Embed presentation

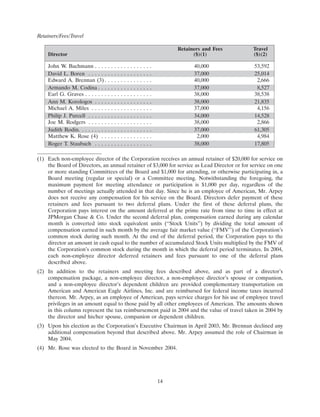

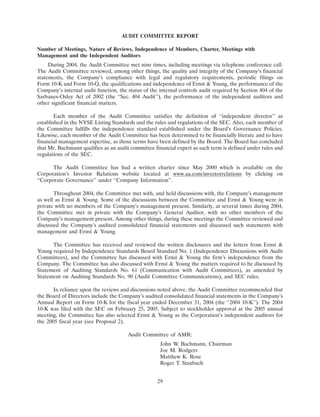

Download to read offline

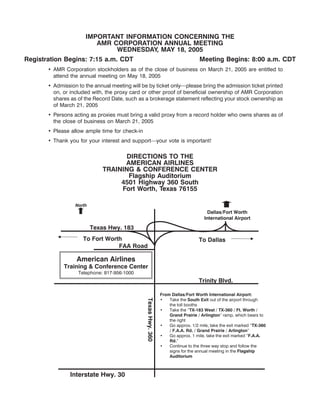

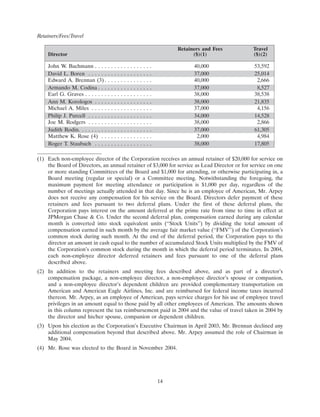

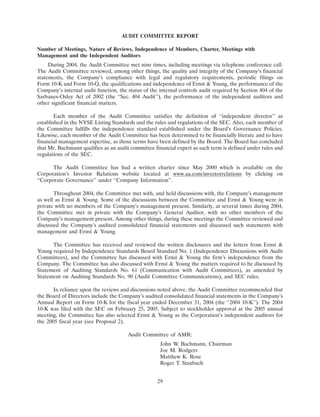

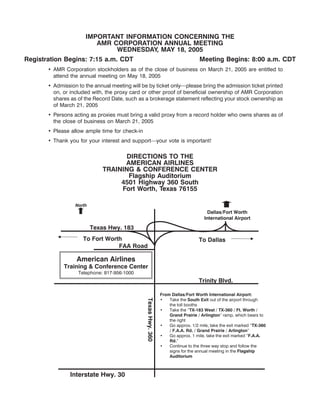

The document is a notice from AMR Corporation inviting stockholders to attend its 2005 Annual Meeting of Stockholders on May 18, 2005 at 8:00am at the American Airlines Training & Conference Center in Fort Worth, Texas. It provides information on the items of business to be voted on, including the election of directors, ratification of auditors, and a stockholder proposal. Stockholders of record as of March 21, 2005 are entitled to vote. Admission to the meeting will require an admission ticket or proof of stock ownership.