Embed presentation

Download to read offline

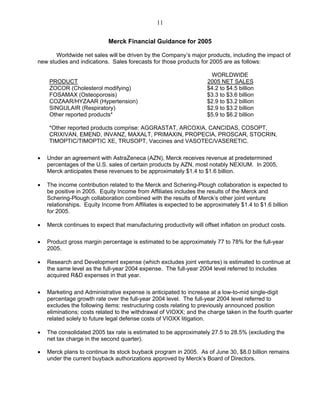

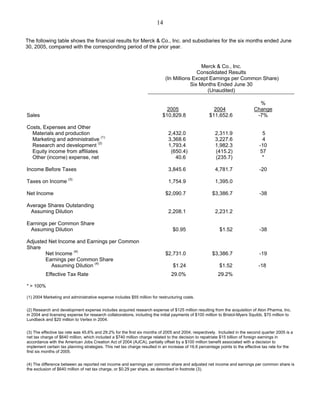

Merck announced second-quarter 2005 earnings per share of 33 cents, down from 79 cents in 2004 due to a $640 million net tax charge. Excluding this charge, EPS were 62 cents. Worldwide sales were $5.5 billion, down 9% from 2004 due to the Vioxx withdrawal. Merck anticipates third-quarter EPS of 61-65 cents and full-year 2005 EPS of $2.44-$2.52 excluding the tax charge. Major drug franchises like Singulair, Fosamax, Cozaar, and Zocor maintained or grew market share. Merck's vaccine and diabetes drug pipelines progressed with regulatory submissions.