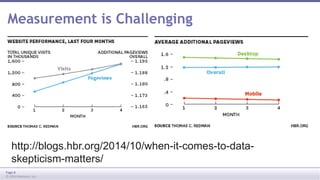

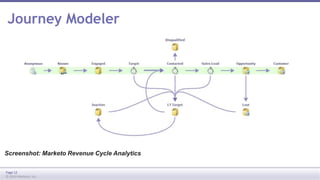

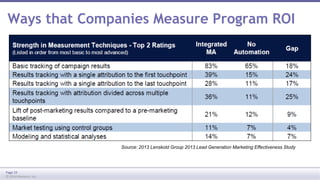

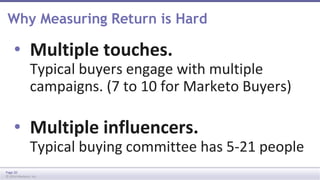

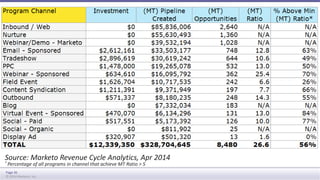

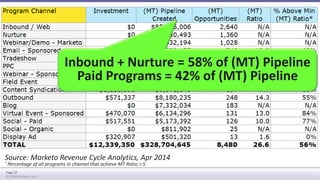

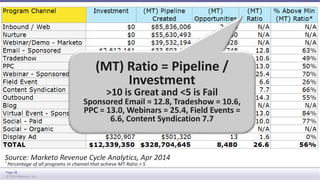

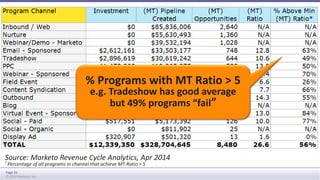

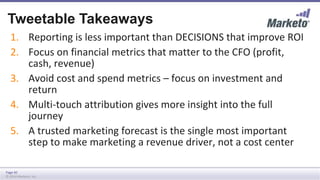

The document discusses the importance of utilizing the right metrics to build marketing credibility and demonstrate value to CEOs, who tend to trust CFOs and CIOs more than marketers. It emphasizes the need to shift focus from vanity metrics and cost metrics to meaningful financial metrics that showcase ROI and investment impact. Additionally, it highlights the challenges of measuring marketing effectiveness due to multiple touches and influencers in the buying process.