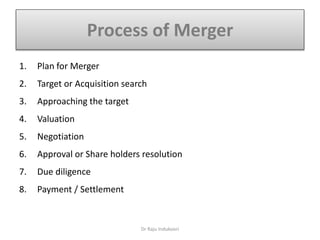

The document outlines the 8 key steps in a merger process:

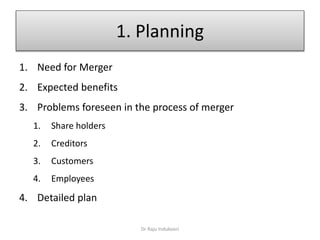

1. Planning for the merger including identifying benefits and potential issues.

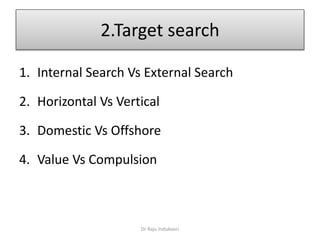

2. Searching for a target company through internal or external means.

3. Approaching the target company and convincing them of potential benefits.

4. Valuing the target company based on assets, cash flows, costs, and tax benefits.

5. Obtaining shareholder resolution and approval despite potential opposition.

6. Negotiating the deal terms including valuation of both companies.

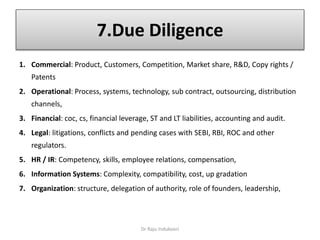

7. Conducting due diligence on commercial, operational, financial, legal, and HR aspects.

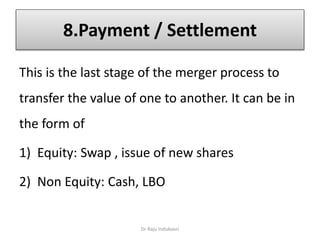

8. Finalizing the payment or settlement structure, which can include equity swaps