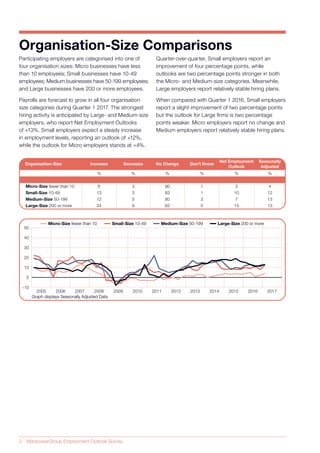

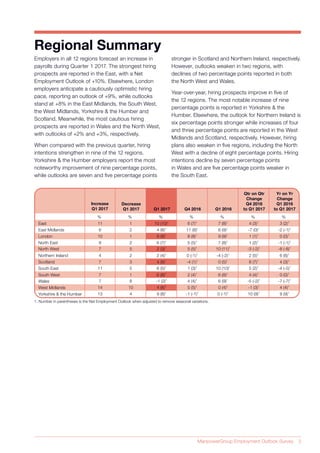

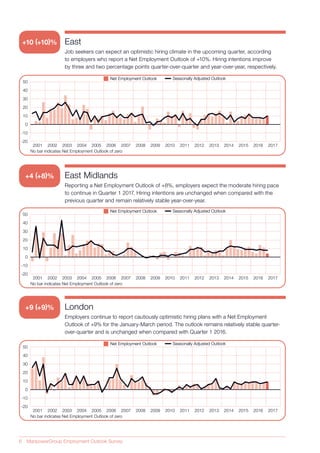

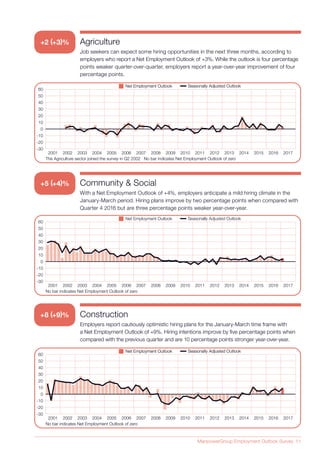

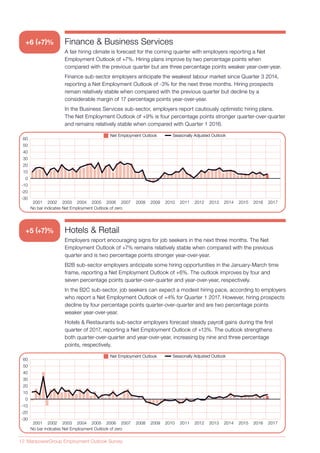

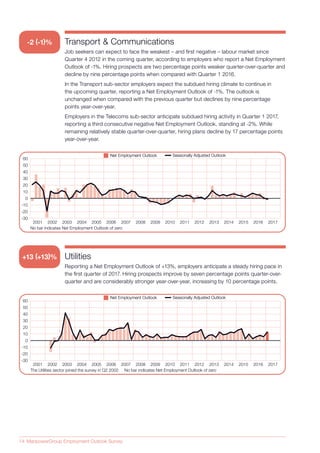

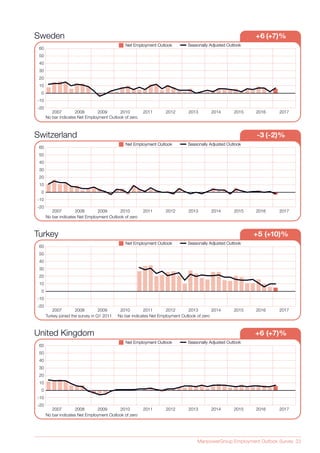

UK employers expect modest hiring activity in the upcoming quarter, with a Net Employment Outlook of +6%. The survey interviewed over 2,000 employers and found that 9% expect to increase staffing levels, 3% expect decreases, and 87% expect no change. Hiring prospects are strongest in the East region and several industry sectors, including utilities, while they are weakest in Wales and the transportation sector.