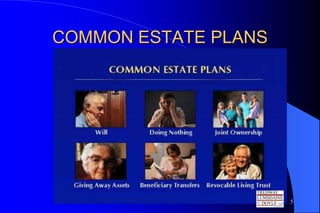

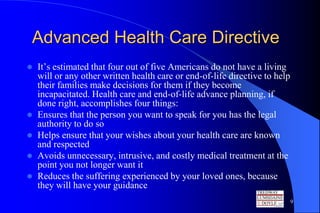

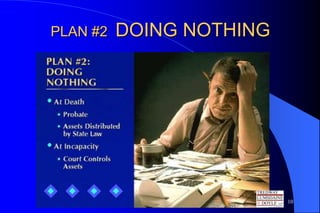

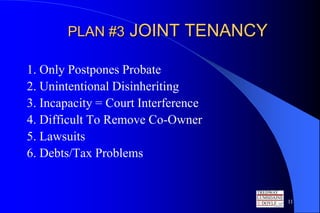

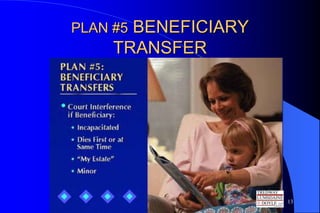

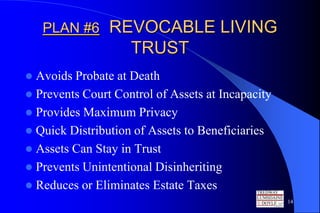

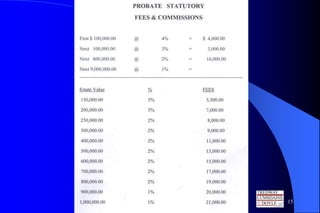

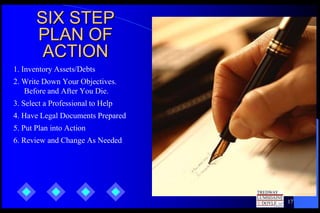

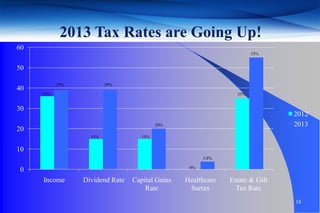

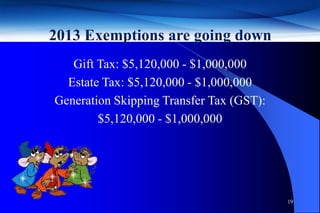

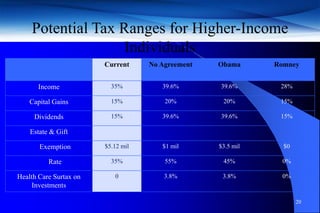

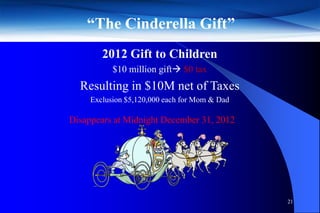

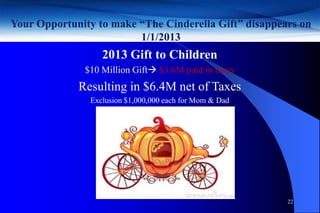

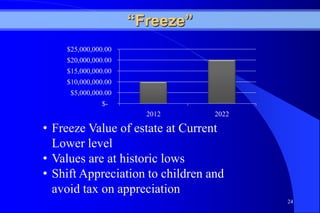

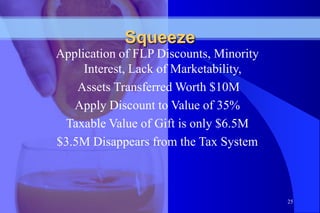

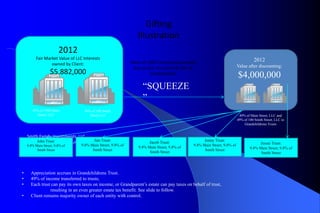

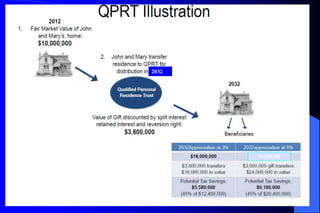

This document provides an overview of estate planning and discusses various estate planning strategies. It begins by defining what an estate is and listing common asset types. It then discusses the importance of estate planning to control who receives assets after death and to plan for incapacity. Several common estate plans are described, including doing nothing, joint tenancy, giving assets away, beneficiary transfers, and revocable living trusts. Key details are provided on wills, powers of attorney, healthcare directives, and taxes. The document encourages reviewing one's situation and assets to determine the best estate planning strategy. It emphasizes acting before the end of the year to take advantage of higher gift and estate tax exemptions before they decrease in 2013.