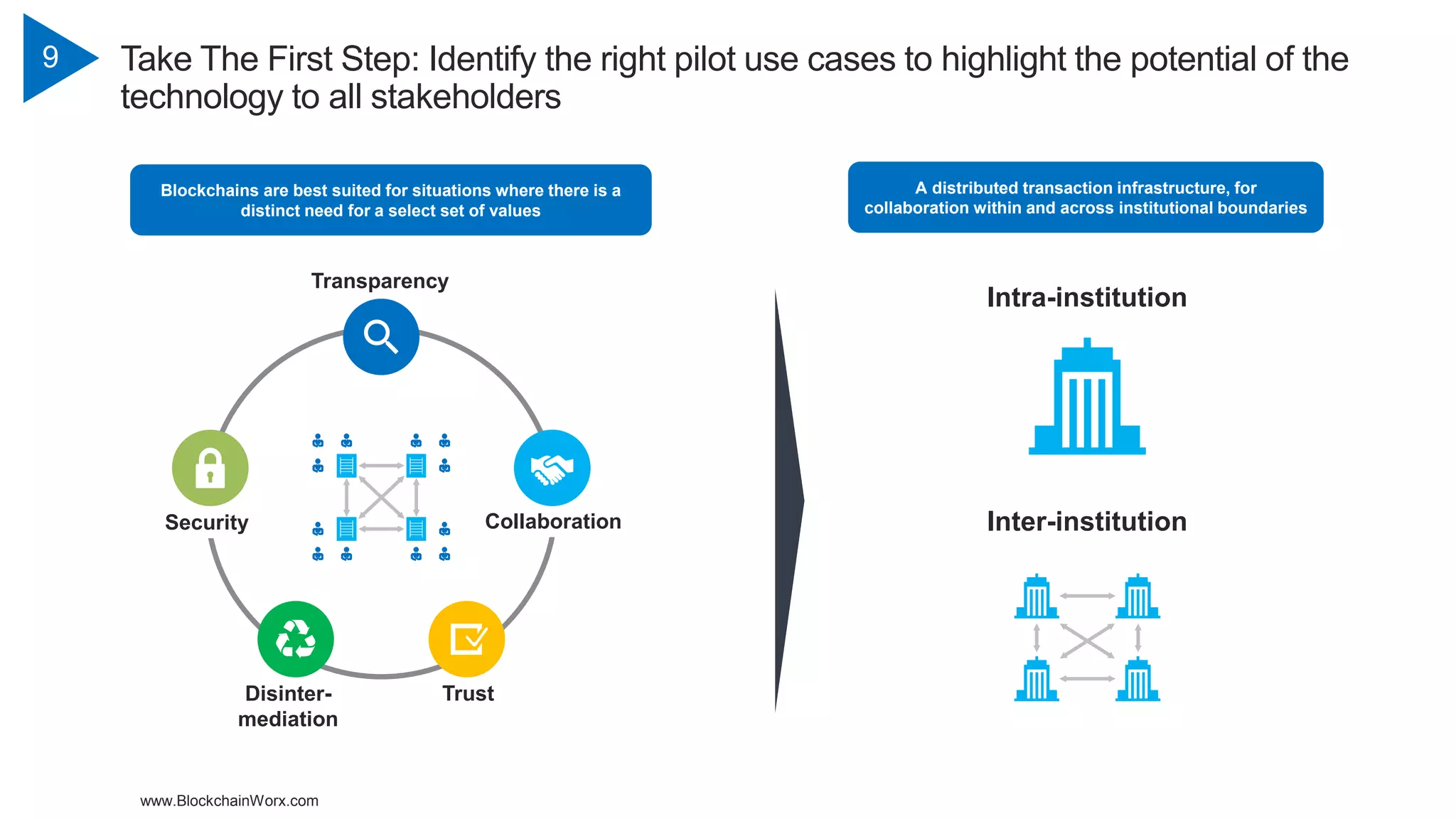

The document discusses the transformative potential of blockchain technology in the financial services sector, highlighting its role in digital transformation and the growing institutional interest in its applications. By 2019, a significant majority of executives planned to invest in blockchain, anticipating a $20 billion annual expenditure by 2024. Key use cases include cross-border payments, asset management, and KYC processes, with a structured methodology proposed for corporations to implement blockchain effectively.