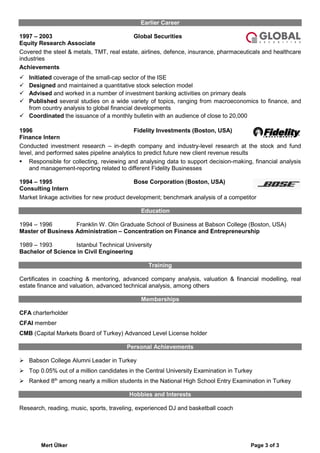

Mert Ülker is an accomplished senior research analyst and cross-asset strategist with over 25 years of experience in equity research, investment management, and strategic advisory. He has held leadership roles at several Turkish financial institutions where he developed cross-asset strategy, conducted fundamental analysis, and managed research teams. Ülker holds a Master's in Business Administration and is a CFA charterholder.