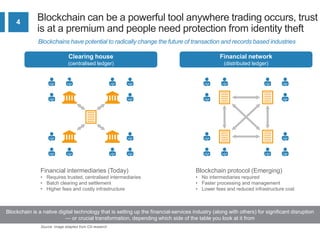

Blockchain technology is revolutionizing digital transformation in financial institutions by providing a decentralized, secure platform for transactions and record-keeping. It addresses challenges related to identity, security, and trust, enabling banks to streamline processes like KYC, cross-border payments, and loyalty programs while reducing costs. A structured methodology for implementation and collaboration with industry consortia is essential for successful adoption and integration into current business strategies.